Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsUnlocking Indonesia’s rural tech frontier: The O2O challenge

Most tech companies either avoid investments in field teams or make sporadic investments only during the initial few months of the agents’ acquisition.

Change text size

Gift Premium Articles

to Anyone

A

biting “tech winter” has frozen Indonesia’s tech-focused start-ups in the post-pandemic era, casting a spotlight on tech companies’ sustainability in the country. The first half of 2023 saw a staggering 74 percent decline in start-up funding from the previous year. Many tech companies, including well-established giants, are grappling with operating losses, leading to waves of layoffs.

Urban markets in Java hit their saturation point, which forced tech companies to explore rural and non-Java regions. These uncharted territories are poised to become the next growth frontier in the coming years, particularly in fintech and e-commerce.

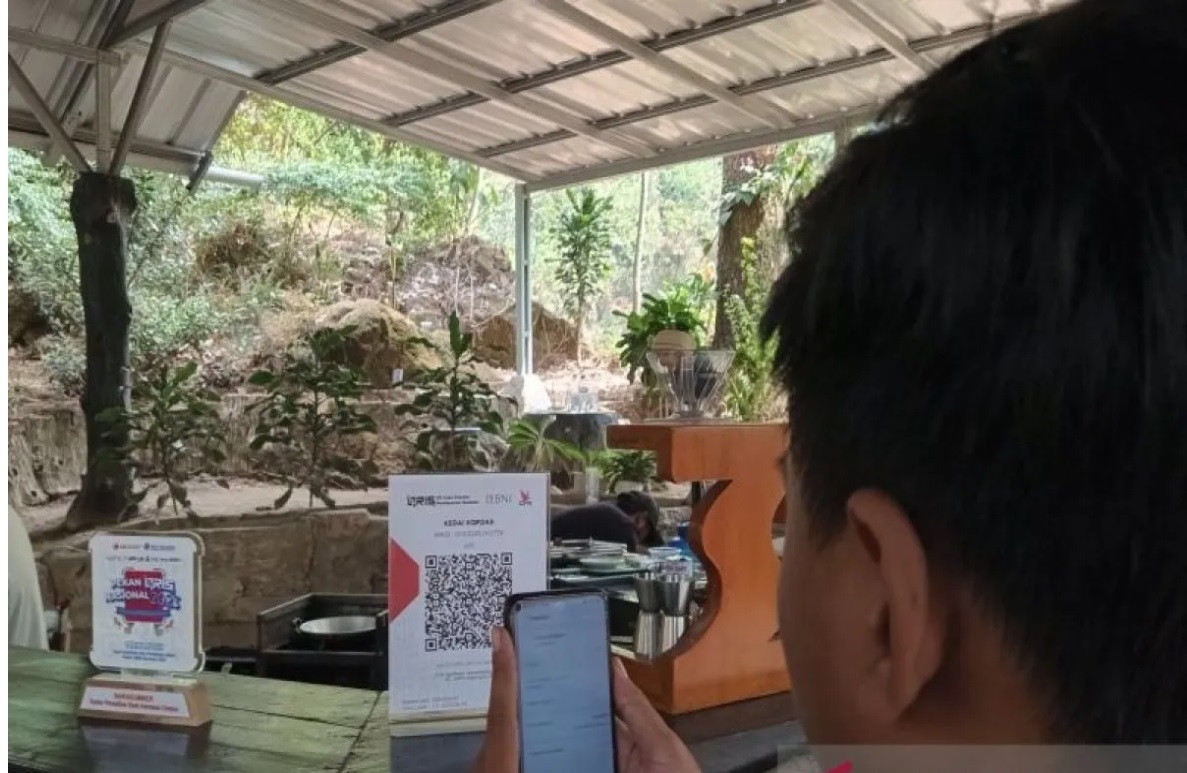

Online-to-offline (O2O) or physical+digital “phygital” channels are the key to success in these areas. Affiliated corner shops and individual agents, referred to as mitra, facilitate customers in e-commerce and digital financial services transactions. These services have become popular among tech companies in Indonesia as the omnichannel approach gained prominence. It allows tech companies to maintain a robust presence in both online and offline channels, promoting deeper customer engagement and satisfaction.

Yet, this transition is no walk in the park. The implementation of O2O channels in these settings has required a formidable learning curve for many tech companies. Paradoxically, highly digitized delivery models that have thrived in urban areas have become the main roadblock to crack the complex rural markets.

Tech firms must shed established methods and assumptions that fueled their success in bustling urban centers to thrive in these untapped markets.

Here are five core foundations that tech companies need to invest in to successfully implement the O2O model in rural areas.

First, they must invest in dedicated field teams that can deepen relationships with agents.

Most tech companies either avoid investments in field teams or make sporadic investments only during the initial few months of the agents’ acquisition.

However, MSC’s ANA survey shows that 67 percent of agents rely on support staff when they have queries, more so than any other communication channels. This holds particularly true in the Indonesian rural market, where trust and client loyalty heavily depend on face-to-face interactions. As a result, investment in physical interfaces, such as field teams, becomes critical.

A dedicated field team can educate agents to navigate a complex web of digital services, boost cross-sales, address queries and build trust. By doing all these, the field teams can make a difference and provide the required competitive edge through enhanced agent loyalty and sustainability.

Partnerships with strong local partners that can deploy and monitor such field teams and provide other support services are often the most prudent strategic choice rather than figuring everything out in-house.

Second, companies must experiment with phygital models for agent recruitment, onboarding and training.

Many tech companies rely on self-service models to acquire agents. While such a model works well in urban environments where potential agents are more aware, informed and tech-savvy, that may not be the case in rural areas. Rural segments are more suspicious of digital interfaces and often need hand-holding to use such digital applications. Also, unstable network connectivity further complicates the digital onboarding process.

A hands-on and customized recruitment, onboarding and training approach has proven effective to onboard agents in rural areas. Conventional banks recognized the unique challenges in rural regions and have successfully employed this method. Their approach’s success indicates that tech companies too should adopt a similar strategy.

Third, provision of proactive cash and liquidity management support is crucial for agent viability.

Liquidity management is vital for agents to support service uptake and enhance customer trust. However, several challenges persist. Agents face setbacks, such as the inability to predict and respond to fluctuations in cash and digital transactions, concerns about rebalancing of points and time and the lack of resources to maintain sufficient float. Most tech companies that implement the O2O model have a hands-off approach to the facilitation of liquidity or cash management for agents. Agents are expected to figure it out on their own.

However, reality says otherwise. For most agents, liquidity management support is a provider’s most valued service.

Fourth, firms should invest in a robust technology backbone that can allow strategic collaborations with third parties.

A successful O2O delivery channel often requires collaborations with third parties, especially in distribution. Most tech companies lack a critical middle layer for agent management and monitoring, although they have fairly advanced product or service tech interfaces. To ensure accountability and ownership in many third-party collaborations, it might be necessary to provide potential partners with access to and control over the relevant tech systems.

Tech companies can either build an agent management system in-house or procure a third-party off-the-shelf solution and customize it to their requirements. Bank and mobile money operators worldwide have benefited immensely from third-party agent network managers’ services. Many such professional third-party agent network managers deploy a robust technology platform.

The platform allows them to set up distribution hierarchies and fees and commission rules, track or manage liquidity positions, generate customized performance reports and track and manage fraud.

Fifth, companies must build a compelling product or service bouquet to make unit economics work.

The cost to acquire channel partners and customers may be higher in rural areas due to the phygital acquisition processes, unlike the entirely digital processes in large urban centers. Furthermore, the gross merchandise volume (GMV) is typically lower in rural areas and underscores the importance of strong unit economics.

Therefore, tech companies should diversify their agents’ services to enhance sustainability. A broader range of products or services will improve their unit economics and reduce dependence on a single product or service.

However, often, many tech companies are product-focused. Individual product teams are responsible for their respective profit and loss, and channel sustainability takes a back seat. Collaboration between different product teams to make the channel viable is not easy, even though some key drivers for individual product sustainability may tightly be interlinked with other products in the ecosystem. For example, e-commerce or digital payments may not be sustainable on a standalone basis.

Tech companies can bolster their value proposition and increase their profitability through cross-selling when they combine various products and services. Without such investments, individual services may devolve into commodities and fuel price wars with competitors that ultimately leave no winner in the process.

Will these investments strain resources amid the “tech winter”? We believe they will not.

They represent a necessary step to break free from the classic chicken-and-egg trap, where suboptimal operating design yields suboptimal results. These then feed into organizational biases on what works and what does not.

Through these investments, tech companies can enhance service quality, pave the way for a more sustainable business in rural markets and endure all seasons of the market.

***

Rahmatika Febrianti and Rhifa Ayudhia are analysts at MicroSave Consulting (MSC). Raunak Kapoor, Vaishali Ashoka Patra, Rahul Ganguly and Nikhil Sati contributed to this article.