AGO defends decision to halt Paulus tax fraud case

The Attorney General’s Office (AGO) defended Friday its decision to halt the investigation (SKPP) into alleged tax evasion by former director of PT Ramayana Lestari Sentosa, Paulus Tumewu

Change text size

Gift Premium Articles

to Anyone

T

he Attorney General’s Office (AGO) defended Friday its decision to halt the investigation (SKPP) into alleged tax evasion by former director of PT Ramayana Lestari Sentosa, Paulus Tumewu.

The Junior Attorney General for Special Crimes, Marwan Effendy, said Friday that the Finance Ministry had the legal right to request AGO issue a letter on the basis of public interest if a delinquent tax payer had paid their taxes as stipulated in article 44B of the General Rule of Taxation Law.

“Although case dossiers have been completed and are ready for trial, the Finance Ministry can ask the AGO to stop investigations for the sake of state income,” he told reporters at the AGO office in Jakarta.

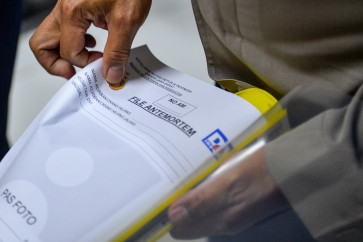

He said that the AGO had issued a letter to stop the investigation after the ministry sent two letters confirming that Paulus Tumewu had paid taxes worth Rp 7.99 billion (US$886,890) and administrative fine of Rp 31.97 billion.

“I can’t confirm if he paid or not,” he said.

Finance Minister Sri Mulyani Indrawati said Friday that there were no irregularities in the handling of Paulus’ tax case. The minister, however, added that she was willing to have the case reviewed.

“We will look into the internal tax mechanism. We will conduct another audit. Should we find invalid data on the part of the tax directorate, we will surely audit it again,” she said as quoted by Antara.

According to the Tax General Arrangements and Procedures Law, she said, tax defaulters could request for halt of investigation if he could pay 400 percent of the fine imposed on him.

“If the lawmakers want to investigate this case, please. They could ask the taxation directorate general. All the related documents are available,” the minister said.

The Association of Indonesian Tax Payers told House of Representatives Commission III on April 20 that Paulus Tumewu might have evaded more taxes up to Rp 399 billion. The association claimed that the issuance of the letter to stop the investigation was “irregular”.

Emerson Yuntho from the Indonesia Corruption Watch (ICW) said that the Finance Minister, Sri Mulyani, should re-examine the possible involvement of unscrupulous judicial and tax officials in the case.

“This will be part of the efforts to eradicate the tax and judicial mafia in this country,” he told The Jakarta Post.

According to him it was unethical for the ministry or the AGO to stop investigations of tax evaders, although the law allowed them to do that, because this could be construed as an indication of corruption and misuse of power by officials in law enforcement agencies.

“Moreover, Paulus’ dossiers has indicated he had committed a criminal action,” he said.

Emerson also urged the AGO to undertake an internal investigation of the issuance of the letter to stop investigations into Paulus because indications that the judicial mafia was involved.

“The law enforcement officers may have taken bribes from this tax evader because this happens very often,” he said.

Emerson recommended that the AGO improve its internal monitoring system to prevent prosecutors from taking bribes or misuse their power for personal gain.

He demanded that the AGO reopen the case with a new prosecution team due to the possibility that the members of the previous team were not “clean”. (rdf)