Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsAsia Pacific Fibers plans expansion amid debt tangle

PT Asia Pacific Fibers (POLY), a major polyester manufacturer, said the company desperately needed US$100 million to expand its production capacity to meet the increasing global demand for polyester

Change text size

Gift Premium Articles

to Anyone

P

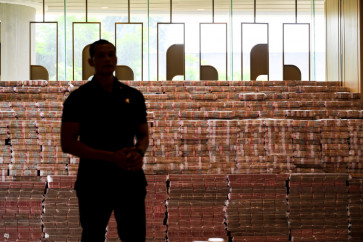

T Asia Pacific Fibers (POLY), a major polyester manufacturer, said the company desperately needed US$100 million to expand its production capacity to meet the increasing global demand for polyester.

However, the company’s unsettled debt restructuring plan means it is unable to secure loans.

Asia Pacific Fibers president director V. Ravi Shankar said the company needed the funds to advance its manufacturing of filament yarn — one of the company’s key products.

“We need to purchase the latest machines,” he said.

The company has an annual production capacity of 148,000 metric tons of filament yarn, manufactured at its facility in Kaliwungu, Central Java. POLY also manufactures staple fibers with an annual capacity of 194,000 metric tons.

The company also produces polymer and purified terephthalic acid (PTA), a chemical for the synthesis of polyester, at its facility in Karawang, West Java.

However, Shankar said that bank loans as a source of financing were out of reach given that POLY still had to settle its secured debt restructuring plan.

POLY’s debt woes stemmed in the 1997 financial crisis. Asia Pacific Fibers, then known as PT Polysindo Eka Perkasa, became saddled with debt, as was its parent company, PT Texmaco Group, a diversified business conglomerate.

Consequently, POLY was declared bankrupt in 2005 by the Commercial Court. The following year, POLY received some financial relief after the court approved the conversion of $630 million of debt into equity capital, leaving the remaining $18.6 million as outstanding unsecured debts.

During this period, Damiano Investments BV — an investment company equally owned by private equities ADM Capital and the Spinnaker Capital Group — purchased POLY’s nonsecured and secured debts, thereby acquiring a 57.69 percent stake in POLY.

The company remains burdened, however, by roughly $1 billion of secured debt, whose restructuring process involving PT Perusahaan Pengelola Aset (PPA), which holds 28 percent of POLY’s secured debts, has reached stalemate. Damiano holds another $660 million of the secured debts.

Shankar admitted that securing bank loans entailed having creditors approve POLY’s restructuring plan, adding that the discussion process had “improved” following the issuance of an upgraded proposal offering “better returns to creditors”.

In the absence of bank loans, POLY has to rely on its $15 million annual excess cash flow to upgrade facilities, although Damiano has also provided the company with approximately $100 million in working capital and capital expenditure loans over the years.

“However, we will not be able to conduct any major expansion to our production lines with these funds,” he told The Jakarta Post.

“We can’t finance our growth unless we can generate significant cash flow by securing a bank working capital facility,” he said.

The company earned $589 million in sales in 2012, down 7 percent compared to the previous year due to price decreases in purified terephthalic acid. Shankar added that the company needed to expand to meet the growing global demand for polyester.

“In the last 40 years, industry has grown at an average of 6 percent annually, while the projected growth for the polyester industry this year is 7 percent,” he said.

POLY’s export value stands at $133 million, although domestic sales total $500 million. Shankar said a domestic market, from petrochemicals to textile manufacturers, could be found here. He added that POLY also needed to expand to maintain its 26-27 percent market share, which it could do by manufacturing value-added products, such as those used in fast-drying sportswear.

“Although sales volume may decrease with the entry of other competitors, our market share would not be eroded as we would move to value-added products to open up new markets for us,” he said.