Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

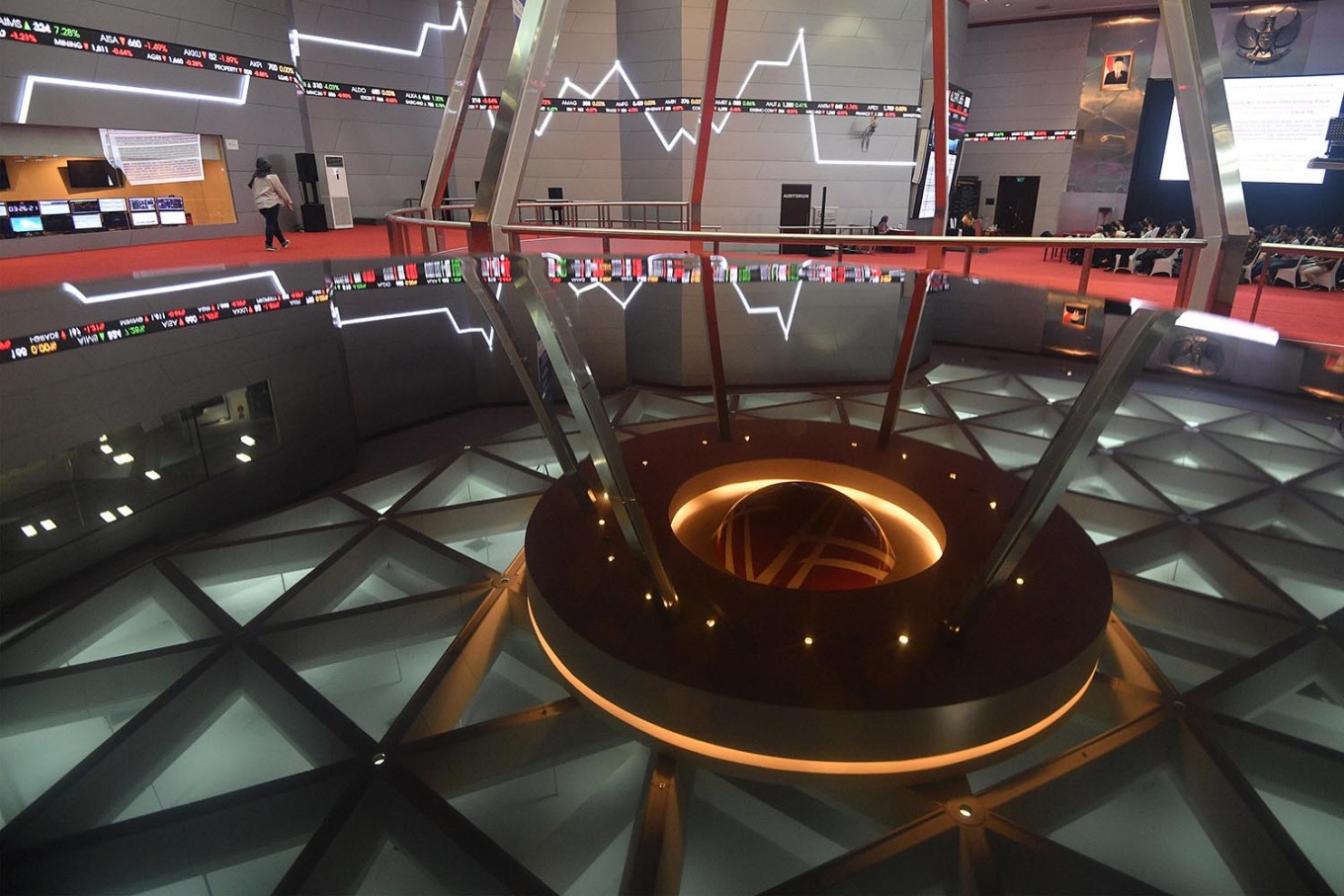

View all search resultsJCI falls 2.59 percent as trade tension escalates, GDP growth slows

The Jakarta Composite Index (JCI) fell by 2.59 percent to 6,175.7 points on Monday following a downward trend in Asian indices, while the rupiah also declined against the US dollar.

Change text size

Gift Premium Articles

to Anyone

I

ndonesian share prices mostly declined on Monday as the escalation of the trade war between the United States and China, and a decline in Indonesia’s GDP growth in the second quarter added to investors’ concerns.

The Jakarta Composite Index (JCI), the main index at the Indonesia Stock Exchange (IDX), fell by 2.59 percent to 6,175.7 points during the day following the downward trend in Asian indices like Japan’s Nikkei, Hong Kong’s Hang Seng and Singapore’s Strait Times Index, which also fell deeper into the red throughout the day.

Foreign investors sold off shares on the day as the IDX recorded a total of Rp 1.1 trillion (US$77.08 million) in net foreign sell during the day, with private lender Bank Central Asia’s stock being the most sold.

Binaartha Parama Sekuritas analyst Nafan Aji told The Jakarta Post that the decline might have been caused by growing concern over the Indonesian economy after GDP growth slowed in the second quarter.

According to Statistics Indonesia (BPS), Indonesia’s economic growth fell to 5.05 percent year-on-year in the second quarter of this year as exports fell and investment growth slowed. That compares to 5.07 percent yoy recorded in the first quarter and 5.27 percent yoy seen in the second quarter of last year.

“However, the slowing economic growth didn’t have much influence on the JCI, as most of the sentiment came from outside of the country,” Nafan said.

United States President Donald Trump announced last week that he would impose new tariffs on goods imported from China. Beijing in response vowed to retaliate.

These factors, coupled with geopolitical strain in Iran and Hong Kong, saw Asian indices weaken and impacted the JCI on Monday.

The rupiah also weakened by 0.49 percent to Rp 14,255 against the US dollar in the spot market.

Futures firm PT Garuda Berjangka president director Ibrahim said that, other than external factors from the US and the United Kingdom regarding its move to prepare for a no-deal Brexit, massive blackouts in Greater Jakarta, West Java and Central Java harmed investor confidence in the government.

“If the blackouts persist, investors will likely take their money out of the country, as they fear it will cost the country trillions of rupiah from halted activities,” he said. (hen)