Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search results[ANALYSIS] Achieving a green economy through sustainable finance

Indonesia’s entry into the top 20 green bond issuing countries provides an opportunity for the country to continue to develop its green issuances in line with environmental, social and governance (ESG) trends.

Change text size

Gift Premium Articles

to Anyone

T

he pandemic is accelerating environmental, social and governance (ESG) trends and has revealed companies’ resilience or vulnerability in facing crises and their ability to be responsive and adaptable. This particularly shows how well prepared companies are against another systemic challenge. The pandemic has increased the need for effective crisis management and emphasizes the importance of stronger council involvement in overseeing ESG issues.

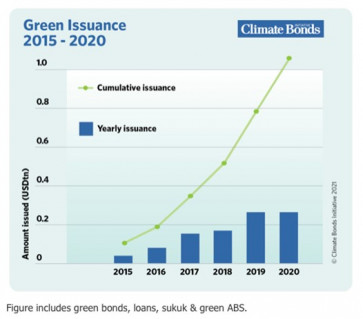

Global green issuances, which include green bonds, loans, sukuks and green asset-backed securities (ABS), continue to increase. The Climate Bonds Initiative (CBI) states that from 2015 to 2020, green issuances cumulatively reached a value of US$1,002 trillion. For 2015 to 2020, regionally and cumulatively, Europe was the highest green-issuing region, reaching $432.5 billion (43 percent), followed by North America at $237.6 billion (24 percent) and Asia Pacific at $219.3 billion (22 percent). Other notable green issuances include $20 billion (2 percent) by Latin America and the Caribbean (LAC) and $3.5 billion (less than 1 percent) by Africa. In 2020, global green bond issuances reached $269.5 billion, and Indonesia (19 percent) was among the top 20 countries for annual green bond issuances.

Investment in the energy sector was the largest component of the $354.7 billion issuance, followed by low carbon buildings at $263.5 billion and transportation at $190.7 billion. Water infrastructure was in the fourth position at $98.7 billion, and waste management at the fifth at $36.9 billion. Industry, information and communication technology and land use collectively amounted to $40.8 billion, while $17.6 billion was for unallocated proceeds.

Financial corporations were the largest issuance source at $205.6 billion, with non-financial corporations next at $205.0 billion, followed by development banks at $158.8 billion. Government-supported entities contributed $153.1 billion to the market size, and local governments contributed $63.9 billion. ABS comprised $116.2 billion, and green loans totaled $28.9 billion in markets with signs of growth, particularly in Asia.

The total sovereign issuance in 2020 reached $71.5 billion, with green sovereign memberships now counting 17 countries: Belgium, Chile, Egypt, Fiji, France, Germany, Hong Kong, Hungary, Ireland, Indonesia, Lithuania, the Netherlands, Nigeria, Poland, Seychelles, Sweden and Thailand. According to the CBI count, 14 other countries may enter the club next year.

Indonesia’s entry into the top 20 countries provides an opportunity for the country to continue to develop its green issuances (ESG). Increasing ESG is one of the focuses of Indonesia’s capital market. In 2017, the Indonesian Financial Services Authority (OJK) issued new regulations that gradually helped all financial institutions issue sustainability reports, starting in 2019 for large banks and beyond. The Indonesia Stock Exchange (IDX) joined the Sustainable Stock Exchange (SSE) initiative in 2019, in line with its commitment to ESG issues.

The CFA Institute, a global association of investment professionals, states that the Indonesian market is dominated by government bonds. The demand for corporate bond issuance continues to increase but is still far below government bond issuance. Most companies still approach banks for debt financing. Bonds are traded over the counter, with all traded bonds reported to regulators and published on the IDX website. The liquidity of the over-the-counter (OTC) market increases over time, especially for government bonds.