Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsHigher healthcare premiums ‘urgent’, BPJS Kesehatan pleads as finances bleed

Indonesia’s universal healthcare insurance scheme, dubbed one of the most generous in the world covering 223 million people, almost 90 percent of the population, has since its establishment in 2014 run a deficit every year and been backed by the state budget to support operations as the large medical benefits are not matched by the premiums paid by participants.

Change text size

Gift Premium Articles

to Anyone

W

ith a ballooning deficit over five years of operations putting pressure on the state budget, the Healthcare and Social Security Agency (BPJS Kesehatan), which is in charge of Indonesia’s universal healthcare insurance system, is pleading for an increase in premiums.

BPJS Kesehatan's director of finance and investment, Kemal Imam Santoso, acknowledged that the increase in premiums would only address one of the many problems that cause a growing deficit in the institution’s finances. However, he said it is necessary to stem the financial losses suffered by the state insurer.

“The need is quite urgent,” Kemal told the press after a meeting with House of Representatives’ Commission XI which oversees state budget and overall financial affairs, which was also attended by Finance Minister Sri Mulyani Indrawati.

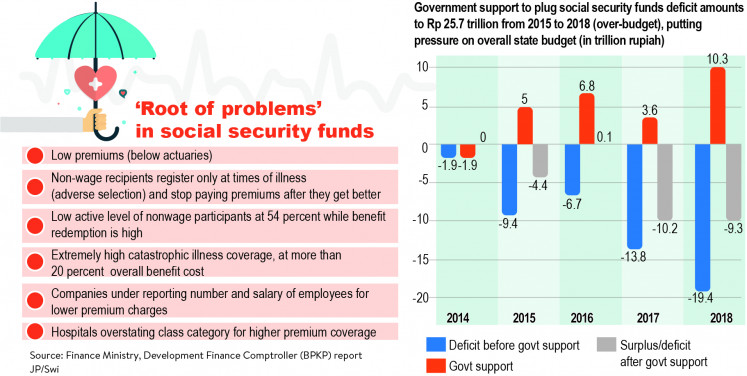

Indonesia’s universal healthcare insurance scheme, dubbed one of the most generous in the world covering 223 million people, almost 90 percent of the population, has since its establishment in 2014 run a deficit every year and been backed by the state budget to support operations as the large medical benefits are not matched by the premiums paid by participants.

Starting with a Rp 1.9 trillion deficit, BPJS Kesehatan’s financial losses continued to increase to Rp 19.4 trillion in 2018. The government did not always fully plug the hole, but from 2014 to 2018 it had spent a total of Rp 25.7 trillion to support BPJS Kesehatan's finances, on top of a budget allocation for a government-funded premium assistance program (PBI) for low-income people to participate in the BPJS Kesehatan insurance coverage.

This year, the financial loss is expected to balloon to Rp 28.5 trillion, of which Rp 9 trillion was carried over from last year’s deficit. These losses primarily stem from high benefits redeemed by participants while premium payments remain low.

BPJS Kesehatan (JP/Swi)