Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsJapanese stocks jump, dollar firms on trade hopes; bitcoin soars

Change text size

Gift Premium Articles

to Anyone

J

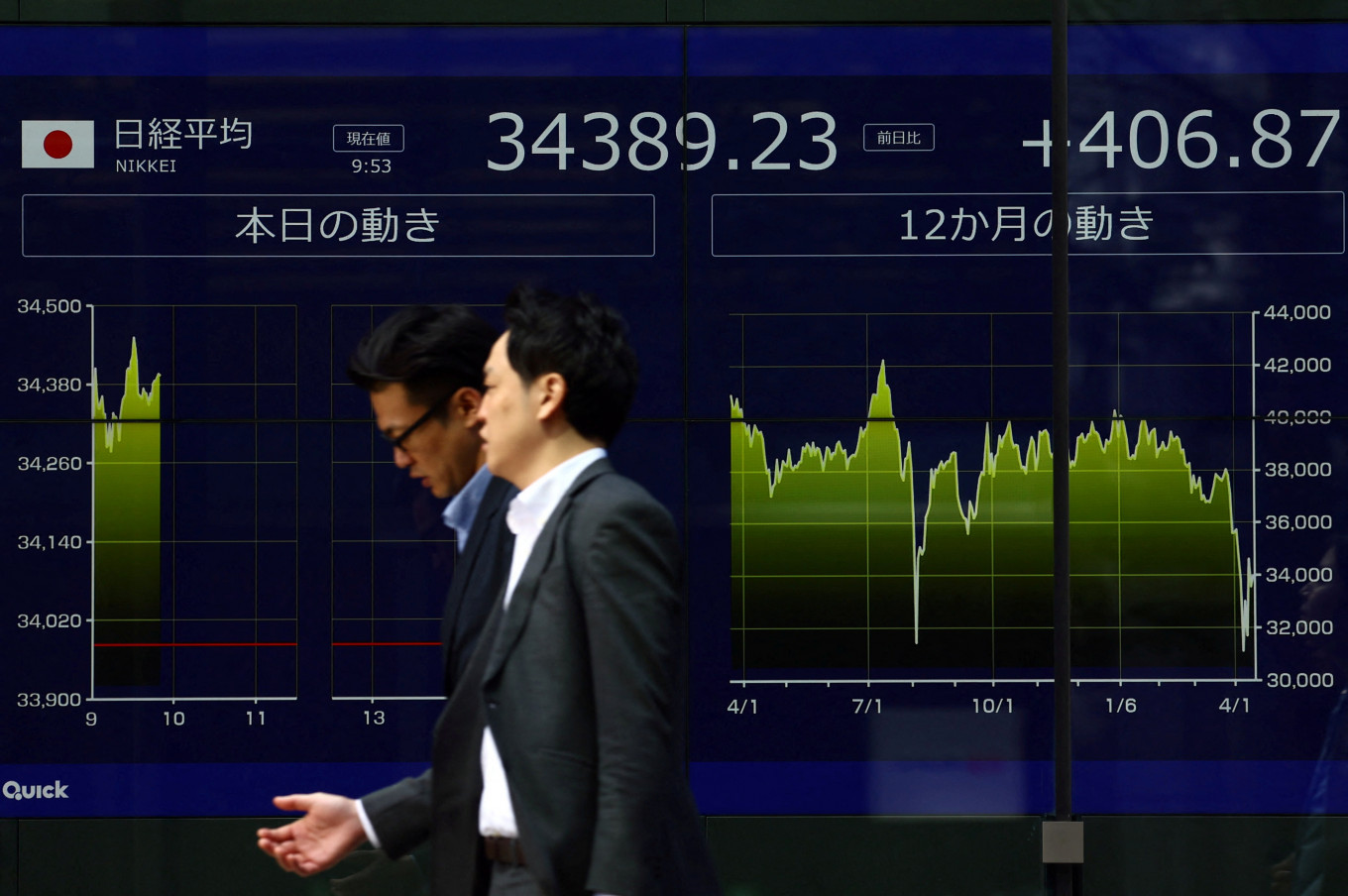

apanese stocks jumped on Friday, supported by the dollar's surge against the yen, after a US trade deal with Britain fueled hopes of progress in tariff talks with other countries.

Bitcoin soared to the highest since January and US crude ticked up after a more than 3 percent surge on Thursday, when President Donald Trump announced the agreement with British Prime Minister Keir Starmer - the first in the month since Trump started a 90-day pause on trade tariffs to allow room for negotiations.

At the same time, concerns that the limited trade agreement with London may not provide much of a blueprint for additional deals cooled optimism around the outcome of Sino-US trade talks set for Saturday in Switzerland.

Mainland blue chips started the day 0.2 percent lower, while Hong Kong's Hang Seng rose 0.2 percent.

Japan's Nikkei and broader Topix each climbed about 1.2 percent, with the Topix set to extend its winning streak to an 11th session, the longest run since October 2017.

Taiwan's equity benchmark advanced 1 percent, while Australian stocks added 0.4 percent.

MSCI's broadest index of Asia-Pacific shares outside Japan was broadly flat.

"The deal between the US and UK was more style over substance," said Kyle Rodda, a senior financial markets analyst at Capital.com.

"However, it feeds the narrative that the US is looking to bang-out rapid fire trade deals and reduce tariffs - at the margins - and other trade barriers," Rodda said.

"Constructive language and statements of intent will likely be enough to drive stocks higher off the back of the US-China trade talks."

Trump pushed back against seeing the UK deal as a template for other negotiations.

The "general terms" agreement leaves in place a 10 percent tariff on goods imported from the UK but lowers prohibitive US duties on UK car exports. Britain agreed to lower its tariffs to 1.8 percent from 5.1 percent and provide greater access to US goods.

Last week, Trump said he has "potential" trade deals with India, South Korea and Japan.

Nymex crude ticked up 0.2 percent to $60.02 per barrel early on Friday, building on the previous day's 3.2 percent surge. Brent crude added 0.3 percent to $63 per barrel, following Thursday's 2.8 percent rally.

Safe-haven gold continued its slide, weakening 0.5 percent to around 3,288 an ounce, after dropping 3.6 percent in the past two sessions.

The US dollar index, which measures the currency against six major peers, edged up 0.1 percent to reach a one-month peak at 100.77.

The euro sagged to a one-month trough at $1.12105, and sterling slipped to a three-week low of $1.32205.

The yen ticked up slightly to 145.77 per dollar, but that was after a 1.5 percent tumble on Thursday, when it touched a one-month low of 146.175.

Higher US Treasury yields helped support the greenback, with the 10-year yield steady at 4.3687 percent following Thursday's 10-basis point jump as demand for the safety of bonds ebbed.

Bitcoin was also buoyed by the improvement in market sentiment, rising to the highest since January 31 at $103,090.17, and closing the distance with the all-time high from January 20 at $109,071.86.

Standard Chartered's Geoffrey Kendrick no longer sees risk sentiment as the main driver for the world's biggest cryptocurrency.

"It is now all about flows, and flows are coming in many forms," said Kendrick, the bank's global head of digital assets research, pointing to an influx of cash into bitcoin ETFs, as well as buying by so-called whales.

"I think a fresh all-time high for bitcoin is coming soon," he said. "I apologize that my $120,000 Q2 target may be too low."