Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsBiden’s verbosity on China’s economy

As evidenced by Fitch Ratings' recent downgrading of the US' debt rating from AAA to AA+, the country's economic trajectory is far from stellar.

Change text size

Gift Premium Articles

to Anyone

I

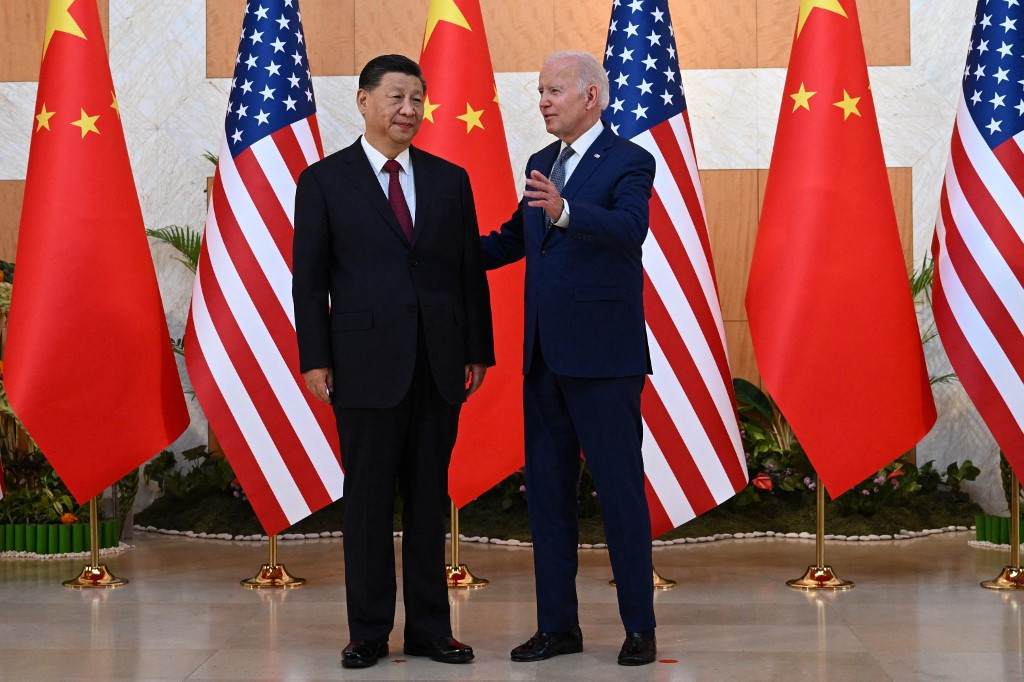

n an astonishing display of rhetorical hubris, United States President Joe Biden recently unleashed a fusillade of criticism aimed squarely at China, dubbing it a "ticking time bomb" during a political fundraising event in Utah last week.

Such rhetoric, laden with inaccuracies and sensationalism, raises pertinent questions: Is it indeed China that warrants this ominous label, or could it be the US that teeters on the precipice of global economic instability?

Biden's verbal missteps are manifold, revealing an astonishing lack of exactitude when discussing China's economic trajectory. His misinformed and misleading references to China's growth rate and demographic trends betray a superficial grasp of the complex factors shaping China's economic landscape.

There is no doubt that July presented a mixed picture that left analysts squinting for clarity about China’s financial numbers. The Consumer Price Index (CPI) took a peculiar route: it stumbled year-on-year, yet pirouetted from a previous month's slump to a surprising reversal. The July CPI, once a stagnant year-on-year fixture, now exhibits a modest 0.3 percent dip.

And analysts contend that this downward trajectory could be a transient occurrence. Meanwhile, the Producer Price Index (PPI) had its own pas de deux, plunging 4.4 percent year-on-year. Concurrently, the offshore renminbi slipped below 7.3 against the US dollar on Aug. 15, marking its lowest ebb since 2023.

These economic notes, twined with the renminbi's recent descent, have struck discordant chords in Western media. Amidst this chorus, Biden dubbed China, constrained by relatively sluggish growth in second quarter, a ticking "time bomb".

But other data shows that, despite continued direct and indirect US pressure, the initial six months of 2023 defy the odds, boasting a staggering 35.7 percent surge in fresh foreign-backed ventures in China – a robust 24,000 in total. High-tech sectors also revel in a 7.9 percent investment uptick, driving their share to a notable 39.4 percent, up by 3.9 percentage points.

The tumultuous current of transient economic data and Western media critiques holds no sway in disparaging China's steadfast economic trajectory in the post-pandemic period. Biden's claim that China's recent economic numbers make it vulnerable to decline carries an air of ignorance and prejudice.

This is not the first instance of US politicians resorting to the “Chicken Little” tactic, talking about China's imminent economic collapse only to be proven wrong time and again. Regrettably, this tactic seems to have become a staple in the playbook of electioneering, an alluring strategy to attract public attention through the vilification of China. In this disconcerting race, the true casualty is factual accuracy.

Yet, should the notion of a "ticking time bomb" indeed resonate as a motive, it finds its ironic resonance more aptly in the realm of US economic affairs. As evidenced by Fitch Ratings' recent downgrading of the US' debt rating from AAA to AA+, the country's economic trajectory is far from stellar.

Fitch's sobering appraisal attributed this devaluation not to a mere isolated bout of partisan wrangling over the debt ceiling but rather to a protracted decline in governance standards over the course of two decades. This conspicuous erosion pertains specifically to the fiscal and debt dimensions, signifying a chronic predicament rather than a transient hiccup.

Contrasting these realities, one is compelled to discern the glaring disparities between China's measured resilience in the face of global adversities and the US' own vulnerability. The Chinese economy, while not immune to the challenges posed by the pandemic, has demonstrated an impressive capacity to adapt and persevere.

Overcoming hurdles such as youth unemployment and bolstering domestic consumption, China has displayed economic robustness far from the notion of a "ticking time bomb". In the January-July period, fixed-asset investment–a gauge of expenditures on items including infrastructure, property, machinery and equipment-grew by 3.4 percent compared with a year earlier.

China, the world's second-largest economy, witnessed a growth rate of 5.5 percent in the first half, as per data from the National Bureau of Statistics. However, the quarter-on-quarter expansion fell to a mere 0.8 percent. Such a modest slowdown is exacerbated by an array of challenges, both internal and external in nature.

As expected, western media outlets, quick to pounce on any weakness, have characterized the second-quarter growth as feeble. But their propagation is misleading. As the Chinese economy navigates its way through challenges, seasoned economists and analysts remain sanguine about its overall trajectory, foreseeing a high likelihood of achieving the targeted growth rate.

With China having set a 5 percent gross domestic product (GDP) growth target for 2023, the Chinese leadership also pragmatically acknowledges the hurdles awaiting in the second phase of recovery. The Chinese government has been proactive, orchestrating a series of prompt and astute actions to tackle the situation head-on.

Conversely, a dispassionate evaluation of the US' actions on the global stage yields disconcerting results. The American penchant for unilateralism and protectionism has triggered big disruptions across industries and supply chains, imparting grave repercussions upon the global economy.

It is the US' geopolitical maneuvering, marked by its fervent embrace of destabilizing tactics and machinations, that poses the major impediment to a flourishing global economic landscape. In light of these assessments, it is with an ironic twist that Biden's words turn inward.

The US' penchant for polarization, fiscal imprudence, and bellicose international conduct portrays a nation precariously situated on a veritable time bomb of its own making. The fragility of its economic governance, coupled with its unilateral disruptions to the international order, paints a bleak picture that starkly contrasts with China's measured resilience.

As the world watches, it becomes evident that the real "ticking time bomb" is not an external adversary, but an internal quagmire fueled by shortsightedness, hubris, and neglect. If Biden's aim is to scrutinize such a volatile concept, he might be prudent to reassess his comments, for it is the US, not China, that symbolizes the disquieting idea of an imminent disruption on the global economic platform.

***

The writer is an international relations analyst based in Karachi.