Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsStrategy key in stocks investment amid volatility: Experts

Fund managers and brokers expect the Jakarta Composite Index (JCI) to drop around 15 to 20 percent this year, with the current valuation deemed suitable as an entry point for long-term investment.

Change text size

Gift Premium Articles

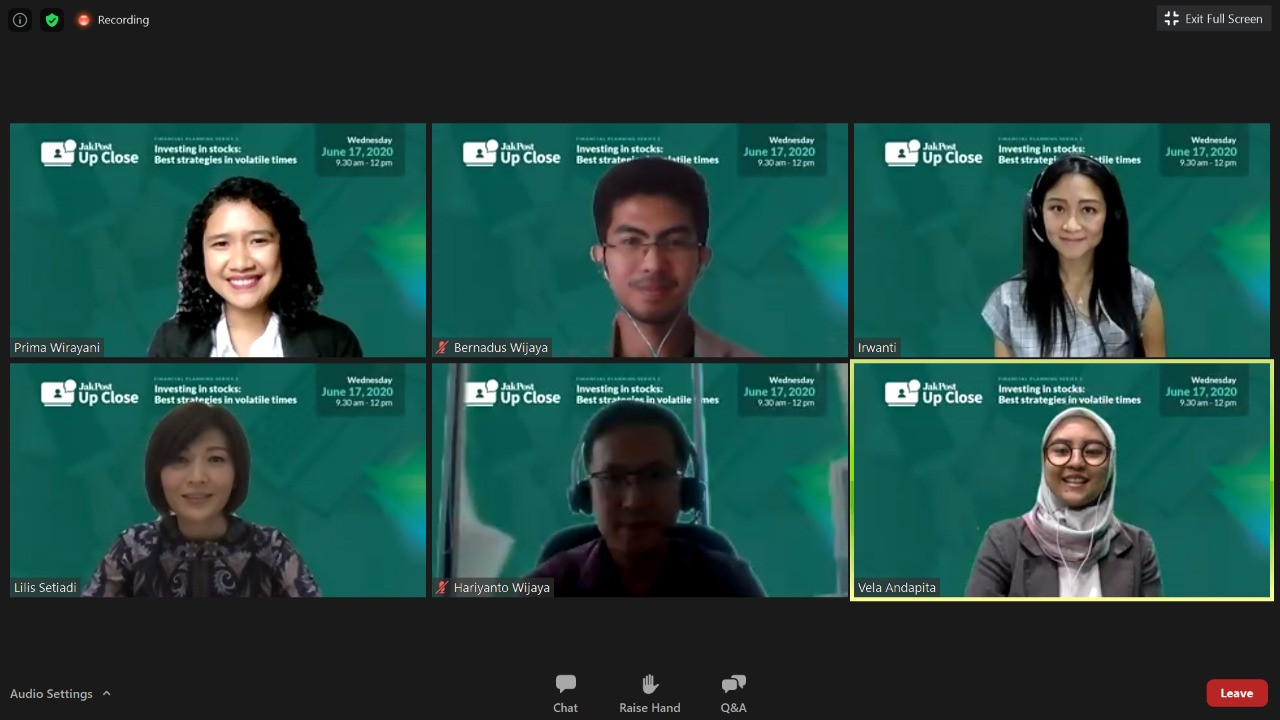

to Anyone

(Clockwise, from upper left) 'The Jakarta Post' Business editor Prima Wirayani, Sucor Sekuritas director of equity and business development Bernadus Wijaya, Schroders Indonesia investment director Irwanti, 'The Jakarta Post' journalist Vela Andapita, Mirae Asset Sekuritas Indonesia head of research Hariyanto Wijaya and Batavia Prosperindo Aset Manajemen president director Lilis Setiadi attend a Jakpost Up Close webinar, "Investing in stocks: Best strategies in volatile times", on Wednesday, June 17, 2020. (JP/est)

(Clockwise, from upper left) 'The Jakarta Post' Business editor Prima Wirayani, Sucor Sekuritas director of equity and business development Bernadus Wijaya, Schroders Indonesia investment director Irwanti, 'The Jakarta Post' journalist Vela Andapita, Mirae Asset Sekuritas Indonesia head of research Hariyanto Wijaya and Batavia Prosperindo Aset Manajemen president director Lilis Setiadi attend a Jakpost Up Close webinar, "Investing in stocks: Best strategies in volatile times", on Wednesday, June 17, 2020. (JP/est)

V

aluation, entry point and market knowledge are key in strategies for investing in stocks during volatile times as COVID-19 risks will likely persist throughout the year, fund managers and brokerages have said, expecting a drop of 15 to 20 percent in benchmark stock prices this year.

Lilis Setiadi, president director of major Indonesian fund manager Batavia Prosperindo Aset Manajemen, said that virus-related matters would continue to cause a lot of volatility in the country’s capital market, at least until the discovery of vaccines.

“Be ready and get used to volatility in the stock market. It should be seen as an opportunity for dollar-cost averaging,” Lilis said in her presentation for The Jakarta Post’s Jakpost Up Close webinar, “Investing in stocks: Best strategies in volatile times”.

Dollar-cost averaging refers to an investment strategy in which investors try to reduce the impact of market volatility by dividing their investments into multiple smaller purchases, with regular intervals in between each purchase. Aside from that, Lilis also recommended a diversification strategy amid the pandemic.

Batavia, which managed Rp 44.79 trillion funds as of the end of May, projected the benchmark Jakarta Composite Index (JCI) to close the year at between 5,000 and 5,300, representing a fall of 15 to 20 percent from last year’s end point of 6,300.

Steep falls in domestic stocks this year had been unprecedented, with the local stock index falling into bear market sooner than previous declines, which were more gradual, Indonesia Stock Exchange (IDX) development director Hasan Fawzi said during the webinar.

“If I can give a bit of advice, the basic strategy [in volatile times] is to invest in yourself, know and understand yourself, fully understand your investment profile, risk profile and goals, skills, capacity and investment behavior. So in the end you adopt the best strategy that best fits your portfolio,” Hasan said.

During this year’s first quarter, the JCI fell 37.33 percent to a historic low of 3,937.63 on March 24, the lowest it had been since 2012. From that lowest point, the index rallied 26.67 percent to 4,987.78 at the end of Wednesday’s trading. The accumulated fall throughout the year was recorded at 20.82 percent, whereas the market gained 10 percent in the past month, indicating high volatility.

“This is like a discount in the stock market,” said Irwanti, investment director of Schroders Indonesia, which had Rp 61.1 trillion in assets under management as of the end of May. “If you invest in the future, if you look far into the horizon, you shouldn’t be afraid [of short-term volatility].”

The stock market still offered bigger returns in comparison to other assets, such as property, gold and time deposits, she added. For this year, Schroders did not have an official JCI target set out given the high market volatility, however Irwanti estimated a best-case scenario of the stock index losing 15 percent this year.

Both Schroders and Batavia prefer large-cap stocks. Schroders was limiting exposure to high beta names, or stocks that have higher returns in bull markets and lower returns in bear markets, Irwanti said. Meanwhile, Batavia included several small and medium cap stocks with strong fundamentals and earnings projections in its portfolio, Lilis said.

Hariyanto Wijaya, head of research at Mirae Asset Sekuritas Indonesia, the country’s most active brokerage house, reminded investors to keep their losses small when investing during volatile times.

“Please set your cut loss limit quite reasonably, we suggest around 20 percent,” Hariyanto said during the webinar. And on the flip side, he said: “If investors already get sufficient gains, I suggest taking a profit,” as a buy-and-hold position may not always be a good investment strategy.

Mirae forecast the JCI to end the year at 5,180 in a baseline scenario, reflecting a 17.8 percent drop from the previous year. The bull case is projected at 5,830 and bear case at 4,160, according to Mirae estimates.

In the past month, the JCI recorded a net foreign buy of Rp 12.22 trillion, a reversal of foreign investment outflows in the past three months where the bourse recorded a total net foreign sell of Rp 5.14 trillion. Throughout the year, foreign investors have sold Rp 11.63 trillion worth of Indonesian shares.

For millennial investors who are still navigating their way around the stock market, Sucor Sekuritas equity and business development director Bernadus Wijaya pointed to three styles of investing: value investing, growth investing and income investing.

Value investing is when an investor tries to find stocks that are sold relatively cheaper in the market in comparison to its book value. Growth investing, as indicated by its name, is when an investment decision is determined by the stock’s strong earnings growth. In income investing, an investor looks for companies that give high dividend yield consistently.

“Buy in stages. Choose good companies with good fundamentals, but we have to understand technical analysis so we know when to enter,” said Bernadus, advising first-time investors to get capital gain from their stock investments.

Based on gains made between Dec. 31, 2007, and Nov. 30, 2018, the local bourse was the best-performing stock exchange for long-term investors, Bernadus said, as it gained 120.56 percent during that period, while the United States’ S&P 500 only made a gain of 87.98 percent.

This year, however, the JCI was among the worst-performing markets year-to-date, despite its recent gains. When the JCI fell by almost 21 percent, Hong Kong’s Hang Seng Index dropped 14.23 percent, while Japan’s Nikkei 225 fell a modest 3.23 percent.

The panelists agreed that the recent market rebound was largely driven by the reopening of economies worldwide, as well as central banks’ stimulus funds, which flow into the financial market. However, full economic recovery may largely depend on solutions to end the pandemic, with vaccines currently still being developed.