Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsOur overliberal policy fails oil refinery investors

Some may argue that investors are deterred from going into the refinery business because the government controls the pricing on some petroleum products.

Change text size

Gift Premium Articles

to Anyone

I

ndonesia faces an enormous challenge in meeting domestic demand for petroleum in the coming years, but for some reason, the 2001 Oil and Gas Law intended to liberate the downstream petroleum sector has not led to new private refineries.

The law has attracted investors, but all have gone into the marketing and distribution sector and avoided making long-term commitments to build refineries. This overliberal policy for the downstream petroleum industry has been an utter failure.

All evidence suggests that there is a case for making it less liberal. Now, with the COVID-19 pandemic and the incoming economic recession, Indonesia should rethink its long-term policy for the sector.

The global recession has slashed the demand for oil, creating a supply glut and bringing world oil prices to US$19 a barrel in April, compared to US$65 at the end of last year. April also saw a historic drop in West Texas Intermediate, trading at negative US$37 per barrel.

Inevitably, Indonesia is feeling the impacts.

Demand on finished petroleum products has plummeted more than 30 percent, with aviation fuel falling hardest at around 50 percent in the second quarter.

While supply and demand find a new equilibrium, this is a good time for Indonesia to revisit the implementing guidelines for the 2001 law to attract investors to refineries.

The pandemic-driven recession aside, the economy will continue on its trajectory that will put Indonesia among the world’s top five largest economies by 2045 from its current ranking of 16th.

Even as Indonesia diversifies its energy mix away from hydrocarbons, petroleum will continue to be an important energy source for the next four decades.

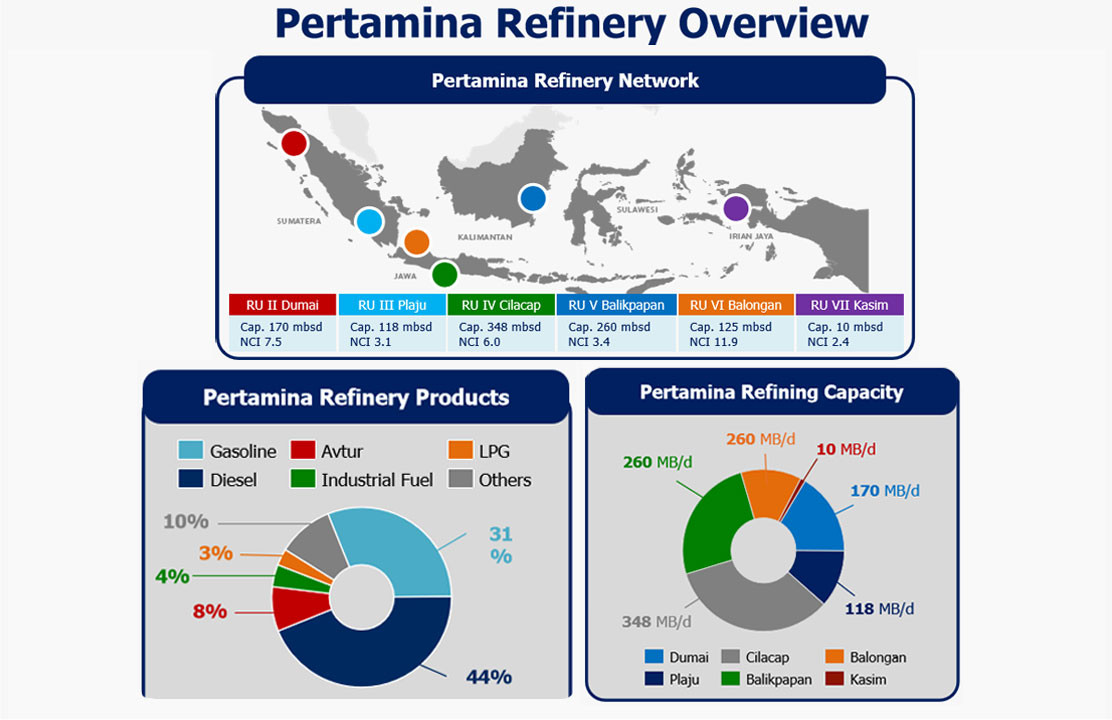

The seven refineries Indonesia has today can process only around 1 million barrels per day (bpd), far below the nation’s total consumption of 1.6 million bpd. Demand is projected to increase to 2.4 million bpd in 2030 and then to 3.5 million bpd in 2040, even after accounting for the country’s plan to diversify its energy mix.

We still need to build more refineries. But this will happen only if Indonesia can attract investors.

With six players in the downstream oil industry, all owned, operated or supported by major oil companies, Indonesia has too many compared to other ASEAN countries. They came here without making any commitment to investing in refineries.

In addition, the dozens of industrial fuel suppliers that exist, including local companies, are not interested in building refineries either.

Building a refinery is a huge undertaking and must come with a guarantee of a steady revenue stream. Investors need to adopt forward integration measures in two ways: securing long-term sale and purchase agreements with distributors and entering into marketing and distribution themselves.

Sadly, the 2001 law and its implementing guidelines do not contain the relevant provisions. Why would any investor place huge capital into developing a refinery when they could easily step into the marketing and distribution subsector?

Some may argue that investors are deterred from going into the refinery business because the government controls the pricing on some petroleum products. Such market distortions will undermine returns on their investment.

This argument is convincing only for subsidized products, which will eventually be phased out. The prices of other petroleum products are floating to follow the world market. Pricing is not the real problem.

Here is one suggestion for addressing the problem in the downstream petroleum industry: Impose a moratorium on new entrants, order all existing players to stop their development plans, and make investing in refineries a precondition for both new and existing players to gain access or to expand their businesses.

The current economic slowdown is a good time for Indonesia to realign the downstream petroleum sector. We need a less liberal policy and instead, need one that compels investment in refineries.

***

The writer is a petroleum practitioner.