Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

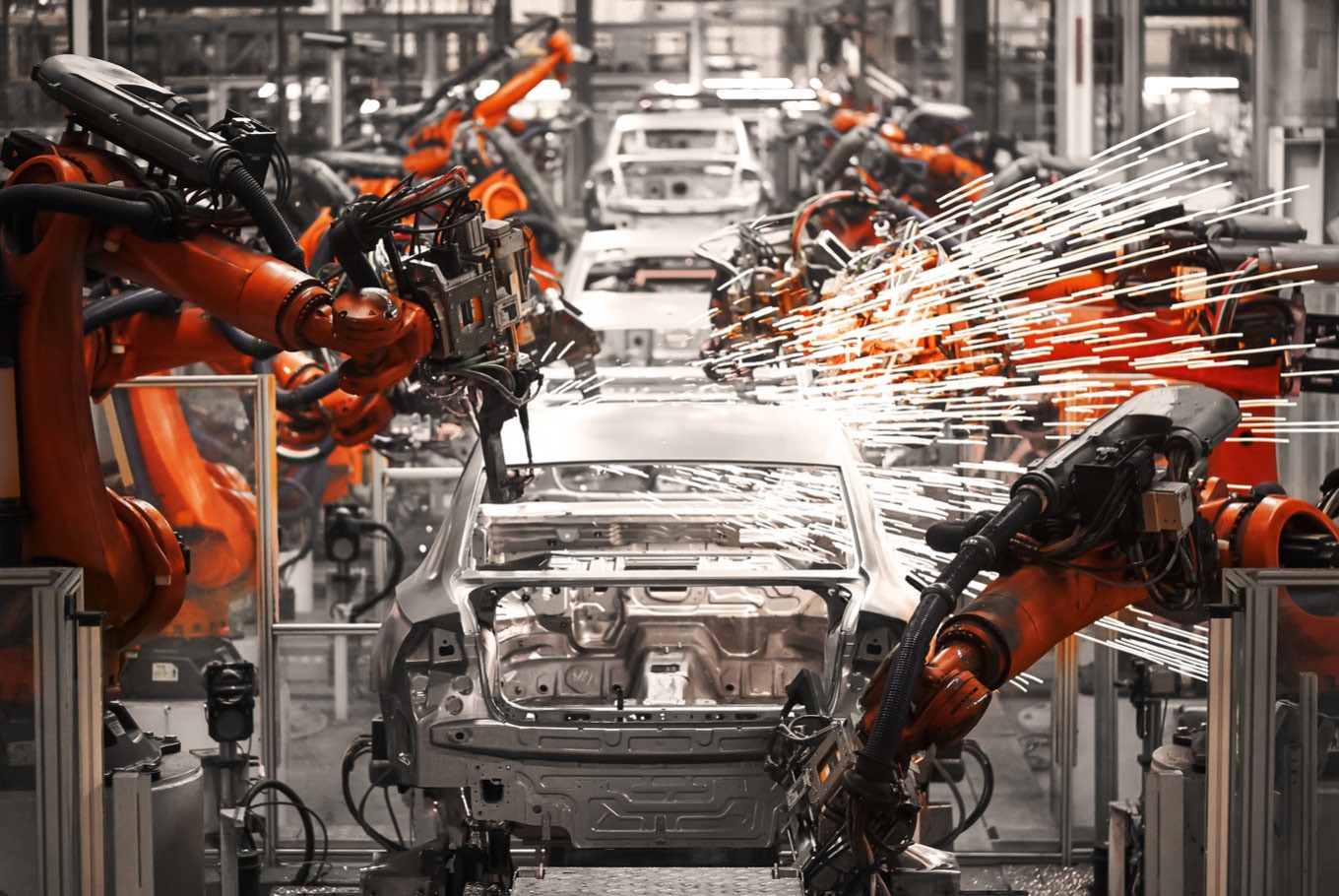

View all search resultsAnalysis: ASEAN automotive sector hits brakes, faces long road to recovery

The COVID-19 pandemic has led to a slowdown in the automotive industry across the world, especially in ASEAN countries. Before the pandemic, Indonesia had a dominant position in the ASEAN automotive market. As COVID-19 hit in late February, the country dropped to fifth position.

Change text size

Gift Premium Articles

to Anyone

T

he COVID-19 pandemic has led to a slowdown in the automotive industry across the world, especially in ASEAN countries. Before the pandemic, Indonesia had a dominant position in the ASEAN automotive market. As COVID-19 hit in late February, the country dropped to fifth position. One of the reasons, according to the Association of Indonesian Automotive Manufacturers (Gaikindo), Indonesia was quite late in responding the pandemic compared to Thailand, Malaysia, the Philippines and Vietnam. However, we have to be aware that Indonesia’s population and geography are very different from that of those countries. The handling of the outbreak requires much more time and large funds because the population is large and scattered over thousands of islands.

In 2019, Indonesia’s domestic car sales reached 1.03 million units, the highest sales in ASEAN. While in second place was Thailand with 1.01 million units, followed by Malaysia with 604,000, Philippines 369,000 and Vietnam 322,000. If we take the average monthly sales of new cars in Indonesia in 2019, it was 86,000 units per month. Meanwhile, in early 2020, the average sales dropped due to the prolonged pandemic. Since the Indonesian government announced the first positive case of COVID-19 in March and imposed restrictions to fight the pandemic and business was disrupted globally, car sales decreased sharply.

Car sales started to drop significantly to only 7,800 units in April. The lowest figure was booked in May, which dropped to 3,500 units. Then in June, the government relaxed social restrictions and car sales increased to 12,623 units and gradually went up to 25,283 units in July.

If we look at data from the ASEAN Automotive Federation, in August, Indonesia was only able to sell 37,291 units while Thailand reached 68,883 units, Malaysia sold 52,800 units, Vietnam 20,655 units and the Philippines 17,906 units. From January-August, Indonesia’s total car sales ranked second in ASEAN with a total of 323,507, while Thailand sold 456,858 units in the same period.

The following is a detailed record of ASEAN car sales growth from January-August year-on-year (yoy): Indonesia’s car sales contracted 51.1 percent, followed by Singapore contracting 47.8 percent, the Philippines contracted 47.6 percent, Thailand contracted 33.4 percent, Malaysia contracted 28.4 percent and Vietnam contracted 25 percent. Overall in ASEAN, car sales from January-August significantly contracted 38.4 percent on a yoy basis.

This data shows that Indonesia’s automotive sector was the most affected in ASEAN due to COVID-19 and the recovery would be very slow, because demand for cars would remain depressed for an extended period. There will be uncertain economic prospects, very much dependent on the spread of COVID-19.

Bank Mandiri Research Team estimates that the performance of Indonesia’s automotive industry in the 2020 fiscal year will be very depressed. Our estimation is that car sales will fall 41.7 percent with 600,000 units, assuming that the economic growth scenario heads toward a positive trend in the fourth quarter. We also estimate that car sales in the 2021 fiscal year are projected at 845,000 units, a growth of 38.7 percent, and car sales in the 2022 fiscal year are projected at 935,000 units, 10.7 percent growth. However, if economic growth is worse than expected, we predict car sales will contract even further if COVID-19 cases continue to increase.

As mentioned earlier, Indonesia holds a dominant position in the ASEAN automotive market, meaning that Indonesia is also very attractive to global investors, particularly in the downstream sectors such as automotive, minerals and electronics. The House of Representatives has approved the omnibus bill on job creation to boost investment and it is expected to spur national economic recovery.

The Job Creation Law is a catalyst to encourage investment in Indonesia, especially in the automotive industry. This law is intended to cut bureaucratic red tape. Although investors still need time to see progress in the implementation of this law, if this law is implemented smoothly, there will be many relocations of automotive factories from China to Indonesia.

Indonesia and Thailand had become regional production hubs for the automotive sector before the pandemic but Indonesia was hit worse. Indonesia should reexamine and expand faster to become the hub of the regional supply chain. This law is expected to support Indonesia’s structural reforms that have been a major obstacle to investment in Indonesia.

The Job Creation Law will bring a positive impact on Indonesia, namely encourage more foreign direct investment in the automotive sector. This law not only supports passenger cars but also commercial cars, as it provides business certainty for companies and provides incentives for the coal downstream industry. This can drive commercial car sales going forward.

Although car sales have started recovery in the last three months, uncertainty is still very high because the rate of daily positive COVID-19 cases in Indonesia is still high. Even though the imposition of social restrictions in Jakarta has been relaxed, car sales are still sluggish. Though future demand of domestic car sales is very uncertain, Indonesia has to shift gears to attract foreign investors and prompt automakers and suppliers to start investing and also exporting from Indonesia.

The writer is an analyst with the Office of the Chief Economist at Bank Mandiri