Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

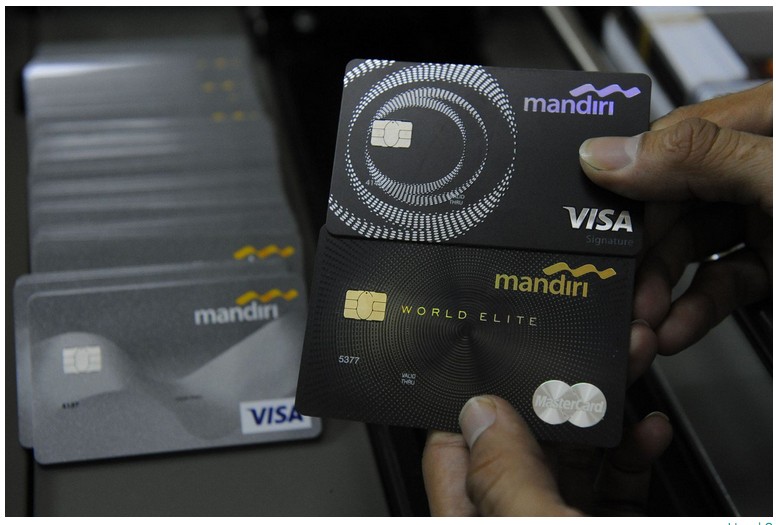

View all search resultsBI pushes ahead with domestic credit card to cut reliance on foreign ones

Bank Indonesia will launch a domestic credit card to reduce reliance on foreign payment networks. The scheme promises lower fees, as settlement is done locally.

Change text size

Gift Premium Articles

to Anyone

B

ank Indonesia (BI) says it will introduce a domestic credit card system allowing for greater independence and lower fees, as transactions are settled locally rather than by foreign providers.

BI spokesperson Erwin Haryono said on Saturday that the central bank had been in discussion with local industries and progress stood at 90 percent, but he declined to reveal when the domestic credit card would be launched or what it would be called.

Erwin said a domestic credit card would have several benefits, notably lower fees, because offshore settlement and relying on foreign payment networks like United States-based Visa or Mastercard would no longer be necessary.

“Let’s say I bought something in Yogyakarta with a credit card. Usually, the settlement is done overseas, but now it can be done in Indonesia,” Erwin told reporters during a forum in Yogyakarta.

Read also: Jokowi wants local governments to ditch Visa, Mastercard

The announcement comes shortly after President Joko “Jokowi” Widodo called for the use of homegrown credit cards to increase the country's independence in financial transactions.

The President deems such independence essential to shield transactions from geopolitical fallout.