Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsBUMI's share price soars amid debt speculation, what do its fundamentals say?

Publicly listed coal miner PT Bumi Resources Tbk (BUMI) has been known for its forte to make sensational moves.

Change text size

Gift Premium Articles

to Anyone

Daily routine: Heavy equipment and trucks pass through the site of a coal mining field in East Kalimantan. BMI Research, a unit of Fitch Group, has predicted that Indonesia—which is among the five largest thermal coal producing countries— will see its coal production increase by an average 7.5 percent per year from 2017 to 2020, after suffering from a 15 percent year-on-year decline this year. (Antara/Wahyu Putro A)

Daily routine: Heavy equipment and trucks pass through the site of a coal mining field in East Kalimantan. BMI Research, a unit of Fitch Group, has predicted that Indonesia—which is among the five largest thermal coal producing countries— will see its coal production increase by an average 7.5 percent per year from 2017 to 2020, after suffering from a 15 percent year-on-year decline this year. (Antara/Wahyu Putro A)

Publicly listed coal miner PT Bumi Resources Tbk (BUMI) has been known for its forte to make sensational moves.

Although the Bakrie Group-affiliated firm is still waiting for a court decision on its debt restructuring plan, the company’s share price has soared threefold over the past 15 trading days.

Speculation has been the key trigger for the significant increase, which spanned from Oct. 19 to Nov. 8. The latest update suggested that BUMI management is proposing debt conversion to share at the price of Rp 926 (7 US cents) apiece, about four times its current market price. But, what do its fundamentals actually say?

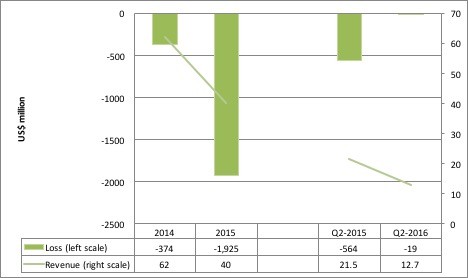

The company’s financial report showed that BUMI saw US$19 million in losses from January to June this year, as opposed to $564 million in losses booked in the corresponding period last year. Although it managed to cushion further losses in the first half of this year, the company’s revenue fell by 41 percent year-on-year (yoy) to $12.7 million from $21.5 million.

Bumi Resources’ Financial Performance

Source: BUMI financial report, Bareksa(/)

Source: BUMI financial report, Bareksa(/)

BUMI has managed to reduce losses after restructuring its debts through the sale of 1.6 million shares of copper producer Newmont Nusa Tenggara (NNT) worth $207 million.

The company, whose revenues mainly come from subsidiaries Kaltim Prima Coal (KPC) and Arutmin, has been facing capital deficiency since 2013. This means that it has bigger liabilities than equities. As of June, BUMI’s debt stood at $6.5 billion while its capital deficiency at $2.9 billion.

Although the company has not yet published its third quarter financial report, BUMI has announced that it has seen an increase in sales volume. During the first nine months of this year, it posted a coal sales volume of 64.6 million tons, up by 10.7 percent from 58.4 million tons sold in the same period last year.

At the same time, it also recorded a rising volume in coal mined to 62.7 million tons, or up by 4.5 percent yoy from 60 million tons.

However, the average selling price (ASP) of BUMI’s coal during the nine-month period fell by 12.25 percent yoy to $40.1 per ton compared to $45.7 per ton.

A rough calculation by multiplying the ASP and sales volume suggests that BUMI’s total revenue from January to September was $2.59 billion, slightly down by 2.99 percent from $2.67 billion it posted in the corresponding period last year. BUMI, meanwhile, plans to publish its third quarter financial performance by December. (hwa)

Source: Bareksa.com