Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsSurviving the perfect fraud storm

In Indonesia, efforts to prevent and combat financial and trading frauds seem still inadequate because the agencies in charge are short of resources.

Change text size

Gift Premium Articles

to Anyone

M

any people believe that fraud predates human civilization. Fraud evolves alongside human civilization. Fraud can take many forms, but it is primarily defined as the misrepresentation of facts in order to obtain illegal benefits.

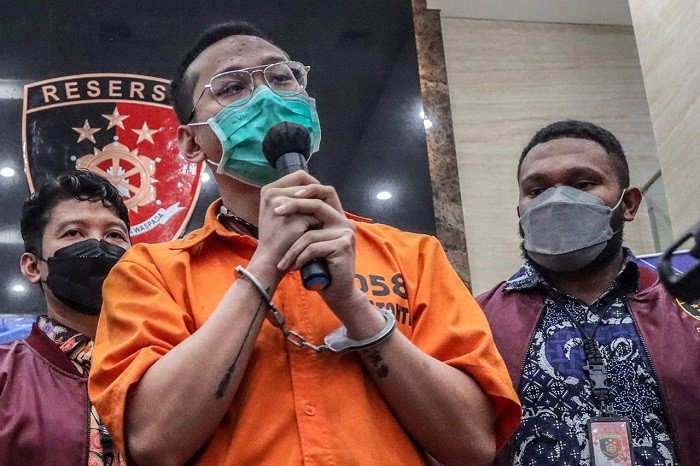

Thousands of Indonesian financial-services consumers are victimized each year by various consumer fraud schemes, many of which are perpetrated by organized criminals. Illegal financial investment, multi-level marketing, cryptocurrency exchange, lotteries and gold investment are just a few examples, according to the Investment Alert Task Force of the Financial Services Authority (OJK). Recent incarnations of consumer fraud in Indonesia include multiple forms of fraudulent binary options.

The government has been taking concerted efforts to combat financial and trading frauds but new fraud schemes with new technology continue to emerge. The Trade Ministry’s Commodity Futures Trading Supervisory Agency (Bappebti) has closed down hundreds of website platforms in the field of commodity futures trading (PBK) that did not have licenses. OJK also has shut down many platforms selling bogus investment products and the Indonesian Financial Transaction Reports and Analysis Center (PPATK) also uncovered and reported to law enforcement agencies suspicious financial transactions. But those measures seemed inadequate.

More thorough investigations are needed to know the underlying causes, the roots and motivations of fraud schemes in order to be able to design an effective and comprehensive framework of preventive measures to protect the people from fraud.

Fraud requires fraudsters to have skills in manipulating human behavior. The more skilled a fraudster is at manipulating human behavior, the more likely he or she will succeed in his or her offenses. However, the success of a fraud scheme is also dependent on the vulnerability of the target victims. The greater a victim's ability to protect himself from the scheme, the less likely he will be victimized. Consumers' resistance to fraud is thought to be linked to their financial literacy. The rise in literacy has long been thought to be a protective factor against investment fraud. Financial literacy is a person's ability to understand how money works in the real world. This includes how people can earn and manage money, as well as how they can invest to increase their wealth. Many people have been victimized by fraudsters as a result of their lack of financial literacy, which made them unaware of multiple fraud schemes.

Similar to Indonesia, countries such as Australia and the United Kingdom are also continuously being targeted by fraudsters who attempt to cheat consumers through a variety of means, especially investment scams. According to the Australian Competition and Consumer Commission (ACCC), Australians lost more than A$850 million (US$629 million) to scams in 2020. In the UK, according to the Fraud the Facts report, a total of £135.1 million ($176 million) was lost to investment scams in 2020, and only £49 million of the losses could be recovered.

In light of the increasing ease of access to multiple investment choices due to the advancement of technology, the financial literacy of the people must improve. Nationwide anti-fraud initiatives have become more imperative to prevent and combat fraud, using multiple tools and involving multiple stakeholders in a collaborative effort to protect consumers. For example, to mitigate the risk of consumer fraud, the Australian Banking Association (ABA), launched a new campaign in 2021, warning Australians to be on the lookout for scam phone calls, texts and emails as the number of victims of financial scams increases. The goal of this campaign is to educate Australians about scammer tactics so that they can protect themselves, their friends and their families.