Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsBusiness, investor cooperation key for Indonesia-Australia relationship

The fragmentation of trading markets provides likemined, pro-growth nations like Australia and Indonesia with the opportunity to turn toward each other.

Change text size

Gift Premium Articles

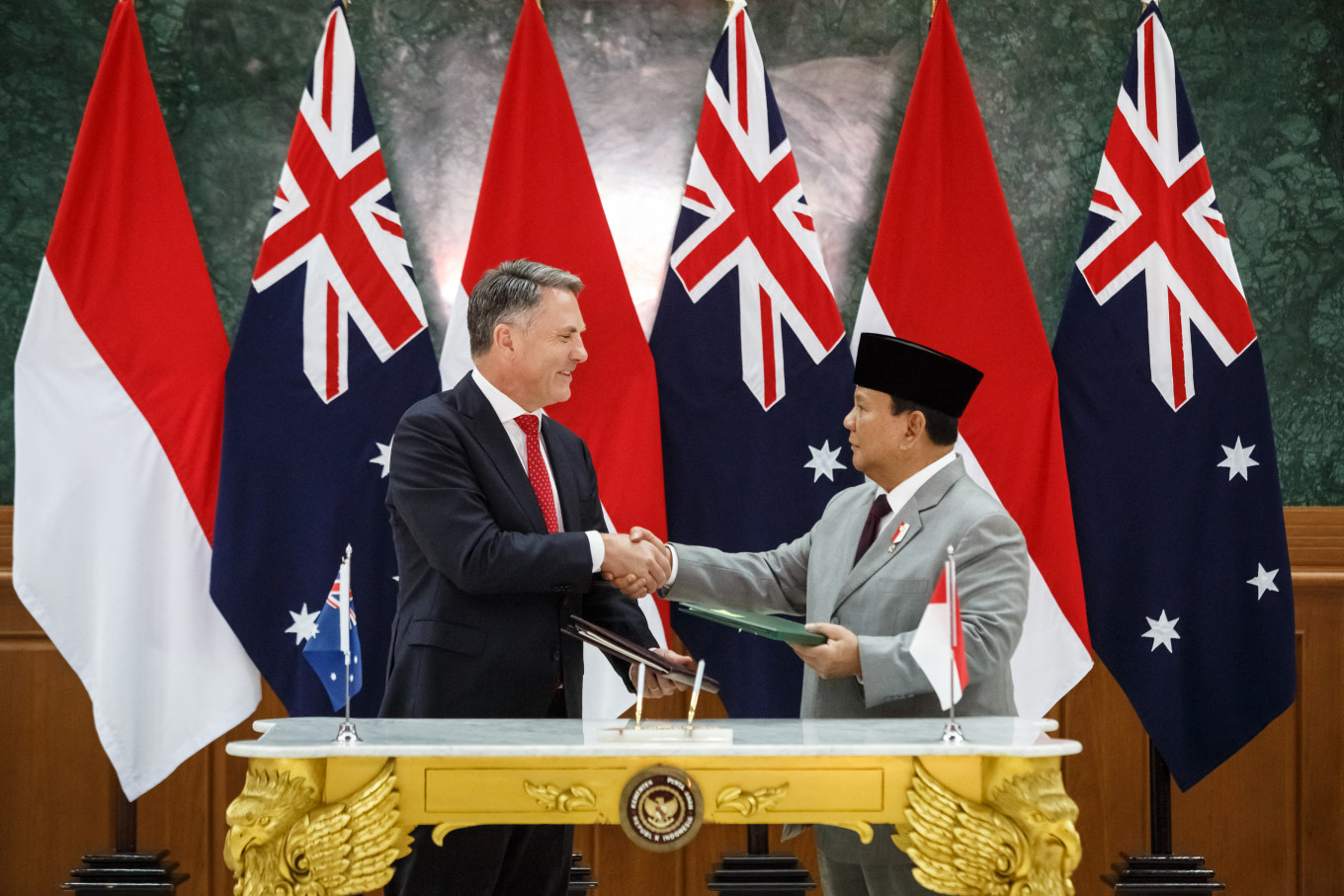

to Anyone

Then-defense Minister and president-elect Prabowo Subianto (right) and Australia's Deputy Prime Minister and Defence Minister Richard Marles shake hands after signing the Australia-Indonesia Defence Cooperation Agreement (DCA) at the Military Academy in Magelang, Central Java, on Aug. 29, 2024. The pact, which includes provisions for joint drills and deployments to each country, was signed during Marles' visit to Indonesia this week.

(AFP/Devi Rahman )

Then-defense Minister and president-elect Prabowo Subianto (right) and Australia's Deputy Prime Minister and Defence Minister Richard Marles shake hands after signing the Australia-Indonesia Defence Cooperation Agreement (DCA) at the Military Academy in Magelang, Central Java, on Aug. 29, 2024. The pact, which includes provisions for joint drills and deployments to each country, was signed during Marles' visit to Indonesia this week.

(AFP/Devi Rahman )

S

ince Australia became one of the first nations to recognize Indonesia’s independence in December of 1949, the two nations have forged a special relationship.

Recently, both Canberra and Jakarta have sought to prize open opportunities to seize a competitive advantage in a global economy which is rapidly reorganizing.

The Australian government’s Future Made in Australia policy, and Indonesia’s determination to multiply the value of its nickel mining industry with downstream processing are contemporary examples.

It is not incendiary to suggest that strong bilateral relationships will count for more now than ever. Particularly as we see the economic policy agenda of the new United States government shake up the global trade system.

For Australia, while talks continue, there is no guarantee of an amnesty from the US administration’s tariffs on steel and aluminum imports. Indonesia, meanwhile, is reportedly considering options to diversify its trading relationships. It exported more than US$26 billion to the US in 2023, and around $28 billion last year.

This fragmentation of trading markets provides likeminded, pro-growth nations with the opportunity to turn toward each other. Closer trade cooperation between Australia and Indonesia would provide both economies with a measure of assuredness and certainty.

Which is why we should pay close attention to the positive early results of the recently ratified Indonesia-Australia Comprehensive Economic Partnership Agreement (IA-CEPA). Under the agreement, 99 percent of goods traded between the two economies are tariff-free.

Two-way trade has surged since its inception, with an AU$8.4 billion ($5.21 billion) uptick in trade recorded in 2023, to AU$26.7 billion. While decidedly smaller than Indonesia’s trade with its top partners, China, the US, and Japan, it is clear there is room for growth.

And, as barriers to global trade become more common, the outcomes of this piece of economic architecture may prove more important than policymakers might have envisioned. With trade growing, our attention must turn to investment.

Targeting economic growth of 8 percent during his first term, President Prabowo Subianto is wasting no time. Within the first 100 days of his term, the President is said to have visited nine nations as he secured around $18 billion in foreign direct investment commitments, with a focus on energy and social infrastructure, and infrastructure asset recycling.

As a renowned builder of social infrastructure, and with decades of experience in designing and implementing effective infrastructure asset recycling programs to attract private capital, Australia is capable of supporting President Prabowo’s growth ambitions.

Indonesia, and the broader ASEAN region is on the precipice of economic superpower status.

Projected to be the world’s fourth-largest economy by the mid-point of the century, and with $1.7 trillion of infrastructure spending required by 2040 to support a rapidly urbanizing population, Indonesia presents numerous opportunities for Australian investors.

Meanwhile, Australia sits on Indonesia’s doorstep and has a pension system with a capital allocation challenge of sorts. Currently worth more than $2 trillion and set to more than double over the next 15 years, Australia’s superannuation system is constantly searching for long-term assets to invest in on behalf of workers.

Tapping that deep pool of capital to help fund Indonesia’s asset development pipeline serves as a significant opportunity for closer cooperation between the business and investment communities of both nations.

Currently, Australian investment into Indonesia is nascent; just AU$1.2 billion was registered in 2023.

Both Canberra and Jakarta have made changes, which should help boost this figure.

In line with the recommendations of its landmark ASEAN economic engagement strategy, the Australian government recently established a “deal team” in Jakarta to earmark opportunities ripe for willing, patient Australian capital.

Recently, a delegation of Australian investment and business leaders visited Jakarta to investigate these opportunities in-person and discuss how to hasten greater business-to-business connectivity across the Timor Sea. Initiatives like these fit well with Indonesia’s plan to attract foreign capital.

A range of investor-friendly laws, including streamlined labor regulations, simplified environmental requirements, tax reform and the publication of a priority investment list are encouraging developments.

Of course, not all opportunities will stack up commercially, and all discussions require parties to successfully navigate debt capital markets and consider the need for foreign exchange and interest rate hedges to keep risk to a minimum.

In such cases where Australian investors and Indonesian asset owners cannot agree to work together, both parties should consider how the investment case can be refined to ensure future proposals land closer to the mark.

Flush with the minerals critical to the world’s energy transition, greater cooperation would enhance both nations’ natural strengths.

Adding Australian lithium to Indonesia’s nickel industry to meet the needs of a growing global electric vehicle market, has previously been the subject of discussion between Prime Minister Anthony Albanese and former president Joko “Jokowi” Widodo.

With government support and enhanced policy frameworks in place, the responsibility for enhanced collaboration shifts to the business and investor communities of both nations.

With focused, coordinated effort, the Indonesia-Australia economic relationship may yet reach its potential.

***

Riko Tasmaya is director of PT Bank HSBC Indonesia. Antony Shaw is chief executive of HSBC Australia and New Zealand.