Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsP2P lender advertises client for sex service to pay debt

Gede said YI took the loan as she needed to pay her child’s school fees. She only received Rp 650,000 from the total loan of Rp 1 million because she had to pay the administration fee to the P2P lender.

Change text size

Gift Premium Articles

to Anyone

A

n unregistered financial technology (fintech) company or peer-to-peer (P2P) lender has advertised a client for sexual services after the client failed to pay installments on her loan.

Solo Raya Legal Aid Institute (LBH Solo Raya), which was appointed by the client identified only as YI as her advocate, will take the case to the police. Incash, the P2P lender, advertised YI as if she was ready to have sex for Rp 1.05 million (US$75.37).

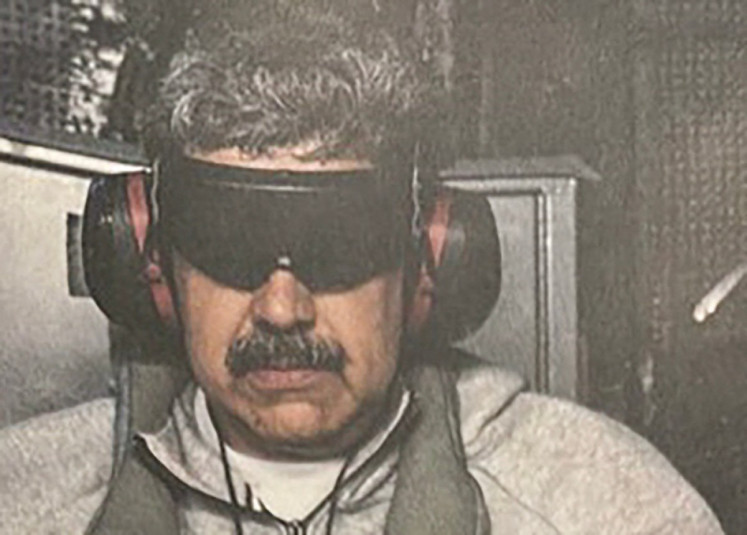

Incash and their debt collectors spread the photograph of the client with the caption: “Willing to do anything to pay off debt on the Incash online loan application” on Facebook and WhatsApp.

“It was extraordinary cruelty. It also violated the Electronic Information and Transactions (ITE) Law. It is a defamation case,” said LBH Solo Raya director I Gede Sukadenawa Putra recently.

Gede said when YI came to the Solo Raya office to seek legal assistance, she said she was stressed as she was ashamed of being advertised for sex.

Gede said YI took the loan as she needed to pay her child’s school fees. She only received Rp 650,000 from the total loan of Rp 1 million because she had to pay the administration fee to the P2P lender.

YI had paid her installments several times, but at times when she was late she would get terrorized by the company, Gede added.

“Her debt soared to Rp 25 million. The debt collectors threatened to spread her name and picture on social media, but advertising her for sexual services crosses the line.” Gede said.

According to LBH Solo Raya, there are four other victims who experienced similar threats from Incash's debt collectors. The clients’ debts ranged from Rp 5 million to Rp 30 million.

Meanwhile, Financial Services Authority (OJK) consumer protection head Anto Prabowo stressed that Incash was not registered.

“Reporting to the police is the right thing to do, it should be filed under blasphemy,” Anto said, adding that the OJK would keep trying to educate people to stay away from unregistered P2P lenders because “such easy loans are always unsafe”. (dmy/bbn)