Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search results[INSIGHT] Tax digitalization needed to aid pandemic relief, boost recovery

Tax digitalization can have positive ancillary effects as well, especially via digital tax payments, such as greater financial inclusion, particularly for women and marginalized groups, and accelerated formalization of the economy.

Change text size

Gift Premium Articles

to Anyone

T

ax system digitalization will provide a potent second shot in the arm to accompany recent COVID-19 vaccine breakthroughs as Indonesia strives to provide relief from the pandemic’s devastating impact and pursue post-pandemic recovery and growth.

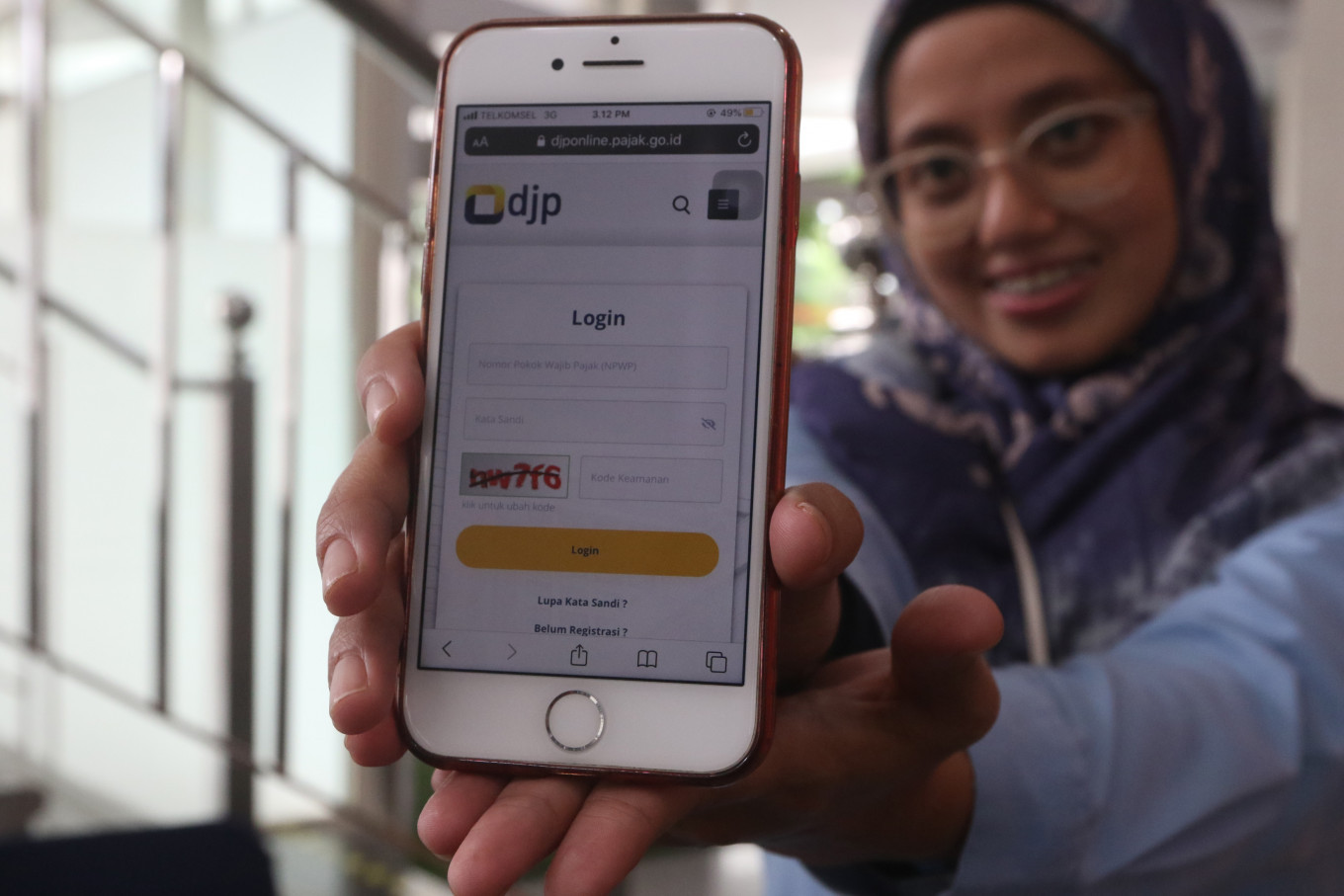

Digitalization is not the ultimate objective. Instead, it is a tool to enable the Directorate General of Taxation (DGT) to fulfill its mission better.

A report by the United Nations-based Better Than Cash Alliance finds that digitalization of tax systems in emerging markets, when coupled with complementary administrative reforms, can raise annually an additional US$300 billion worldwide.

This can help close much of the fiscal gap that threatens achievement of both the UN’s Sustainable Development Goals and Indonesia’s vision to become a high-income nation by 2045.

The government has been extremely proactive in responding to the pandemic with a package of fiscal measures totaling approximately Rp 700 trillion ($49.6 billion), equal to roughly 5 percent of the 2019 gross domestic product (GDP), which has certainly helped to mitigate COVID-19’s impact on vulnerable households and businesses.

But this extraordinary fiscal response has raised the budget deficit to an unprecedented level of 6.1 percent of GDP, whereas Indonesia is known for its strict fiscal discipline in maintaining the deficit below 3 percent of GDP.

The Budget Law has permitted budget deficits to remain above 3 percent through fiscal year 2022, but this forbearance ends in 2023, after which the deficit must revert to less than 3 percent of GDP.

However, much more will be needed to alleviate current suffering, restore previous social and economic gains lost to the pandemic, and “build back better” in the future through substantial investments in infrastructure, human capital and social protection.

The need for additional revenue to finance current and anticipated expenditures has never been more urgent, even though all major tax bases are shrinking substantially and Indonesia’s economy is contracting for the first time since the Asian financial crisis of the late 1990s.

Thus, fiscal consolidation is very important. There are two ways of achieving this. First, we must improve budget spending efficiency and effectiveness – a topic for another discussion.

Read also: Indonesia collects $20.9m in digital tax as of October

Second, Indonesia needs to increase its tax collection. Further evaluation of tax policies and tax administration are of course mandatory. For the latter, tax digitalization is an element of great importance.

The value proposition of tax digitalization is attractive to both the DGT and the taxpayer.

The DGT can increase revenue at a lower administrative cost and in a more equitable manner. It can broaden and deepen its tax base through improved service, better analytics and a credible threat of sanctions for noncompliance so that all taxpayers are paying their fair share.

Improved administrative cost-effectiveness will also enhance DGT transparency, accountability, credibility and legitimacy. At the same time, higher quality service and lower compliance costs, in both time and money, through simplified and online registration, fi ling and payment will make it easier and cheaper for taxpayers to fulfill their civic responsibilities.

Tax system digitalization has also taken on a crucial public health dimension in the era of COVID-19 as governments seek to maximize touchless, digital interactions to minimize in-person contact.

Tax digitalization can have positive ancillary effects as well, especially via digital tax payments, such as greater financial inclusion, particularly for women and marginalized groups, and accelerated formalization of the economy.

Mexico provides an example of the potential gains from tax digitalization and accompanying administrative reforms. Like Indonesia, Mexico is a large, upper-middle-income country and a member of the Group of 20.

Tax revenue and social security contributions doubled from 2010 to 2016, tax evasion decreased by 20 percent in the four years to 2016, and the tax base has expanded 150 percent since 2010 as 4.2 million microenterprises transitioned to the formal economy.

Indonesia has also seen significant gains over the past decade from incremental digitalization of its tax system and supplementary operational improvements.

Read also: Taxing digital products

Since 2014, the tax compliance time for businesses has dropped 20 percent and businesses submitting monthly tax returns have saved about Rp 32 million annually.

Overall taxpayer satisfaction with the DGT’s services is slowly rising as well, and Indonesia’s “Paying Taxes” ranking in the World Bank’s “Ease of Doing Business” classification is now 45 places better than it was in 2010. But this is clearly a work in progress since tax reform efforts, including digitalization, have not yet achieved their primary objective, namely a sufficient increase in tax revenue.

Over the past decade, although tax revenue has more than doubled, the economy has also grown. Thus, even before the pandemic, the tax-to-GDP ratio first plateaued and then began to decline slightly.

Nonetheless, tax digitalization remains an integral component of the Finance Ministry’s decades-long comprehensive tax modernization program, and these eff orts were given a significant boost with the Rp 1.7 trillion procurement award in December 2020 for its Core Tax Administration System.

This will provide the DGT with cutting edge technology to build on its strong tax-digitalization foundation.

It can utilize national and global enabling trends such as the use of big data for better decision making, proliferation of digital tools for improved governance and pervasiveness of digital payments for greater convenience and security.

Indonesia’s data protection bill, when passed into law, will also offer taxpayers the right to privacy and recourse, and importantly help to build trust that their sensitive data will be used responsibly.

***

Suahasil Nazara is Indonesia’s deputy finance minister and University of Indonesia professor of economics. Jay Rosengard is adjunct lecturer in public policy and faculty chair of the Indonesia Program at the Harvard University Kennedy School of Government and senior adviser to United Nations-based Better than Cash Alliance. All views expressed are personal.