Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsFive most wanted stocks for foreign investors

Change text size

Gift Premium Articles

to Anyone

President Joko "Jokowi" Widodo opens the first trading day of 2016 at the Indonesia Stock Exchange in Jakarta on Jan. 4. He is accompanied by Indonesia Stock Exchange (IDX) president director Tito Sulisto (right), OJK comissioner for capital market supervision Nurhaida (second right), OJK chairman Muliaman D Hadad (third right), Jakarta governor Basuki Tjahaja Purnama (third left) and Coordinating Economic Minister Darmin Nasution. (JP/Wienda Parwitasari)

President Joko "Jokowi" Widodo opens the first trading day of 2016 at the Indonesia Stock Exchange in Jakarta on Jan. 4. He is accompanied by Indonesia Stock Exchange (IDX) president director Tito Sulisto (right), OJK comissioner for capital market supervision Nurhaida (second right), OJK chairman Muliaman D Hadad (third right), Jakarta governor Basuki Tjahaja Purnama (third left) and Coordinating Economic Minister Darmin Nasution. (JP/Wienda Parwitasari)

D

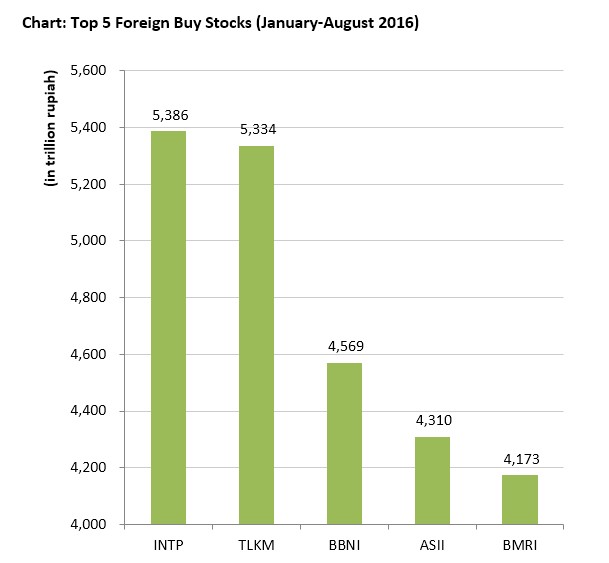

uring the first eight months of 2016, Indonesian stocks have been the target of foreign investors to collect, with the Jakarta Composite Index (JCI) having rose more than 17 percent. They booked a Rp 50 trillion (US$3.79 billion) net buy in the Indonesian Stock Exchange (IDX) from January to August.

Among 535 stocks listed in the composite, a few have brought capital inflow to the market. Based on data from the IDX, here are five stocks purchased the most by foreign investors from January to August.

1. Indocement Tunggal (INTP)

Since the beginning of the year, foreign investors spent Rp 5.38 trillion to buy INTP shares. The average buying price was Rp 17,332 per share, or 0.5 percent higher than the closing price as of Sept. 16 at Rp 17,250 per share.

However, a sellout stock does not always reflect significant financial improvement for the company, as the 31-year-old cement producer has shown. In the first half of 2016, Indocement’s sales fell 12 percent to Rp 7.74 trillion from Rp 8.87 trillion in the same period last year.

Tight competition with newcomers such as Siam Cement and Semen Merah Putih has made the ocean turn red. Slower performance was seen not only in Indocement but also in other old players, including state-owned cement maker Semen Indonesia.

2. Telekomunikasi Indonesia (TLKM)

State-owned telecommunications provider Telekomunikasi Indonesia sits in second place. Since early 2016, foreign investors bought Telkom shares amounting to Rp 5.3 trillion.

Meanwhile, the average buying price of foreign investors was Rp 3,668 per share, below the closing price as of Sept. 16 at Rp 4,090 per share.

Unlike Indocement, which scored declining sales, Telkom's performance was quite satisfying. In the first half of 2016, Indonesia’s largest telecommunication services and network provider booked Rp 56.4 trillion in revenue, up 16 percent from a year ago.

The increase in revenue occurred throughout almost all business segments, with the internet and mobile data segment experiencing the largest hike, doubling to Rp 14.6 trillion from 8.5 trillion the previous year.

3. Bank Negara Indonesia (BBNI)

The third position is occupied by the first established state-owned lender, Bank Negara Indonesia. Since early 2016 until the end August, foreign investors bought BBNI stocks worth Rp 4.56 trillion.

The average buying price by foreigners was Rp 5,128 per share, or 6.4 percent lower than the Sept. 16 closing price at Rp 5,475 per share.

BNI recorded a better performance in the first half of 2016 compared to its achievement in the same period last year. Its net interest income rose 11.7 percent to Rp 13.9 trillion from Rp 12.4 trillion. At the same time, the company's net profit rose 79.9 percent to Rp 4.4 trillion from Rp 2.4 trillion.

The bank’s satisfying performance, under Achmad Baiquni as the president director, was driven by credit expansion, which was larger than other banks. In the first half of 2016, BNI recorded Rp 327 trillion in new lending, up 23 percent from the previous year's Rp 288 trillion and far better than that of BCA and BRI which grew less than 20 percent.

Source: Indonesia Stock Exchange (IDX), Bareksa.com(Bareksa/Chart)

Source: Indonesia Stock Exchange (IDX), Bareksa.com(Bareksa/Chart)

4. Astra International (ASII)

Next is automotive distributor and manufacturer Astra International, which booked a foreign buy of Rp 4.3 trillion. Foreign investors bought ASII stocks at an average price of Rp 7,035 per share, or 11.79 percent lower than the Sept. 16 closing price at Rp 7.975 per share.

Interestingly, Astra remains one of the main destinations for foreign investors, despite its depressed performance. In the first half of 2016, Astra's revenue fell 5 percent to Rp 88 trillion from the previous year's Rp 92 trillion. The company's net profit also dropped to Rp 8.3 trillion from Rp 9.7 trillion.

Pressure in Astra's financial performance was due to stagnant automotive sales. From January to July, the company was able to sell 310,000 cars, up 8 percent from the previous year's 285,000 cars. At the same time, motorcycle sales retreated to 2.3 million units from 2.4 million units.

5. Bank Mandiri (BMRI)

In the 5th position is another major state-owned bank, Bank Mandiri. Since the beginning of 2016 until August, foreign investors recorded a net buy of Rp 4.1 trillion for BMRI stocks. The average buying price was Rp 9,999 per share, or 9.7 percent lower than the Sept. 16 closing price at Rp 11,075.

Bank Mandiri's performance was not as good as BNI. In the first half of 2016, Bank Mandiri booked Rp 2.4 trillion in revenue, rising 14 percent from the previous year's Rp 21 trillion. However, the company's profit fell to Rp 7 trillion from Rp 9.9 trillion.

Bank Mandiri in the first half of the year recorded Rp 610 trillion in loans, rising only 10 percent from the previous year’s Rp 552 trillion. However, its non-performing loans (NPL) increased to 3.86 percent from the previous 2.43 percent. (ags)

Source: Bareksa