Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsBetter policies will lower drug prices

In Indonesia, there has long been a policy to prioritize domestic production of generic medicines but things didn’t work out as planned.

Change text size

Gift Premium Articles

to Anyone

A

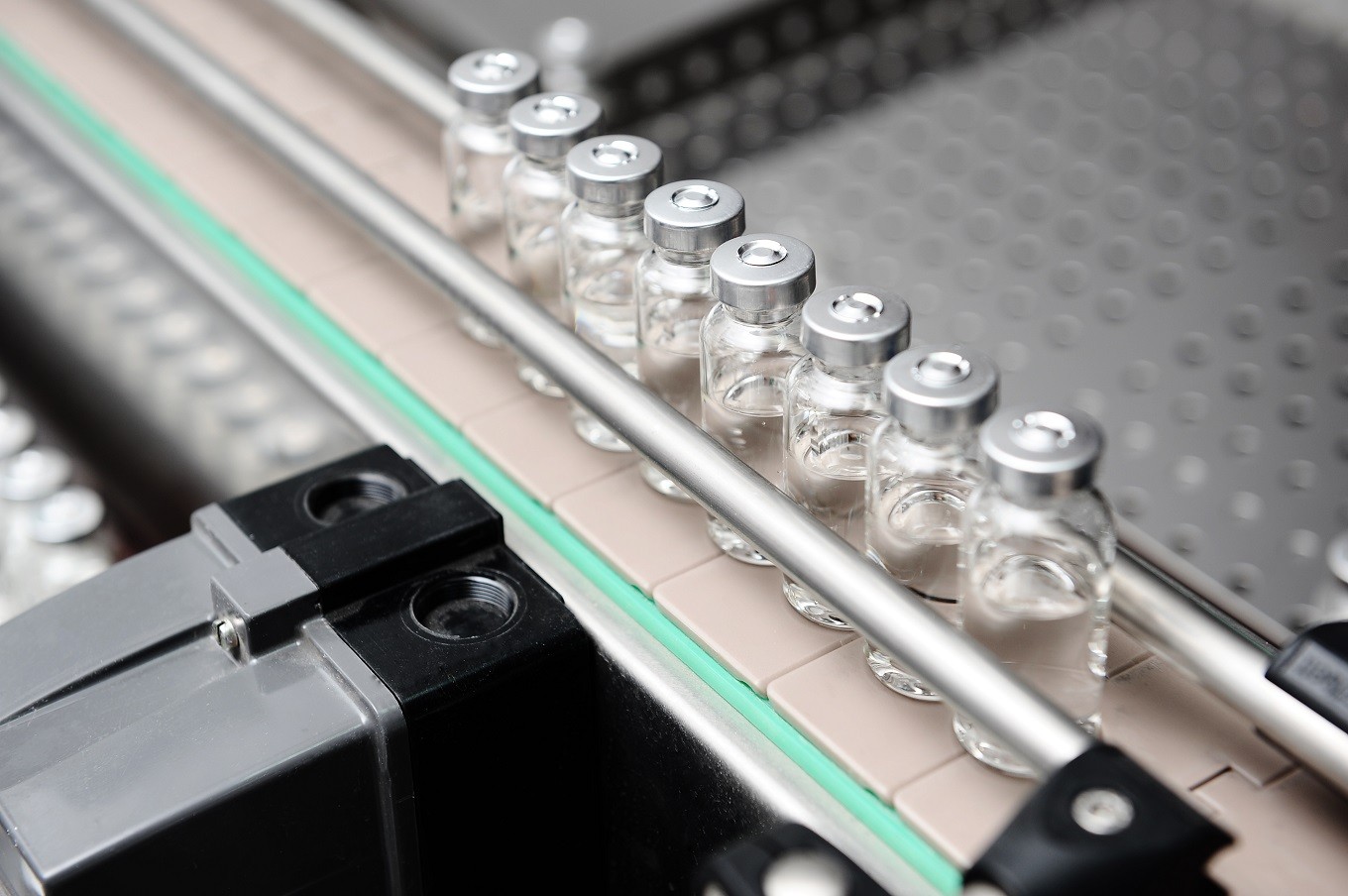

s the government resolutely pursues its commitment to ensure that universal health coverage (UHC) is achieved by 2019, there’s a debate raging on the need to develop home-grown production of active pharmaceutical ingredients (API). The aim is to reduce raw material dependence on import and curb the high-cost of prescription medicines.

With the continuous deficit of the Social Security Management Agency (BPJS) and the approaching 2019 presidential election, the API production debate is gaining a new political momentum.

In any country, the value added from generic manufacturers consists in introducing competition, which in an efficient market can help the government to achieve savings on older treatments and increase investment in new ones or offer lower cost alternatives to out-of-pocket patients.

In Indonesia, there has long been a policy to prioritize domestic production of generic medicines but things didn’t work out as planned.

The government’s unwavering support the last 15 years led to a number of local manufacturers enjoying strong growth while a number of global players operating in the market found themselves under capacity and streamlined their facilities in the country.

In 2005, a study showed that prices of Indonesian generics in public procurement were on average 74 percent higher than the international procurement prices. Despite that, the local industry continued to thrive and never came up for competitiveness review. Key domestic players, unsurprisingly, continue to think they deserve a compensation for “investing” in local production by charging high prices for their branded generics.

In 2016, the market share of domestic generics, by value, reached 60 percent of all drugs in Indonesia. By volume, generic drugs accounted for 80 percent of marketed drug sales. This domination of the market by generics is the highest in ASEAN. Interestingly, it is only rivaled by China and India both vibrant and growing API producers. In comparison, Indonesia’s import of APIs still accounts for more than 95 percent of the industry’s needs.