Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

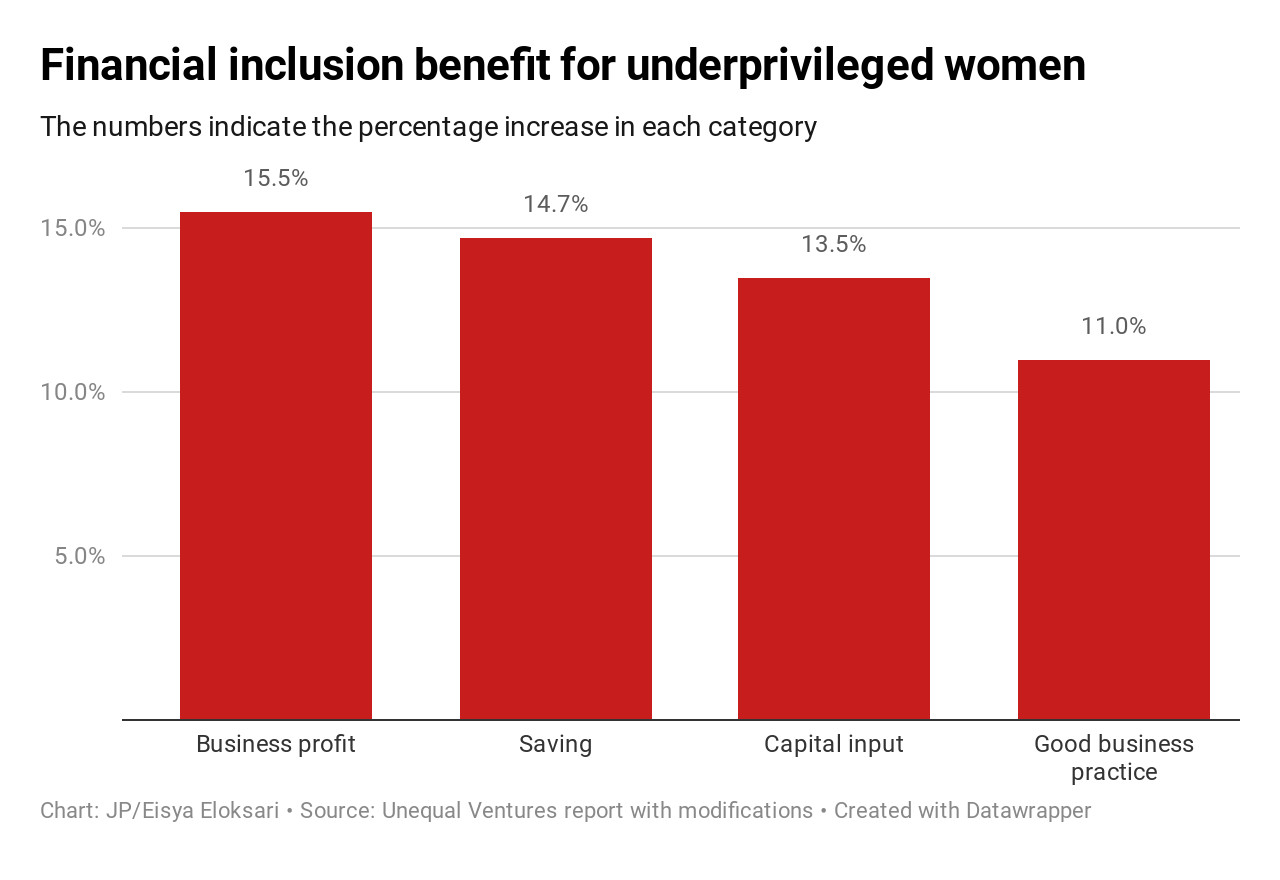

View all search resultsFinancial inclusion empowers women in underprivileged families

Financial inclusion increases women entrepreneurs’ revenue by 15.5 percent and savings by 14.7 percent.

Change text size

Gift Premium Articles

to Anyone

F

inancial inclusion for underprivileged women has contributed to an increase in business profits, savings and women’s role in household decision making, a recent joint study shows.

The study looked into the Financial Services Authority’s (OJK) Laku Pandai (branchless banking) program and its effect on unbanked but productive women in five rural villages in East Java, namely Bojonegoro, Gresik, Lamongan, Ngawi and Tuban.

The study, titled Unequal Ventures: Results from an Endline Study of Gender and Entrepreneurship in East Java, Indonesia shows that the program helped increase women entrepreneurs’ revenue by 15.5 percent and savings by 14.7 percent.

“Women lack access to a safe and reliable saving place in developing countries,” said Myra Buvinic, a senior fellow at the Center for Global Development who conducted the study with other researchers.

She said during the dissemination of the report on Monday that mobile financial services were crucial for these women, especially when a 2018 study showed that adult women were more likely (63 percent) to open a savings account than men (26 percent).

Buvinic went on to say that as men received higher revenue as entrepreneurs, they were able to save more money than women with an average Rp 8.6 million (US$629.5) annually compared to women, with Rp 5.9 million annually.

The Unequal Ventures report stated that the number represented 39 percent of women’s income and only 22 percent of men’s income.