GoTo gains 23% on IDX debut as tech hype cools

Competitor Bukalapak gained 25 percent on its IDX debut last year, despite being multiple times smaller in market cap.

Change text size

Gift Premium Articles

to Anyone

H

omegrown tech giant GoTo gained 23 percent at its Indonesia Stock Exchange (IDX) debut on Monday, a smaller gain compared with competitor Bukalapak, following a global cooldown of investor appetite for tech stocks.

GoTo, a merger between ride-hailing firm Gojek and e-marketplace Tokopedia, saw share prices rise to Rp 416 (2.8 US cents) apiece during the first hour of trading, from the initial public offering (IPO) price of Rp 338 apiece. Listed under the ticker GOTO, the company is the first tech decacorn to be publicly listed in Southeast Asia.

However, GoTo's gains were lower than homegrown e-marketplace unicorn Bukalapak – the first tech giant to go public in the region – that posted a 25 percent gain during its IDX debut on Aug. 6 last year, even though the former is 15 times larger than the latter in terms of market cap.

The decacorn went public at a time when companies were delaying IPOs amid market volatility due to the Ukraine war and rising interest rates, and as investors were letting go of stocks of tech firms including Bukalapak, Grab and SEA Group – owner of e-marketplace Shopee.

"There was no perfect timing for this IPO, but our focus was on Indonesia, with a local investor audience. Despite uncertainty in the market, Indonesia has performed much better than other countries," GoTo CEO Andre Soelistyo told reporters in Jakarta.

He said the company would focus on improving its business performance and share prices would adjust accordingly.

GoTo shares closed at Rp 382 apiece on Monday, just 13 percent higher than the IPO price.

GoTo, which is the 15th company listed on IDX this year, brought Rp 400 trillion in fresh market cap to Indonesia’s stock market, raising the bourse total to Rp 9.4 quadrillion.

Following the IPO, the decacorn became the fourth largest publicly listed company on the IDX by market cap after private lender BCA, state-owned lender BRI and state-owned telecommunications firm PT Telkom Indonesia.

GoTo raised Rp 13.72 trillion in fresh capital through the IPO with GoTo and e-commerce arm Tokopedia slated to get 30 percent each, e-wallet GoPay 25 percent, multifinance arm PT Multifinance Anak Bangsa (MAB) 5 percent and business arms in Singapore and Vietnam 10 percent each.

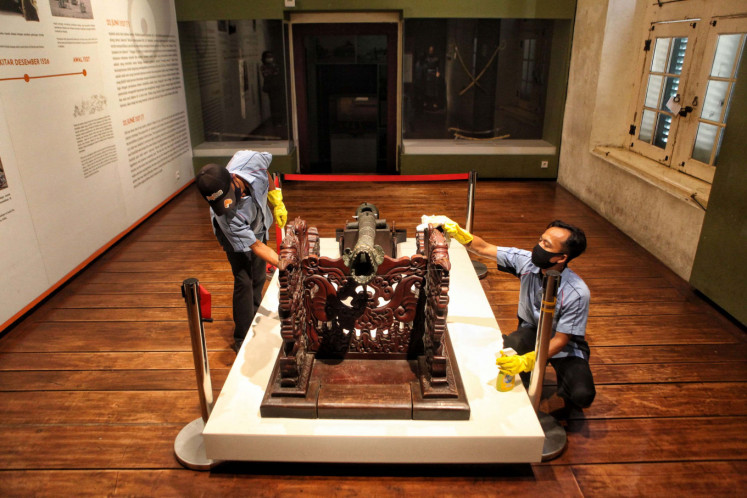

“The IDX hopes the listed company could soon realize its strategic plan with the fund it gathered, while remaining transparent and accountable to the public,” IDX assessment director I Gede Nyoman Yetna said during GoTo’s IPO ceremony on Monday.

He reminded the company to maintain the performance of its financial fundamentals after the IPO.

Analysts have raised concerns over GoTo's ability to deliver returns as the tech giant was expected to continue posting net losses until 2024. The company booked GoTo posted a loss of Rp 7.59 trillion as of July 2021, according to its prospectus.

Read also: Analysts lukewarm about GoTo IPO, caution against overhype

GoTo carried out its IPO plan as global investors’ appetite for tech stocks was reaching record lows. Grab saw its shares fall to $3.16 apiece on Sunday, a 75 percent drop since going public, while SEA fell by more than 68 percent to $114.42 apiece on Sunday since its peak in October last year.

Bukalapak also saw its price drop to Rp 334 apiece as of Monday, down by 60 percent since its first trading day in IDX.

Andre said the company had yet to decide on its dual listing plan on an overseas capital market because it was still observing market conditions.

Despite the stormy days for tech stocks, GoTo shares were oversubscribed by 15.7 times during the offering period, almost double the oversubscription for Bukalapak shares at 8.7 times.

Following the GoTo IPO, the IDX Composite Index, the main gauge of the local bourse, hit an all-time high at around 7,355 during the first trading session, up by more than 200 points from the previous trading day, before closing at around 7,239.

In comparison, the IDX Composite Index closed at 6,203 after BUKA’s IPO, down from 6,205 a day prior.

Read also: GoTo to build up war chest with IPO amid fiercer competition

Mirae Asset Securities analyst M. Nafan Aji Gusta said on Monday that market euphoria had driven GoTo’s share price upward, albeit not as much as it did for Bukalapak, as investors, especially Indonesian retail investors, have been more accustomed to having listed start-ups in the market.

Global economic uncertainty such as the Russian invasion of Ukraine and the United States Federal Reserve's monetary tightening also spurred investors, particularly foreign investors, to avoid high-risk assets like stocks.

“But this is good because a steady increase will make the stock's performance steady as well. If it rises too much, such as if it hits the upper auto rejection limit, then it could soon hit the lower auto rejection limit as well,” Nafan told The Jakarta Post.

A rapid rise in share prices would likely trigger profit-taking, which would cause prices to fall afterward, he added.

Paulus Jimmy, an equity research analyst at Sucor Securities, said on Monday that the strong foreign capital inflows to the Indonesia market would continue supporting GoTo’s share prices, albeit only in the short term.

“It is best to wait until there was a little correction [on GoTo share prices] to make an entry,” Paulus told the Post.