Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsHousehold wealth sheltered from crisis

Change text size

Gift Premium Articles

to Anyone

I

ndonesia’s domestic consumption-reliant economy and intact growth relative to the global economy worked their magic in safeguarding households from the 2008 global financial crisis.

“The global financial crisis had little impact on wealth in Indonesia,” Credit Suisse Research Indonesia (CSRI) wrote in a media release in its seventh annual Global Wealth Report published Wednesday.

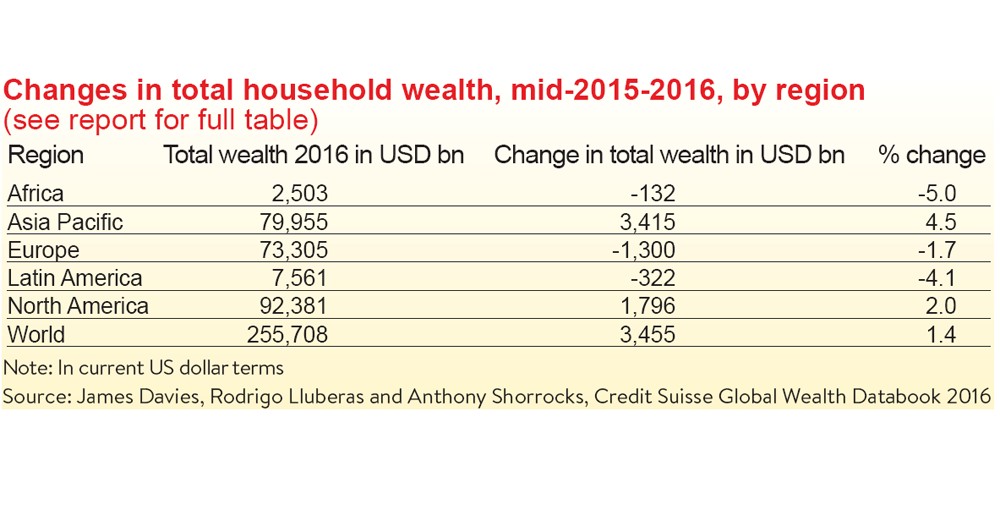

Indonesia’s household wealth grew by 6.4 percent this year to reach US$1.8 trillion, much faster than the global average of 1.4 percent and even Asia Pacific’s 4.5 percent, the fastest-growing region in the world, the report shows.

In Indonesia, 84 percent of the adult population owns less than US$10,000 — above the global figure of 74 percent — but wealth per adult in rupiah has skyrocketed six-fold from 2000 to now.

“China, Korea and Indonesia are examples of countries where individuals have been ascending rapidly through the wealth pyramid,” the press statement shows.

Indonesia’s emerging middle class has lured multinationals, especially those in the consumer goods-related sector, to invest and expand in Southeast Asia’s largest economy. Dubai-based Lulu opened its first hypermarket in Indonesia earlier this year, while Singapore’s Courts, South Korea’s Lotte, Sweden’s IKEA and H&M have big plans for their young Indonesian operations.

“Shopping centers are not vacant — they’re more liquid. They’re really indicators for spending power,” said Sigit Pratama Wiryadi, president director of Aberdeen Asset Management, which manages Rp 780 billion of wealth in Indonesia.

Indonesia’s 5 percent economic growth in recent years — relative to the world’s average of less than 5 percent — had also pushed up household wealth, Sigit added.

At higher wealth levels, the number of millionaires in Indonesia have grown strongly at 13 percent to 112,000 individuals owning a total wealth of $500 billion, which is projected to grow 9.1 percent per year to reach 173,000 by 2021, CSRI’s report shows. The number of ultra-high-net-worth individuals — those with net worth of over $50 million — also has jumped 25 percent to reach 1,092 this year.

Binaartha Sekuritas senior analyst Reza Priyambada said it was no surprise that Indonesia saw its household wealth increase thanks to its huge domestic market that was relatively resilient to external shocks.

“Household wealth correlates with the spending of a country’s citizens. Consumer spending in Indonesia is relatively large because most of our citizens are at a productive age who are more inclined to spend,” Reza said.

Companies that run businesses related to private consumption were not hesitant to expand their businesses as domestic purchasing power would remain high, he added.

Home to more than 250 million people, household consumption still provides the largest contribution to the country’s gross domestic product (GDP) of 55 percent, followed by investment at 32 percent and exports at 18 percent.

Throughout the world, African, Latin American and European households have been the most affected by the ongoing global economic slowdown, with wealth contracting by 5 percent, 4.1 percent and 1.7 percent in those regions, respectively. North America has seen 2 percent growth.

“The downward movement in equity prices and market capitalization also led to the relatively small increase in household financial wealth,” the report reads.

The UK suffered a significant drop in wealth of $1.5 trillion in response to the Brexit vote, which triggered a sharp decline in exchange rates and the stock market, CSRI said. (wnd)