Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsWhy RCEP is more dangerous than Bilateral Investment Treaties

Most RCEP investors are already protected by International Investment agreements. So why is the RCEP investment protection chapter an added risk for RCEP countries?

Change text size

Gift Premium Articles

to Anyone

Not for us: Protesters under the umbrella of the Indonesian People Coalition for Economic Justice rally in front of Merdeka Palace in Jakarta. They profoundly reject the Regional Comprehensive Economic Partnership (RCEP) negotiation because the clauses, they say, will pave the way for global investors to dominate the economy and harm state interests as well as public welfare. (JP/Bimo Raharjo)

Not for us: Protesters under the umbrella of the Indonesian People Coalition for Economic Justice rally in front of Merdeka Palace in Jakarta. They profoundly reject the Regional Comprehensive Economic Partnership (RCEP) negotiation because the clauses, they say, will pave the way for global investors to dominate the economy and harm state interests as well as public welfare. (JP/Bimo Raharjo)

C

hief negotiators from sixteen Asian countries are meeting in Hyderabad, India, since July 24 to advance negotiations of RCEP (Regional Comprehensive Economic Partnership). RCEP is at the moment the only mega-regional deal being negotiated worldwide.

Crucial to RCEP’s investment protection chapter is the highly controversial Investor-State Dispute Settlement mechanism (ISDS). As it stands as of December 2016, RCEP would grant corporations the exclusive right to bypass domestic legal systems and sue governments at international arbitration tribunals whenever they feel government regulation can limit their profits.

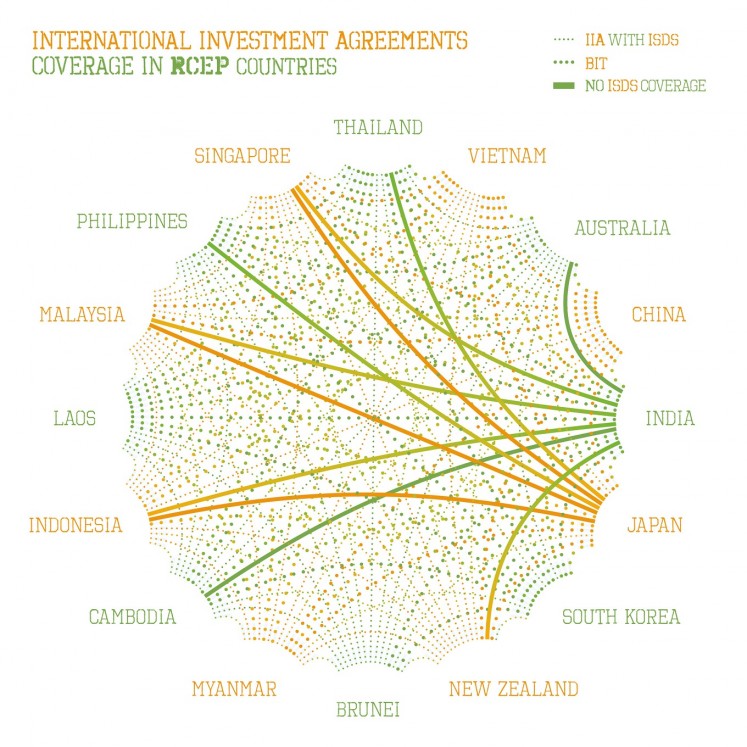

But this is not unique to RCEP. RCEP countries have already signed a massive web of Bilateral Investment Treaties (BITs) and other International Investment Agreements in the past, which also include the ISDS mechanism. Investors from the sixteen countries negotiating RCEP already have almost 90% ISDS coverage in RCEP countries. Only investors from Japan and India might find themselves unable to recourse to international arbitration against some RCEP countries, and vice versa.

International investment agreements coverage in RCEP countries (Transnational Institute/File)If RCEP will not lead to a massive expansion of ISDS in the region and investors from the region are already protected, what’s the added risk?

At first sight, it might seem there is no added risk and negotiating countries have nothing to lose by agreeing to an investor protection chapter in RCEP. However, RCEP will lock in place a system of privatized justice characterized by international arbitration tribunals outside of the reach of domestic legal systems.

RCEP is a mega-regional trade deal. Investment protection is only one element of many other issues included in this treaty, such as Intellectual property rights, market access, services liberalization, and regulatory cooperation.

If governments agree to grant investors rights in such a treaty, they will find it almost impossible to ever withdraw these commitments if they ever wish to do so, because they would need to put an end to the whole agreement with all sixteen parties and not just the sections on investors’ rights.

De facto, this type of mega-regional trade deal becomes too big to break away.

The situation is similar to those of multinational banks that during the financial crisis became too big to fail, and were bailed out during the financial crisis even when governments felt they had no choice, even knowing they were one of the sources of the crisis.

India, together with Indonesia, will experience the negative effects of an investment protection chapter in RCEP almost immediately.

Currently, all the investment protection treaties signed by India are Bilateral Investment Treaties, with the exception of India-Japan FTA. India has already indicated its intention to terminate these treaties and/or renegotiate them based on a new model BIT.

India’s new model BIT is much more restrictive in its clauses than the ones promoted under RCEP. However, by signing RCEP, India is undermining its own effort to rein in the foreign investors’ abilities to sue the country and to promote an alternative investment protection framework that protects the government’s right to regulate.

For example, the Australia-India BIT was terminated on 23 March, 2017, but RCEP would reinstate similar investor protection as in the newly terminated BIT. Also, India has recently signed a BIT with Cambodia, the first BIT based on India’s new model. RCEP will override this BIT since investors will be able to choose the treaty with the highest level of protection.

No doubt, agreeing to an investment chapter in RCEP is more dangerous than the current 51 BITs that RCEP governments have in force among each other.

***

Cecilia is a Researcher with the international research and advocacy institute Transnational Institute (TNI) based in Amsterdam. She is the co-author of several reports on the issue, such as The Hidden Costs of RCEP and corporate trade deals in Asia and Profiting from Injustice.

---------------

We are looking for information, opinions, and in-depth analysis from experts or scholars in a variety of fields. We choose articles based on facts or opinions about general news, as well as quality analysis and commentary about Indonesia or international events. Send your piece to community@jakpost.com.