Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsHomeownership slides as affordability issues arise

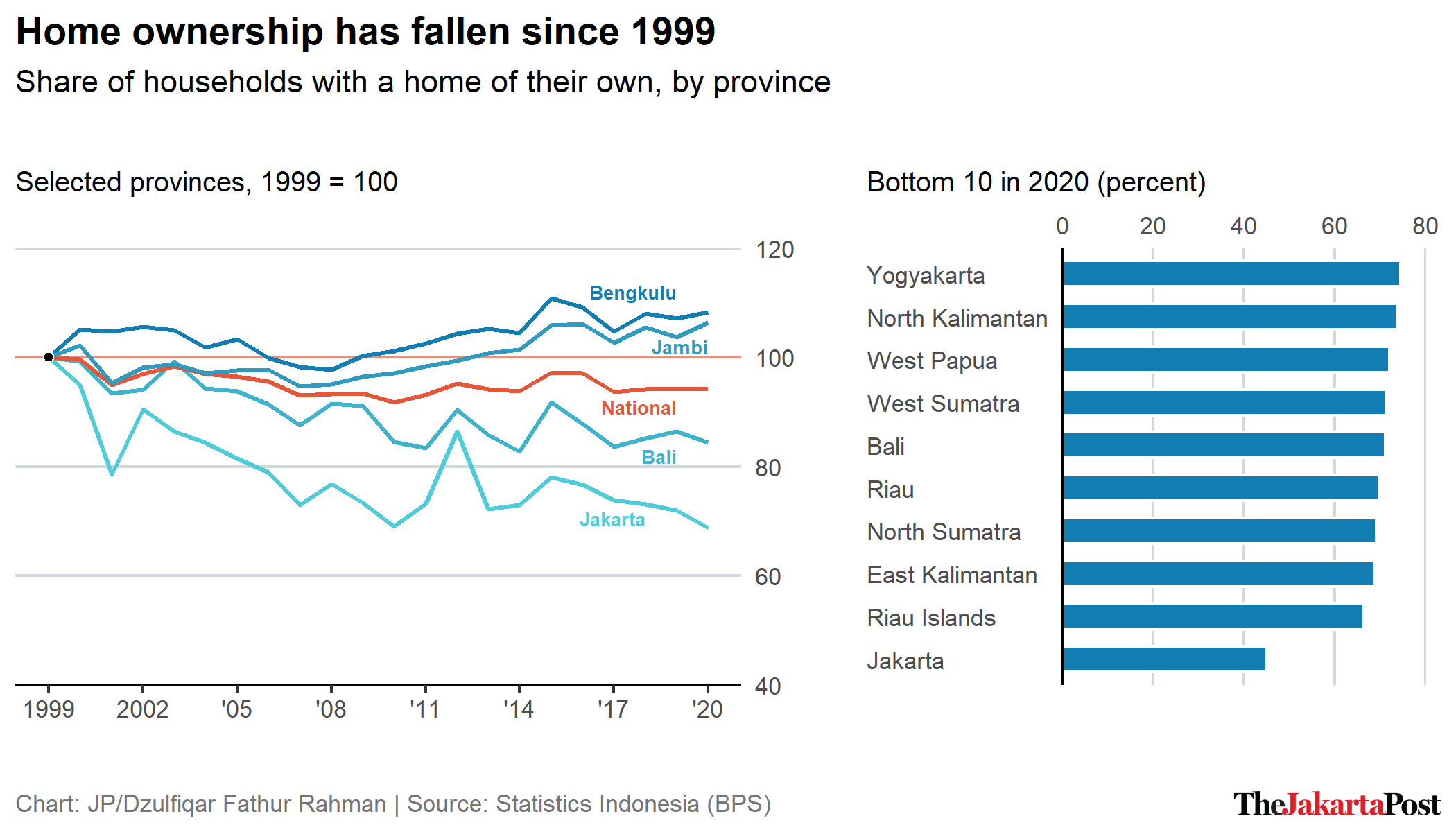

The national share of households with a home of their own has fallen markedly over the past two decades. Jakarta recorded the lowest share last year. What lies behind the numbers?

Change text size

Gift Premium Articles

to Anyone

H

omeownership in Indonesia has been dropping since 1999 as house prices have risen. Now, the affordability of homes is under further threat as a number of people face declines in real income as a result of the pandemic.

The national share of households with a home of their own fell to just over 80 percent last year from nearly 85 percent in 1999, according to data from Statistics Indonesia (BPS). Jakarta recorded the lowest share last year.

The fall in Jakarta homeownership is in line with the share of households renting a home in the city, at 37.71 percent last year, higher than any other province, as workers flock to the capital to find jobs.

Although some provinces ended up with a higher homeownership rate after the first 20 years of the century, Jakarta posted the steepest decline between 1999 and 2020. Now, fewer than half of all households in the capital city live in their own home, down from nearly two thirds.

“It is indirectly related [to affordability],” said Wendy Haryanto, the executive director of the Jakarta Property Institute (JPI), a nonprofit that facilitates dialogue between the government and real estate firms.

“The rise in our income is very little, while property prices have been rising astronomically. So, the gap is increasing and housing is becoming less and less affordable,” Wendy told The Jakarta Post in a phone interview on Wednesday.

The housing market has taken a blow from the pandemic-induced economic slump, as reflected in declining quarterly sales last year. However, sales have since rebounded, growing 13.95 percent year-on-year (yoy) in the January to March period, according to Bank Indonesia’s (BI) latest survey of developers in 18 cities. The growth was driven by a rebound in sales of homes measuring 36 to 70 square meters.

The rebound has occurred as the government tries to spur consumer spending, including by relaxing the value-added tax (VAT) on houses worth less than Rp 5 billion (US$345,733) from March to August of this year.

BI has also relaxed the loan-to-value (LTV) ratio to 100 percent for the March to December period, up from between 85 and 95 percent.

Read also: BI policy to boost weak demand hinges on consumer, bank appetites

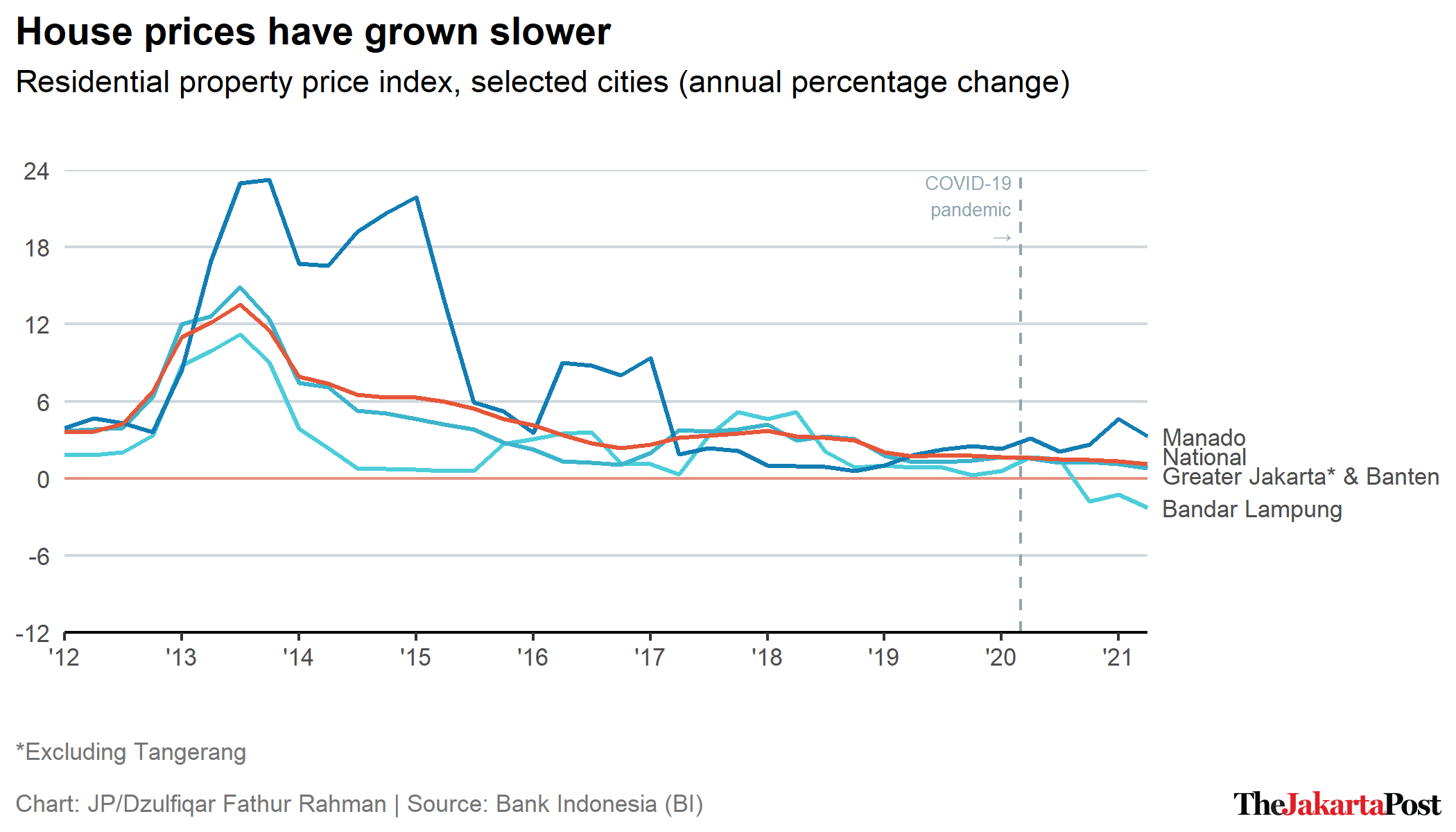

Despite falling sales, BI’s Residential Property Price Index (IHPR), which measures house prices in 18 cities nationwide, has kept growing, albeit at a slower pace recently. The index grew 1.35 percent yoy in the first quarter and was projected to grow by 1.1 percent yoy in the second quarter.

The fastest growth was 4.62 percent yoy in Manado, North Sulawesi, followed by Medan, North Sumatra; Pekanbaru, Riau; Yogyakarta; and Padang, West Sumatra.

Wendy said average house prices kept growing in large part because the taxable value of property (NJOP) also kept rising, which was determined by the government every one or two years, depending on the region. The NJOP often serves as a gauge for a house’s value.

Based on Jakarta Gubernatorial Decree No. 37/2019, the taxable value of property in the Kebayoran Lama district ranges from Rp 4.26 million per sq m to nearly Rp 26 million per sq m.

Read also: Jakarta hikes NJOP by 19.54 percent

A 2019 report from the World Bank found that the house price-to-income ratio for Jakarta was 10.3, nearly double that of New York in the United States. Bandung’s ratio was 12.1 and Denpasar’s 11.9.

“Given the current land prices, it is no longer possible to develop affordable downtown housing, and there are limitations related to the height [of buildings] and everything,” said Wendy.

In 2019, most households had no plan to buy a home, mostly because they already owned one, according to BPS’s National Social and Economic Survey (Susenas) from September 2019. More than one third of households cited a lack of money as the reason for not being in the market for a home.

Among those who bought homes, 31.89 percent did so with a mortgage, BPS found. The average mortgage term was around 12 years and the monthly payment Rp 1.71 million.

The average monthly payment was highest in Jakarta at Rp 6 million with an average term of 10.64 years, followed by Yogyakarta with an average payment of Rp 5.6 million and a term of 9.19 years.

In April, mortgage disbursement for housing reached Rp 508.35 trillion, up 5.5 percent from a year earlier, according to BI. The growth remained below prepandemic rates.

Hera Haryn, a spokeswoman for publicly listed Bank Central Asia (BCA), said the bank had recorded more than 20,000 mortgage applications in the first five months of the year.

In an online event earlier this year, the bank booked 1.2 million visitors, leading to mortgage applications worth Rp 15 trillion in total, Hera added, noting that business conditions had begun to pick up, not least because the government was offering stimulus measures to spur the economy through loan disbursement.

“We expect BCA’s mortgage disbursement to keep growing this year compared to last year,” Hera told the Post on Wednesday.