Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsTwo SOEs' roles in utilizing repatriated assets

Change text size

Gift Premium Articles

to Anyone

M

ultiple billions of US dollars are expected to flow into Indonesia and state-owned enterprises (SOEs) are to play two roles to channel it into real projects.

The government is aiming to attract home Rp 1 quadrillion of assets held by Indonesians offshore, but the central bank has estimated the repatriated funds would amount to about Rp 560 trillion.

Regardless of the target, any million- or billion-dollar inflow is valuable as it would help boost development.

As of the end July, the government recorded Rp 3.7 trillion (US$281.48 million) of declared assets and Rp 579 billion of it is going to be repatriated.

However, the inflow may end up as a burden and create an over-liquidity problem if it is jammed into banks as deposits. Therefore, SOE Minister Rini Soemarno recently underlined the vital role of SOEs as the state’s agents to utilize the funds.

Here are two potential channels:

Corporate bonds

State-owned energy firm PT Pertamina has announced a plan to issue Rp 19.5 trillion ($1.5 billion) worth of bonds. The proceeds will be used to enlarge the capacity of its oil refinery, increase the upstream production through mergers and acquisitions and optimize production in existing blocks.

Our assessment showed that the company is financially healthy and has enough leverage to issue new bonds. In 2015, it had total debts of $3.9 billion, plus $8.6 billion in bonds. Compared to its equity, which stood at $19.2 million, it’s debt to equity ratio (DER) was 0.65.

PT Waskita Karya has also declared a plan to issue bonds worth Rp 5 trillion as part of its financing to build toll roads in Pemalang, Batang and Semarang. As the company pocketed Rp 5.3 trillion from a rights issue last year, the additional debts from the bonds has limited risk to its financial profile.

Rights issues

Rini has also sent a signal about opening a possibility for share purchases using the repatriated assets. The government has obtained permission from the House of Representatives to buy shares in SOEs through state capital injections (PMN).

A rights issue allows shareholders of listed SOEs to inject more capital into companies with equal rights and in equal portions to those of the state. Thus, it will attract other investors to inject capital. This is another way out for the government to allocate the repatriated assets into real work.

=============

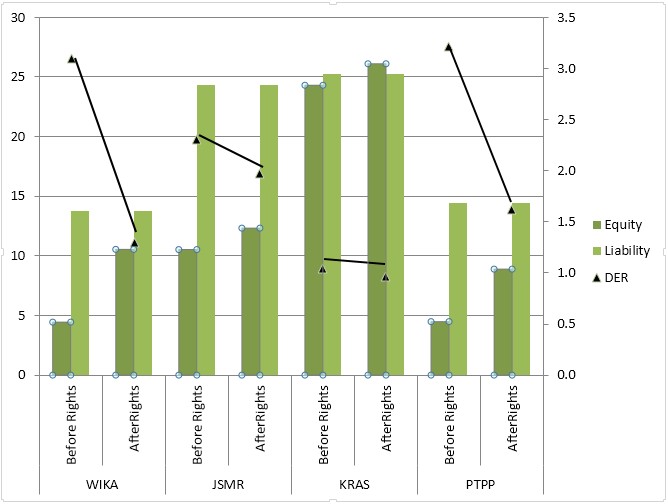

Projection of the changes in SOEs capital structure post-rights issue.(Bareksa/-)

Projection of the changes in SOEs capital structure post-rights issue.(Bareksa/-)

=============

Several SOEs among the PMN recipients next year are PT Wijaya Karya, PT Pembangunan Perumahan, PT Jasa Marga and PT Krakatau Steel. The four SOEs are expected to draw Rp 7.4 trillion in public funds.

The rights issues will strengthen their financing capacities and give them more room to expand. (ags)