Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsLoosening monetary policy for COVID-19

QE is effectively complementing the BI-7DRRR in boosting the effectiveness of loosening monetary policy.

Change text size

Gift Premium Articles

to Anyone

F

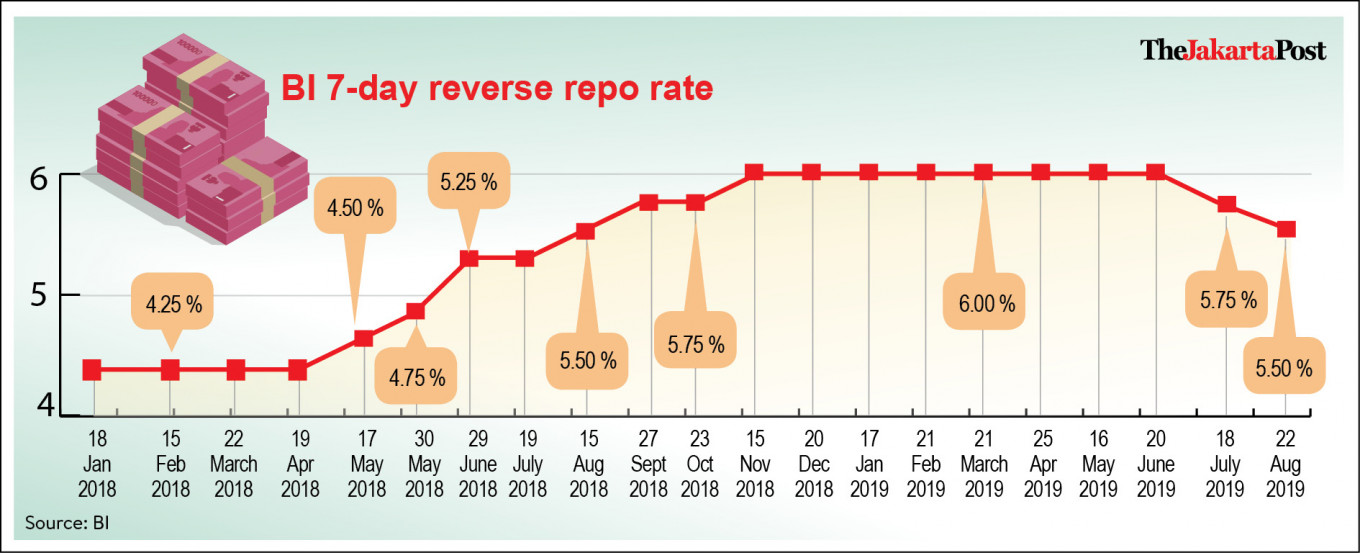

or the third time this year, Bank Indonesia (BI) has decided to adjust its policy rate, lowering its BI 7-day reverse repo rate (BI-7DRRR) by 25 basis points to 4.25 percent in mid-June. The new policy rate was announced soon after the government decided to reopen the economy, starting on June 8.

Compared to other countries, it seems that Indonesia has been better at managing the economic impacts of COVID-19. Macroeconomic indicators have started to improve. The exchange rate of the Indonesian rupiah against the US dollar has improved, precisely in line with capital inflows. The tipping point might be bottoming out.

Ever since the COVID-19 epidemic hit the economy, BI started to loosen its monetary policy stance. This was not only a proper but also a necessary response to manage the macroeconomic dynamics. The overall downward economic trend ought to be followed by a move to ease liquidity.

The BI 7-DRRR is the primary policy instrument to manage the monetary sector. The policy rate mainly influences the operational rate on the interbank money market; the bigger picture is to guide the expectations for economic liquidity.

History has deemed the policy rate an effective instrument for influencing the economy. John Maynard Keynes made his pivotal identification of liquidity preference around 1936 and hence endorsed adjusting the policy rate to modulate the monetary sector. However, the policy rate is not the only instrument, especially in today’s monetary landscape.

The global financial crisis of 2008 offered a lesson on how the zero lower bound (ZLB) became a real spectrum in the monetary policy. It was proven to be more than a sophisticated myth in the pile of macroeconomics literature. Over-indebtedness in the speculative market at the time tore the financial system down and disrupted aggregate demand. As a result, the Fed Funds Rate, the policy rate of the US Federal Reserve, lost its effectiveness in influencing the economy. Even worse, when the policy rate entered the “zero neighborhood”, it became too low for further downward adjustment. There was nowhere else to go, so it was simply the same as a trap.

Against the downward spiral, central banks around the world began to see an unconventional way to inject liquidity through the solution of quantitative easing (QE). They allowed the liability side of their balance sheet to grow to make liquidity available for the market. For today’s challenges, QE seems to have become more conventional, a step that is arguably more acceptable than Modern Monetary Theory (MMT).

BI is prudently sustaining its measures to ease banking liquidity through QE. It is another dimension of monetary policy that has been loosened recently. BI’s total estimated QE has reached Rp 583.5 trillion (US$39 billion), achieved by absorbing government bonds (SBNs) in the secondary market, currency swaps and lowering its reserve requirement. QE is effectively complementing the BI-7DRRR in boosting the effectiveness of loosening monetary policy.

BI had already begun to introduce a monetary-macroprudential policy mix even before the COVID-19 era. The countercyclical action might be made now, not necessarily toward the policy rate alone, but also by controlling the market’s leverage level. This is consistent with the conceptual similarity and practical links between a central bank’s monetary and macroprudential roles as identified by law professor Robert C. Hockett at Cornell University.

In the context of the pandemic, BI is better equipped in terms of “dynamic provisioning”. A perfect combination of monetary and macroprudential policy tools, if used appropriately, would be better for positioning BI to manage any dynamics that might come.

Inflation in Indonesia is currently progressing in a relatively low and stable manner. The consumer price index (CPI) recorded a decline in inflation to 2.19 percent in May 2020, slightly lower than the previous month. The seasonal CPI of Ramadan and Idul Fitri recorded even lower than its 5-year pattern, so BI still had reasonable space to lower the BI-7DRR, if necessary.

BI should consider at least two points to contemplate further proportional lowering of the BI-7DRRR. First and foremost is BI’s overriding objective of inflation. Indonesia set its 2020 inflation target to 3 percent with a reasonable deviation of 1 percent. For the past 5 years, BI has accountably succeeded in “putting the collar on the band”. However, the unusual threat of COVID-19 must still be anticipated, especially the risk of a second wave of infection.

On the other hand, the ZLB should be recognized as an equally important consideration. Under the dual pressure of supply-side and demand-side disruption, effective coordination among the authorities is a prerequisite. Monetary policy does not necessarily feature direct access to the real economy.

After being retained for 3 months, the recent BI-7DRRR position might be the lowest in the past two years. However, the number does not represent any retrogression. BI has demonstrated deliberate judgment and that its decision is heavily based on how the economy is moving. It is a very clear and necessary response to the pandemic economy.

Tuning the policy rate might be as simple as turning a faucet on or off. But the timing is critical for monetary policy, and is about a modulation to find the perfect balance. Thankfully, BI-7DRRR now comes with stronger signals and better policy communication. Hence, it is reasonable to believe that the monetary policy is now in better shape.

***

The writer is legal affairs staffer, Bank Indonesia. The views expressed are his own.