Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsCultural lens in speeding up financial inclusion

It seems in the city where there is an abundant choice of regular banking services, there is a market for agent banking, too.In this particular context, the gap the agent bridges is actually a cultural one.

Change text size

Gift Premium Articles

to Anyone

A

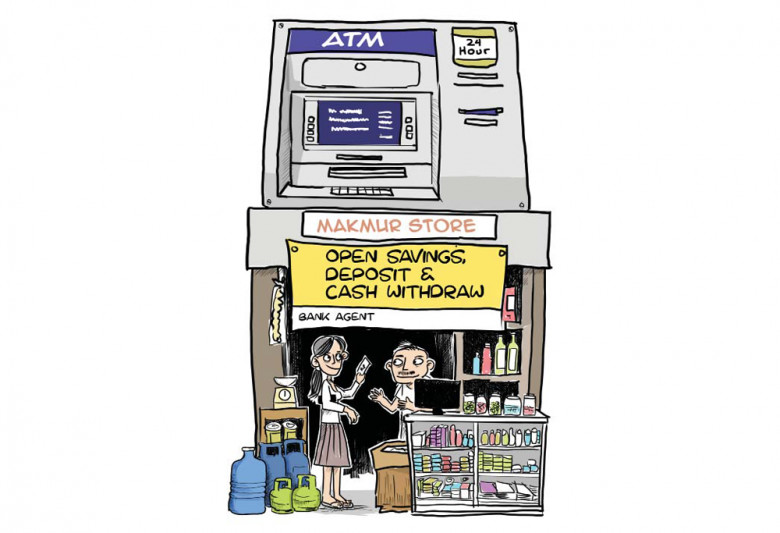

humble warung (mom-and-pop store) stands at the corner of a narrow street in a modest neighborhood of Rawa Belong in West Jakarta. Nothing makes this store stand out from other warung in the area except a slightly discolored banner that hangs in front of it. The sign shows the name of the warung, Toko Novi, along with a logo of a state-owned bank and name. The sign also displays the offer of services usually found in banks, such as opening an account to make deposits, withdrawals, money transfers and bill payments. Unknown to casual observers, Toko Novi is part of the government’s effort to augment financial inclusion.

According to the World Bank 2017 Findex report, only 49 percent of Indonesia’s adult population, aged above 15 years, owned a bank account. The government launched the Laku Pandai and Layanan Keuangan Digital (LKD) initiatives that aimed to address this issue.

Agus manages Toko Novi in Rawa Belong, which he inherited from his mother. He is one of many micro-entrepreneurs in Indonesia who have signed up to become LKD agents. Agus is an agent of a state-owned bank. On average, Agus serves more than 10 customers per day as an agent. Most of these customers visit his store to transfer money and pay bills. Many, if not all, of his banking customers are his neighbors and he knows most of them personally.

The objective of the LKD program is to reduce or remove gaps between banking services and people who have minimum access to banks and other financial services. These gaps can be geographical, economic, or both.

The advancement of cellular technology in the past decade, followed by the emergence of digital financial services, has made it possible for banks to serve customers in remote locations.

However, the paradox in Agus’ case is that there is no geographical obstacle between his neighbors and the banks. Several banks and ATM machines are located less than a kilometer away from Agus’ store.

Yet, as Agus stated, his customers mostly prefer to pay their bills or make cash transfers at his store, even though they have an account in the bank and have a debit card.