Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsRapid proliferation of micro loans leads to bad debt

Change text size

Gift Premium Articles

to Anyone

T

he rapid proliferation of micro loans can lead to bad debt and crises in financial institutions, according to Pakindo, an association representing microfinance institutions.

Pakindo Chairman Slamet Riyadi said that the growth of the gross loan portfolios of financial institutions reached 140 percent per year, with customer growth up to 97 percent.

"Therefore, there is need for a mechanism to share credit information, such as credit bureaus, to improve the quality of loan information for the customers and reduce the risk of bad loans caused by excess loans," Slamet said in Jakarta on Wednesday.

Based on the results of research conducted by Pakindo, some 86 percent of the customers said the loans were taken for business purposes, but almost 60 percent of all customers have difficulties in managing cash flow to meet their loan repayment obligations.

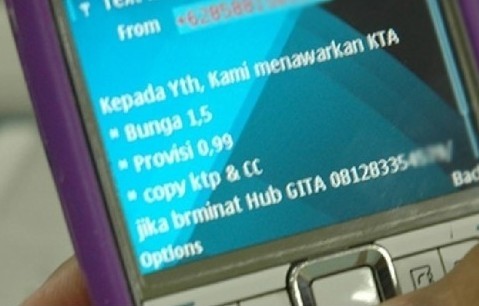

In a study entitled "Loan Overload in Indonesia: Why Customers Take Many Micro Loans", it was found that there are many institutions that offer loans with a simple process that has resulted in customers taking out multiple loans.

The same thing also happens in countries like India, Mexico, Nicaragua and Cambodia, said Slamet. (bbn)