Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsIndonesians expect higher returns but invest for shorter periods

Change text size

Gift Premium Articles

to Anyone

G

ood things come to those who wait. This old saying needs to be pointed out to local capital market investors as they expect the almost impossible: high returns in a short period of time.

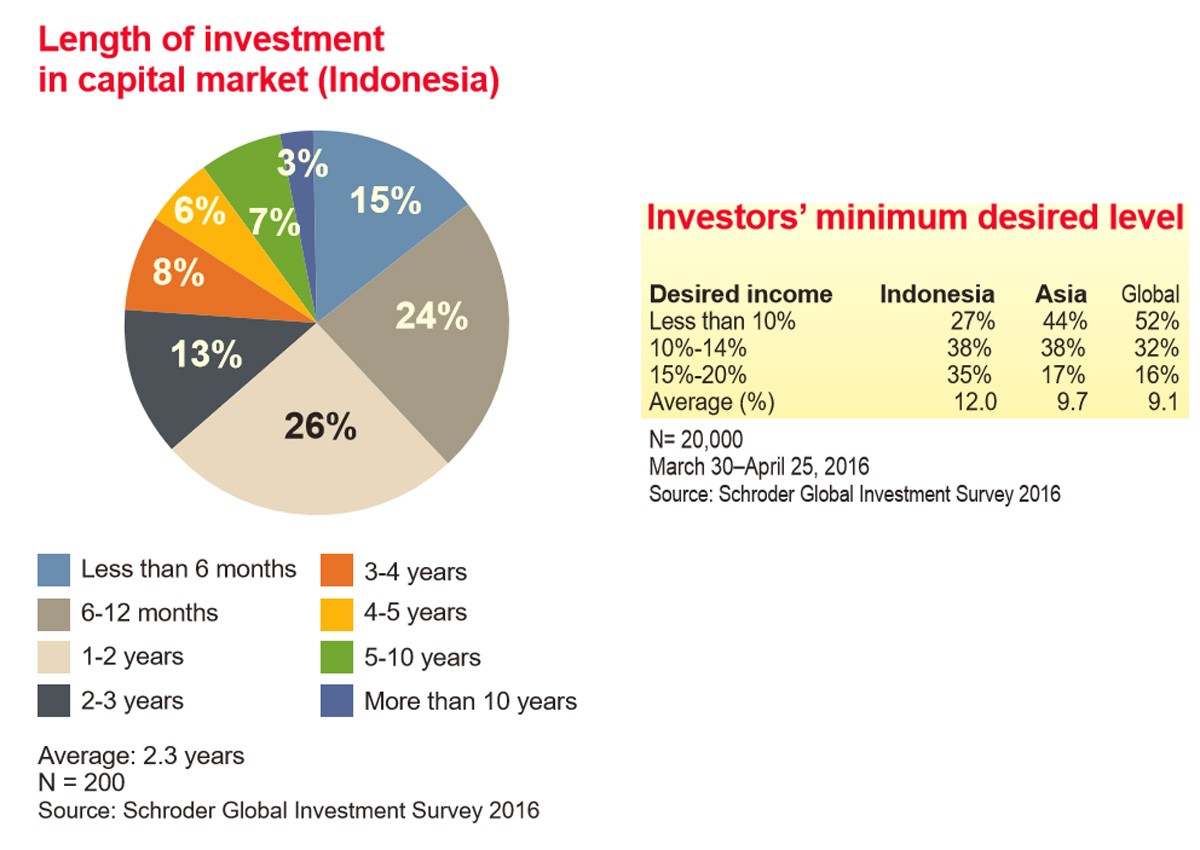

Indonesian capital market investors expect gains of 12 percent on average per year, the second-highest after Russia among 28 countries surveyed by British multinational asset manager Schroders, whose Indonesian operation is the country’s largest private fund manager.

However, they only spend 2.3 years on average on an investment product, the fifth-shortest period in the world, according to Schroders’ Global Investor Study 2016.

“This means we have to educate investors more to invest in the longer term,” said Schroders Indonesia CEO Michael Tjoajadi. “The public needs to invest more in the capital market as it gives higher returns rather than savings and deposits. Hence, purchasing power will improve faster.”

Indonesians are among the least capital market-literate investors in the region, with less than 1 percent of the country’s over 250 million population investing in the stock market.

Efforts have been made by stock market regulator the Financial Services Authority (OJK) and the Indonesia Stock Exchange (IDX) as well as industry players to promote capital market investment as a long-term instrument to manage money instead of the more popular bank savings or deposits. Local stock markets so far this year gained 17 percent while average bank deposits have earned 6.5 percent per year.

Raymond, not his real name, is a typical Indonesian investor based on the Schroders’ survey, as he invests for only one or two years but expects a 15 percent rate of return per year on his capital market investments.

“[...] Or at least higher than bank deposits or savings,” said the 31-year-old civil servant.

Stock MArket(-/-)

Stock MArket(-/-)

Investors also point to the volatility of the stock market in the past few months as reasons for investing in the short-term.

Housewife Siska Cahaya from Serpong, Banten, is among such investors as she invests in stocks for only between two days and three months to reap profits whenever she can.

“The index moves up and down very quickly these days, I can’t keep some stocks for too long. Whenever I see I can get a 15 percent gain I will sell,” said Siska, who cashes in her gains to pay for her child’s school fees or mortgage installments.

Daewoo Securities Indonesia head of research Taye Shim concurred on local market volatility, saying that the performance of local stocks swung widely as a result of local corporations’ dependence on volatile commodities prices.

“We believe the business cycle exhibits greater volatility, prompting investors to exit their positions after a relatively short duration,” he said, adding that promises from fund managers about high rates of return might be the driver of local investors’ investment decisions, rather than the country’s economic fundamentals, which could lead them to stay longer in the market.

Schroders’ Global Investor Study 2016 sampled 20,000 portfolio investors in 28 countries who planned to invest at least €10,000 (US$11,332) in the next year, with a survey period of March 30 to April 25. In Indonesia, the number of respondents amounted to 200, 75 percent of whom were between 25 and 44 years of age. (vps)