Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsImproving financial literacy in Indonesia

Change text size

Gift Premium Articles

to Anyone

R

amadan is a time of spending for most Indonesians, and people usually hold back their spending in the months before to allocate more for Idul Fitri. Retailers, from luxury fashion brands in malls to street food stalls, take this opportunity to get more business by providing discounts.

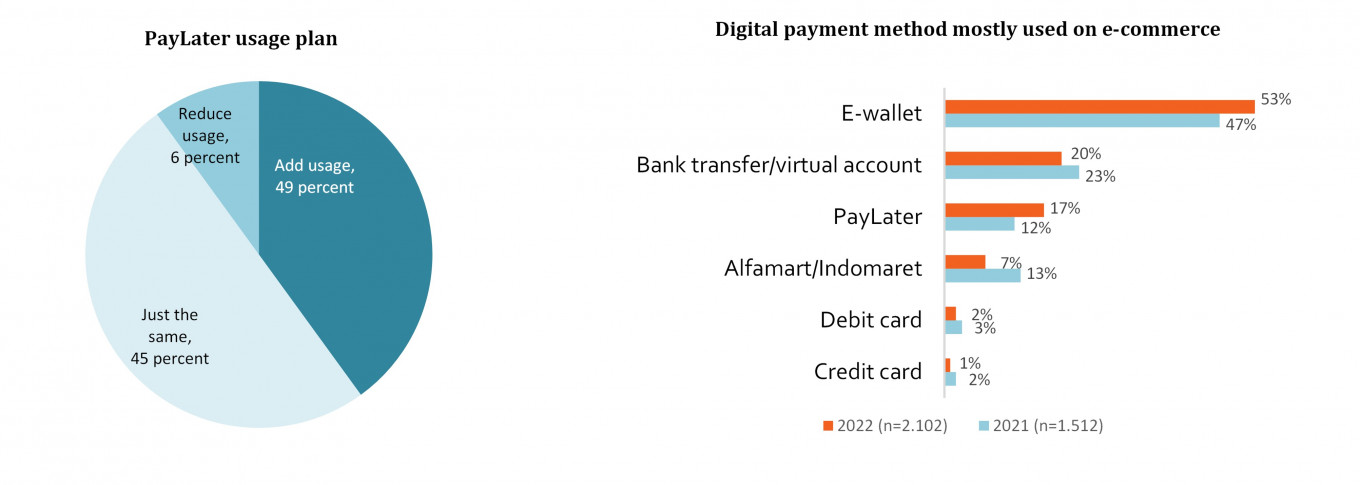

This trend is also amplified by the fact that digital payment provides options to delay actual payments from customers’ wallets. One such service is PayLater, which has received consumer attention in the last two years.

Likewise, online stores and e-commerce see this as an opportunity to boost revenue. By collaborating with e-wallet providers or other fintech lending companies, they offer easier loan processes for the PayLater application with no interest, flexible payment instalments, discounts and cash back.

Fintech lending users continued to increase in March, reaching 14.34 million accounts, up 7.13 percent month-to-month (mtm). The registration and disbursement of loans are simple, with no collateral requirements and no income demonstration requirements, which is a main factor in gaining users.

The Financial Services Authority (OJK) recorded that fintech lending, or peer-to-peer (P2P) lending, operators registered as of March reached 102 providers with total assets of Rp 6.38 trillion, an increase of 41 percent year-on-year (yoy) when compared to the same period in 2022. In addition, fintech lending has collaborated with 1,057 other financial services institutions for loan channeling.

Total outstanding loans as of March were Rp 51.02 trillion, an increase of 1.9 percent mtm and 36.5 percent yoy. The default rate under 90 days (TWP90) for P2P lending companies, which is an indicator of nonperforming loans (NPL) in fintech lending has increased annually and monthly.

In March 2023, TWP90 was 2.81 percent, while in 2022 it was 2.32 percent.