What to expect from OJK regulations on digital banks?

Since there is no specific license provided for digital banking, it appears that the appellation "digital bank" has been exploited as gimmick for marketing purposes.

Change text size

Gift Premium Articles

to Anyone

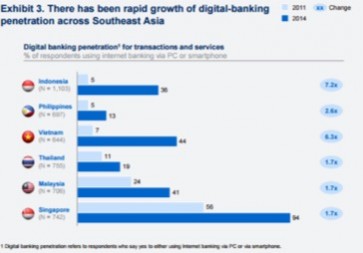

Digital banking penetration across Southeast Asia. (JP/File)

Digital banking penetration across Southeast Asia. (JP/File)

F

intech companies have been actively acquiring equity stakes in Indonesian banks. Recently, Funding Societies and Carro have announced their investment in Bank Index. This behavior makes sense for fintech companies as it expands their digital ecosystem. As for banks and their existing shareholders, it is simultaneously advantageous since fintech companies bring in technology together with additional capital.

The Financial Services Authority (OJK) has addressed this trend by issuing regulations on commercial banks, which encompass digital bank provisions. However, unlike Singapore or Malaysia, Indonesia does not have a license specific to digital banks. The license falls under the commercial banking licensing regime, as OJK arguably considers digital banking as a business model that does not require a specific license.

Along the way, this approach seems to have resulted in many banks becoming self-proclaimed digital banks. It is clear, under the regulation, that a digital bank is a commercial bank that operates through electronic channels, having at least one physical office. However, since there is no specific license provided for digital banking, it appears that the appellation “digital bank” has been exploited as a gimmick for marketing purposes.

To mitigate this practice, OJK intends to issue regulations sometime this year that specifically governs qualifications for digital banking.

OJK would apply Digital Maturity Assessment for Banks to determine the digitalization level of banks, which, pursuant to OJK’s blueprint for digital transformation in banking, would be done by assessing six pivotal elements in a bank: data, technology, risk management, collaboration, institutional governance and customers. OJK then will rate the digitalization level from 1 to 3, with 3 being the highest digital maturity level. Banks with digitalization level 3 would then able to claim themselves as digital banks.

We suppose that OJK will incorporate the abovementioned elements into the regulations, considering recent news. In that case, the following are several points to be considered by those expecting to be Indonesian digital banks.

First, the blueprint suggests that OJK adopt principle-based regulations. Instead of setting out detailed and prescriptive rules, the regulations should be set out in a broad and high-level manner, and outcome-focused (which indicates that details would be left to the banks to achieve outcomes). Despite this, for implementation purposes, we foresee there will be some detailed elaboration of the principles in the regulations.