Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsNEWS ANALYSIS: Rapid hikes in emerging stock markets: Should we worry?

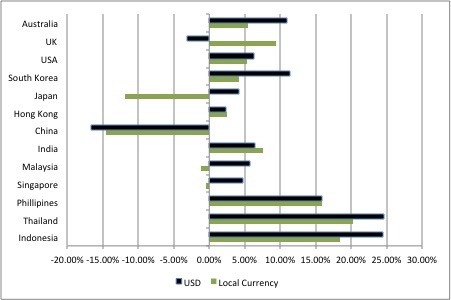

Stock market performance year-to-date ( ytd ) in developing countries outperformed that of developed markets. Indonesia, Thailand and the Philippines experienced rapid hikes in their stock markets with double-digit growth. Should investors be worried about this?

Change text size

Gift Premium Articles

to Anyone

A man walks by an electronic stock board of a securities firm in Tokyo, on June 27, 2016. Japanese and Chinese stocks rose Monday but other Asian markets declined, crude prices fell further and U.S. shares appeared headed for a lower opening as jittery traders watched for more fallout from Britain's vote to exit the European Union. (Associated Press/Koji Sasahara)

A man walks by an electronic stock board of a securities firm in Tokyo, on June 27, 2016. Japanese and Chinese stocks rose Monday but other Asian markets declined, crude prices fell further and U.S. shares appeared headed for a lower opening as jittery traders watched for more fallout from Britain's vote to exit the European Union. (Associated Press/Koji Sasahara)

S

tock market performance year-to-date (ytd) in developing countries outperformed that of developed markets. Indonesia, Thailand and the Philippines experienced rapid hikes in their stock markets with double-digit growth. Should investors be worried about this?

The Indonesian stock market booked an 18.45-percent return ytd in local currency, one of the best performers in the regional and global market. In Southeast Asia, the Jakarta Composite Index is not the only index that performed well. Thailand and the Philippines also experienced double-digit growth in their stock markets.

In local currencies, the Stock Exchange of Thailand (SET) Index increased 20.28 percent, while the Philippines Stock Exchange PSEi Index (PCOMP) rose 15.87 percent. In US dollars, their performance was greater, with the JCI rising 22.44 percent and the SET Index jumping 24.30 percent within seven months. Concerns have arisen considering the emerging markets are pricey.

Stock Market Performance Comparison ytd (Dec. 31, 2015 to Aug. 9, 2016)

Source: (Bareksa/Bloomberg)

Source: (Bareksa/Bloomberg)

(Read also: Revealing Indonesian Corporate Bond Market potential)

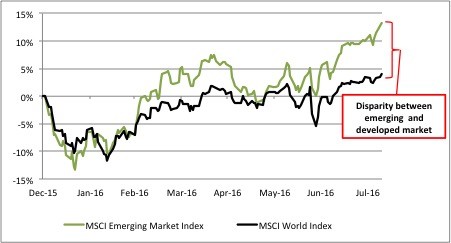

A widening disparity between emerging markets and developed markets has indicated a higher risk on more yield-giving assets. On the base of this condition, investors may switch their funds from emerging markets to developed countries if there is significant global sentiment, such as a US Federal Reserve rate hike.

The performance of developed markets is lagging behind that of emerging markets, as seen in the return of the respective indexes released by the global financial institution.

The Morgan Stanley Capital International World Index (MSCI World Index), which reflects the performance of developed markets, rose not more than 3.95 while its peer for emerging markets, the MSCI EM, gained 13.3 percent ytd. The situation implies a 9-percent gap between the two indexes.

Faisal Basri, an Indonesian economist, wrote that most developed countries encountered pressure throughout the year. He stated that the US stock market had a moderate performance but was relatively below emerging markets. This condition, in fact, shows widening disparities.

MSCI Emerging Market Index vs MSCI World Index

Source:(Bareksa/Bloomberg)

Source:(Bareksa/Bloomberg)

Two research papers suggest that the current valuation of the Indonesian and Thai stock markets is relatively expensive. This may indicate a correction in the short term.

Citi Group head of research Ferry Wong wrote that the current JCI valuation is expensive, driven by positive catalysts like the Cabinet reshuffle, lower interest rates and better-than-expected gross domestic product (GDP) in the second quarter.

Using a Price to Earnings Ratio (PER) measurement, the JCI is valued at 16.1 times (excluding the HMSP, which is overweighting the index). The current value is considered expensive, so the JCI will face a correction soon after reaching peak valuation.

Moreover, a Maybank Kim Eng Research paper stated that the Thai stock market was vulnerable to profit taking as it is pricey, given that sluggish economy earnings growth is likely to remain muted.

However, this may be a chance for those looking for short-term benefits. "Although there is a global risk, we should ride the wave while the JCI is on an uptrend," said Satrio Utomo, Universal Broker head of research. (dan)

Source: Bareksa.com