Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsState lender BTN offers Rp 5t in bonds

Change text size

Gift Premium Articles

to Anyone

S

tate-owned lender Bank Tabungan Negara (BTN) is offering bonds worth Rp 5 trillion (US$376 million) as a part of its Rp 10 trillion shelf registration.

Shelf registration is a method in which certain issuers are allowed to offer and sell securities to the public without a separate prospectus for each offering.

The lender, widely known as a mortgage specialist, will issue the debt papers in four series, namely Series A with a tenure of three years and coupon ranging from 7.65 percent to 8.3 percent, Series B with a tenure of five years and coupon of between 7.95 percent and 8.5 percent, while Series C has a tenure of seven years and coupon from 8.2 percent to 8.7 percent.

Finally, Series D has a tenure of 10 years and coupon range between 8.3 percent and 8.9 percent.

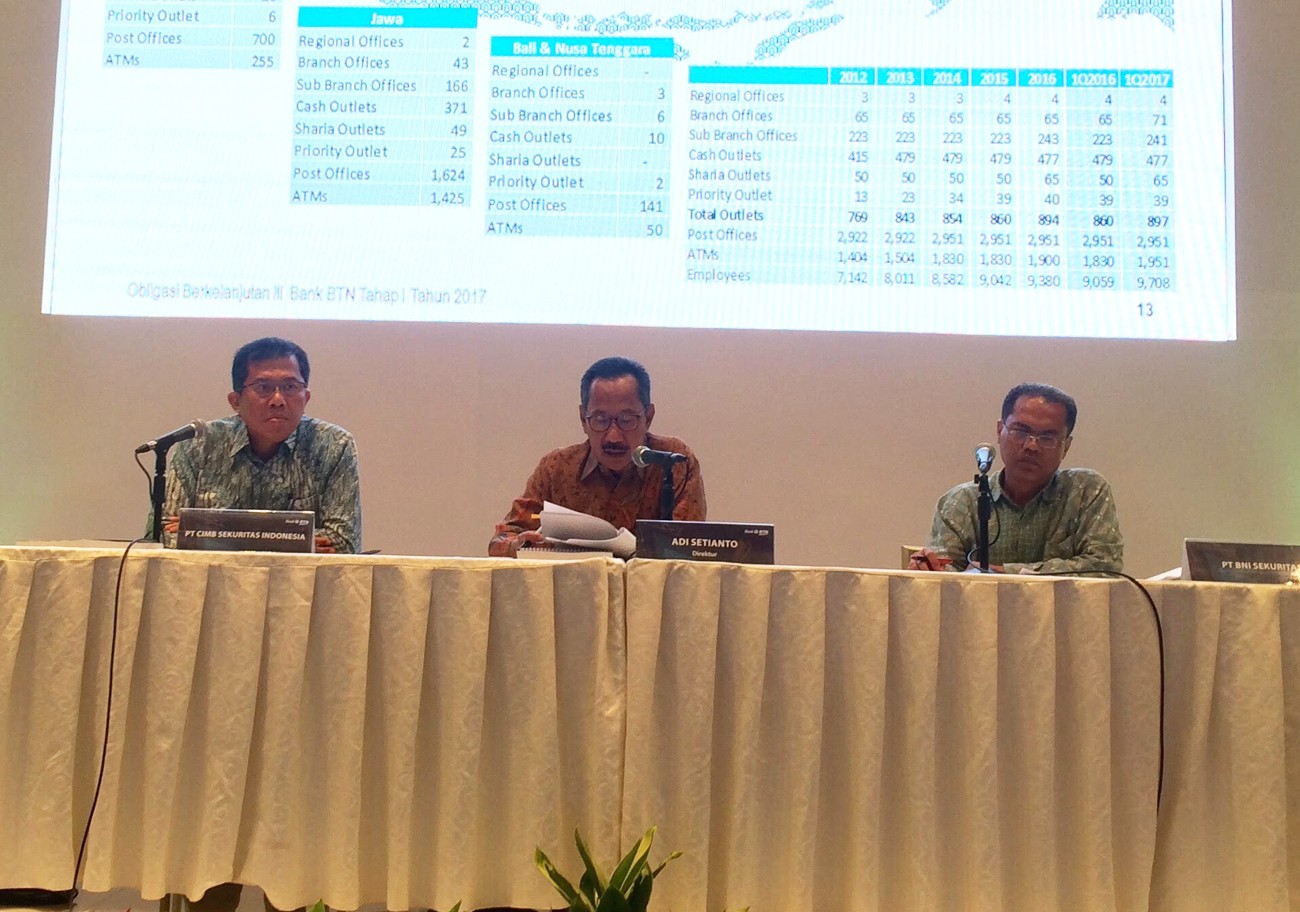

"All proceed will be used to fund BTN's loan expansion that is still tentative, and at the same, time support the government's 1 million-houses program," BTN director Adi Setianto said in Jakarta on Tuesday.

BTN has set an aggressive loan growth target of more than 20 percent by the year-end. The bank has disbursed Rp 170.45 trillion in loan as of April, an 18 percent year-on-year (yoy) increase.

It collected Rp 157.52 trillion in public funds during the period, a growth of almost 22 percent yoy. (bbn)