Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsAnalysis: Coretax under fire amid technical issues, corruption allegations

Change text size

Gift Premium Articles

to Anyone

J

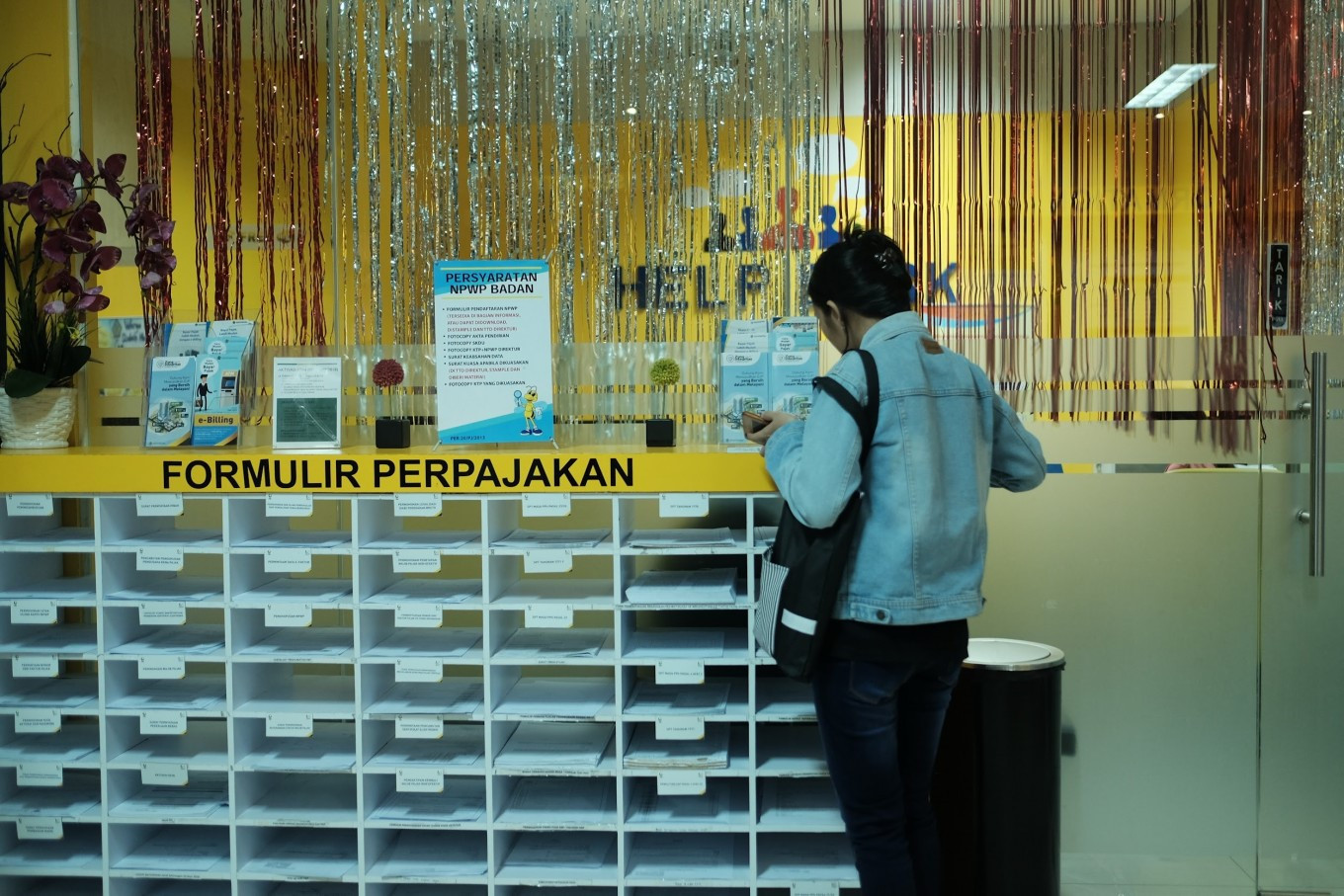

ust one month after its launch on Jan. 1, the government’s Rp 1.3 trillion (US$79.58 million) Core Tax Administration System (Coretax) is already under fire. Designed to modernize and streamline the country’s tax administration, Coretax has faced criticism for technical malfunctions, complexity and allegations of corruption.

Developed by the Finance Ministry’s Taxation Directorate General (DJP) since 2020 under Presidential Regulation No. 40/2018, the Coretax megaproject has drawn public attention, partly due to its hefty price tag. The procurement process, facilitated by PT PricewaterhouseCoopers (PwC), resulted in South Korea’s LG CNS and Qualysoft Group being selected as system developers. However, despite this rigorous process, the system's shortcomings have raised serious concerns.

Allegations of corruption have recently emerged, adding to the challenges surrounding the Coretax project. The Indonesian World Tax Institute (IWPI) has reported a suspected corruption case tied to the development of the system, with potential misappropriation exceeding Rp 1.3 trillion. A notable example fueling suspicion is the allowance for 790 large taxpayers to continue using the old application, while smaller taxpayers are required to adopt the new system. This disparity raises concerns about fairness and transparency, further undermining confidence in the project. These allegations compound the system's ongoing struggles to meet its objectives and deliver on its promises of improved tax administration.

Other challenges remain with the system’s functionality. Despite the government’s promise of improved efficiency, the Coretax system has hindered taxpayers with numerous obstacles. Taxpayers have reported persistent technical difficulties with Coretax, including challenges accessing the platform, errors in generating tax invoices, and discrepancies between National Identity Numbers (NIK) and Taxpayer Identification Numbers (NPWP). The Indonesian Employers Association (Apindo) has highlighted these issues, stating they have disrupted business operations and made compliance more burdensome.

Several businesses are facing trouble specifically with the tax invoice generation function. Up until now, taxpayers are still experiencing difficulties with their monthly tax obligations. Creating withholding certificates and generating tax invoices, such as for workers’ income tax (PPh 21) and value-added tax (VAT), is particularly challenging. Some have anticipated that technical difficulties with the Coretax system will result in a substantial decrease in tax revenue for January 2025.

Coordinating Economic Minister Airlangga Hartarto has voiced concerns over Coretax’s impact on state revenue. He suggested creating separate tax administration systems for corporate taxpayers, particularly in sectors like fast-moving consumer goods (FMCG), which face more complex invoicing and withholding requirements compared with individual taxpayers.

To fully realize the benefits of the Coretax system improvements, corresponding system adjustments in other institutions are crucial for seamless connectivity and enhanced integrated taxpayer compliance monitoring.