Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsOutlook on Indonesian coal exports amid weakening demand in pandemic

There were small increases year on year in exports to China, but exports to India were lower as coal imports into the country were impacted by COVID-19 lockdown closures of ports during April.

Change text size

Gift Premium Articles

to Anyone

T

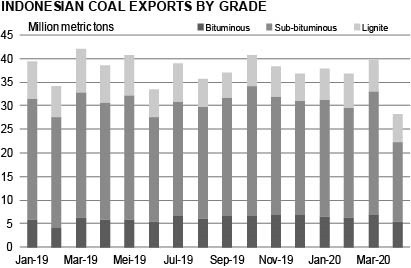

he coal industry can be split into two broad sectors - namely coal-mined that is burnt domestically; and the seaborne market, where coal is mined and exported to countries that need to import energy. For coal used in energy, Indonesia produces and exports three types of coal: high energy bituminous, lower energy sub-bituminous, and very low energy lignite coal. Power stations that burn coal for electricity want to buy a fuel that is energy-efficient and cheap. Indonesian coal production is skewed towards lower energy and cheaper sub-bituminous and lignite coals.

Indonesia’s thermal coal exports reached a record 453 million metric tons (mt) in 2019, mainly comprising sub-bituminous coal, whereas demand, which was flat year on year in 2019 has further deteriorated in 2020. In seeking to address the oversupply in the seaborne market in 2020, there is a need for Indonesian coal producers to reduce sub-bituminous exports.

Latest coal production and export data suggests there will be additional declines, especially as prices near marginal cost of supply. S&P Global Platts Analytics believes weak coal demand, mainly due to reduced demand from India and China, as well as narrow price spreads between high- and low-energy coals have pushed Indonesian low energy coal prices to a floor and should recover with demand.

Indonesian coal exports in April, including lignite, were 27 percent lower year on year, its lowest level since February 2017. There were small increases year on year in exports to China, but exports to India were lower as coal imports into the country were impacted by COVID-19 lockdown closures of ports during April.

For the January to April period, total coal exports were 7 percent lower year on year mt, after first quarter of 2020 exports were flat relative to year-ago volumes.

We have talked about an oversupply of sub-bituminous coal in the seaborne market, and a supply response is required to bring the market back to balance.

We believe COVID-19 lockdown measures impacting demand, particularly in India, has forced Indonesian producers to reduce exports. Declines in sub-bituminous coal exports accounted for the vast majority of the fall in total thermal coal and lignite exports. The fall in prices, due to the oversupply and the poor demand, has likely also contributed to this decline in lower CV coal exports.

Bituminous coal exports (high- and mid-CV coal) for the January-April period were 15 percent higher year on year, suggesting more demand for higher energy coal has displaced lower energy coal demand. S&P Global Platts Analytics expects additional declines in production and exports when official May and June data is released. We estimate May thermal coal exports at 24 million mt and June exports at 21.5 million mt. Our forecast for Indonesian thermal coal exports for calendar 2020 is a 15 percent drop year on year from their record exports of 453 million mt.

We have seen a sharp decline in Indonesian production, particularly in May and June. According to data from the Indonesian Ministry of Energy and Mineral Resources, June production is estimated at 32 million mt, down almost 14 million mt year on year. For first half of 2020, Platts Analytics estimates Indonesian coal production will be 261 million mt, down 21 percent year on year. Our current Indonesian domestic coal production forecast for 2020 is around 11 percent lower than 2019 production.

We believe coal with an energy content of 4,200 kcal/kg GAR (Gross energy content as received by the port) priced below $23/mt FOB (Free on Board or export basis) Kalimantan would see significant pressure on Indonesian coal producers to cut production. We expect a recovery in demand in India and Southeast Asia will help pull prices higher, especially with production and export volumes being taken out of the market during the May to June period.

While the decline in coal selling prices and demand could be cause for concern for Indonesian coal producers, Platts Analytics does not expect additional downside to current price levels. Declining production will help address the imbalance in the export market. This in turn will help keep selling prices for coal above production costs through to the end of the year.

***

The writer is senior coal analyst at S&P Global Platts Analytics.