Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsAnalysis: Tapera law annulment exposes flaws in Indonesia’s housing strategy

Change text size

Gift Premium Articles

to Anyone

T

he government’s ambition to secure long-term affordable housing funds through the public housing savings program, Tapera, has hit a major setback. The Constitutional Court recently annulled the 2016 Tapera Law in its entirety, declaring that the legislation must be revised within two years or risk being void altogether. The ruling has thrown the program, which was scheduled to be fully implemented in 2027, into limbo and further complicated the government’s already ambitious goal of building three million houses annually.

The court’s decision marks the culmination of years of public outcry against Tapera. Since its inception in 2016, the program has faced consistent resistance from both workers and employers, and criticism resurfaced in 2020 when the government issued a government regulation (PP) to operationalize the scheme. Tapera was designed to help low-income workers access affordable housing by pooling mandatory contributions from the workforce. After contributing for at least one year, participants can apply for mortgages to purchase, build or repair their first homes, with savings plus returns accessible only after retirement at age 58.

The crux of public dissatisfaction lies in Tapera’s mandatory 3 percent salary contribution: 2.5 percentage points from employees and 0.5 points from employers. For workers, this adds to an already heavy burden of obligatory deductions, including those for health insurance (BPJS Kesehatan) and social security (BPJS Ketenagakerjaan). Employers, meanwhile, see the additional 0.5 percent as another cost layered onto business operations.

The government envisioned Tapera as a transformative financing pool, projecting collections of Rp 160 trillion to Rp 268 trillion from 43 million formal-sector workers by 2027. Managed by the Public Housing Savings Management Agency (BP Tapera), these funds were intended to finance affordable housing loans and reduce Indonesia’s nearly 10-million-unit housing backlog.

But with the Constitutional Court’s annulment, those projections are now off the table. BP Tapera’s role has shrunk significantly, limited to managing existing civil servant housing funds, transferred in 2020, and disbursing the government’s Housing Financing Liquidity Facility (FLPP). Even there, challenges persist: of the Rp 18.77 trillion FLPP budget allocated this year, disbursement has been slow because the supply of subsidized homes cannot keep up with demand.

This supply-side bottleneck undermines President Prabowo Subianto’s ambitious target of building three million homes annually, two million in rural areas and one million in urban areas. While financing programs such as FLPP aim to address the demand side by making mortgages more accessible, they do little to overcome the structural obstacles of limited land availability and soaring property prices.

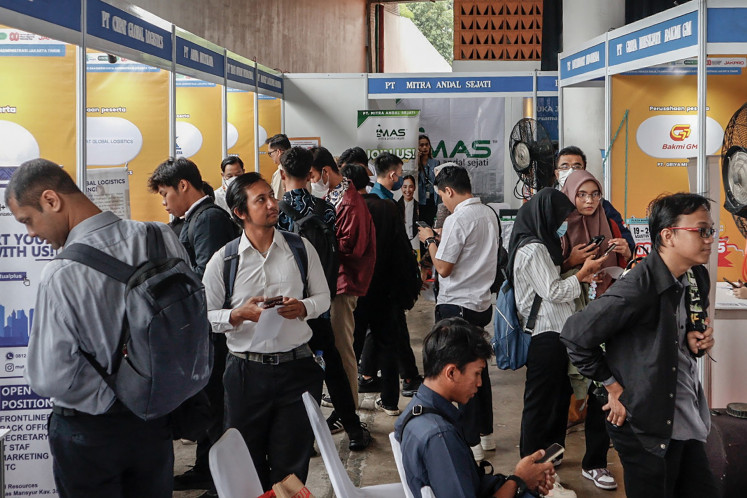

Experts argue that the government has misunderstood the root of Indonesia’s housing crisis. The demand side, bolstered by various financing schemes, is not the key challenge. Instead, the persistent shortage of affordable land, compounded by the dominance of large corporations in land ownership, has constrained the supply of low-cost housing. This imbalance has worsened affordability issues, particularly for younger Indonesians. An estimated 81 million people from the younger generation remain without homes. In Greater Jakarta, house ownership rates are among the lowest nationwide at just 54.44 percent. With rising living costs and skyrocketing property prices, owning a home has become an elusive dream for many.