Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsIndonesia’s recovery from COVID-19: Look beyond 2021

Despite the near-term challenges, we can present the case to be far more optimistic over a multi-year horizon.

Change text size

Gift Premium Articles

to Anyone

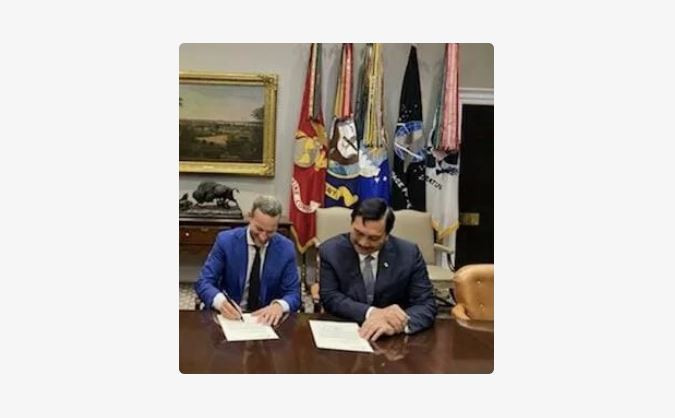

United States International Development Finance Corporation (IDFC) chief executive officer Adam Boehler (left) witnessed by Coordinating Maritime Affairs and Investment Minister Luhut Pandjaitan, signs a letter of interest to invest US$2 billion in Indonesia’s sovereign wealth fund in the US on Nov. 19. (Courtesy of Coordinating Maritime Affairs and Investment Ministry/-)

United States International Development Finance Corporation (IDFC) chief executive officer Adam Boehler (left) witnessed by Coordinating Maritime Affairs and Investment Minister Luhut Pandjaitan, signs a letter of interest to invest US$2 billion in Indonesia’s sovereign wealth fund in the US on Nov. 19. (Courtesy of Coordinating Maritime Affairs and Investment Ministry/-)

M

any will let out a sigh of relief as 2020 comes to a close. To the optimists, the start of vaccine disbursement offers tangible evidence that the world is finally turning a corner. But, for the pessimists, little will change on the first of January.

In the days leading up to 2021, new cases of COVID-19 are expanding at a near-record pace globally. Large swathes of Europe will remain confined well into the new year by some of the strictest lockdowns implemented since the start of the pandemic. Meanwhile, in the case of Indonesia, large-scale social restrictions (PSBB) in Jakarta were recently extended into 2021 in response to the elevated pace of new infections.

But what about vaccines? The Indonesian government deserves credit for proactively seeking to procure vaccines from multiple sources, but the challenge of inoculating a critical share of the Indonesian population spread out across a vast archipelago should not be underestimated. Even under the most optimistic scenario, the distribution of vaccines will not be complete well into 2022, limiting the scope of the economic recovery in the short term.

Consumers will likely remain cautious given the high share of active COVID-19 cases in major cities, not to mention the fact households have lost substantial income over the last nine months, only partly offset by the government’s fiscal stimulus. Indonesia’s economy may underperform regional peers in 2021.

Despite the near-term challenges, we can present the case to be far more optimistic over a multi-year horizon. In fact, we believe Indonesia can outperform the region thanks to three key developments likely to take place over the next few years: the government’s return to an infrastructure-heavy model of investment, an acceleration in foreign direct investment (FDI) inflows thanks to the ‘omnibus’ reform, and a vast existing pipeline of projects pertaining to the country’s nickel supply chain. Based on this, GDP growth should rebound to 4.9 percent in 2021 and 5.4 percent in 2022 – making Indonesia one of the few countries where we expect faster growth in 2022 than 2021.

Let’s start with infrastructure development. This is one of President Joko “Jokowi” Widodo’s hallmark policy initiatives and has proven to be an area where the government can quickly ramp up spending to propel growth. Many projects were delayed or postponed in 2020, in particular the government’s plans for a string of refineries to reduce Indonesia’s dependence on imported refined oil.

Moreover, there is a vast pipeline of toll-road, airport and energy-generation projects that can be fast-tracked when conditions allow. The government’s 2021 infrastructure spending allocation is near a record high, and both domestic state-owned enterprises and foreign investors appear keen to move forward with priority projects. The country’s new sovereign wealth fund will provide yet another channel for infrastructure financing.

Then there is the FDI story. The merits of the government’s recently passed Job Creation Law have been widely debated. While there is some uncertainty about many of the specific provisions as we await full details on how the regulations will be implemented, we nonetheless believe the law can greatly improve the ease of doing business and lower labor costs in Indonesia, two notable impediments to FDI. In particular, the effort to reduce the prevalence of overlapping regulations at the central and local levels should substantially facilitate foreign investment inflows and allow for an acceleration of the long pipeline of projects.

In fact, we calculate that there is a pipeline of at least US$35 billion worth of projects related to the nickel supply chain consisting of additional smelters, steel plants, electric vehicle (EV) battery plants and EV assembly plants – the majority of which is foreign investment. The omnibus law should help accelerate these investments – though the government will need to finalize a coherent strategy for the development of the domestic EV industry.

We believe there is also scope for Indonesia to attract FDI inflows in more traditional manufacturing industries, such as electronics assembly and textile manufacturing; however, given subdued business conditions globally, investments in these areas would take time to materialize.

In short, while the Indonesian economy is set to emerge from the crisis in 2021, growth will remain subdued by regional standards. COVID-19 continues to spread at an accelerated pace in Indonesia, and widespread inoculation remains a distant prospect. But, at the same time, the medium-term outlook is supported by the government’s recent move to accelerate reform momentum, a robust pipeline of possible FDI projects, and policymakers’ strong track record on infrastructure. These factors should allow Indonesia to see a sustained recovery beyond 2021.

To ensure the recovery can last, it is imperative that recent reform momentum is sustained. This entails not only fresh reforms to improve Indonesia’s competitiveness, but also steps to preserve Indonesia’s strengths. A parliamentary proposal from earlier in the year to curtail the central bank’s independence sent shivers down the spines of investors who have long appreciated the sound policies of Bank Indonesia (BI).

Fortunately, the government opposed the proposal, but the episode confirmed the policy risk that emerging market investors have come to fear.

Indonesia’s recovery from the crisis will depend on stable inflows of foreign investment. Safeguarding the strength and independence of key institutions such as BI remains more important than ever, especially as the central bank contemplates an exit from unconventional policies. If this can be achieved, coupled with accelerating other structural reforms, there is little in the way of Indonesia regaining its place as one of the world’s most promising growth stories.

***

The writer is HSBC’s chief economist for ASEAN.