Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsJakpost Fintech Fest

The use of digital platforms is on the rise as people spend more time at home or physically away from other people, resulting in more apps and digital platforms being used actively.

Change text size

Gift Premium Articles

to Anyone

We are familiar with this topic: Financial technology (Fintech).

The use of digital platforms is on the rise as people spend more time at home or physically away from other people, resulting in more apps and digital platforms being used actively. This has resulted in digital commercial activities to resort to fintech, from payments to lending and investment to market aggregators.

In the public sector, fintech platforms are increasingly used for government programs, especially to distribute aid, including in the preemployment program, with more involvement in other government programs expected in the future.

In Indonesia, fintech has been gaining popularity because of its ability to provide financial services to the country’s 93 million underbanked people, according to the 2019 e-Conomy SEA report produced by Google, Temasek and Bain & Company. Digital payments are driving growth in digital economy though Southeast Asia with value expected to reach US$1.1 trillion by 2025, from $22 billion in 2019, according to the same study.

However, growth is still largely concentrated in Java. A recent survey conducted by the Indonesian Fintech Association (Aftech) among its members revealed that only 23 percent of fintech companies have a reach beyond the island of Java, while 41 percent have operations in Greater Jakarta. Meanwhile, Indonesians’ financial literacy remains low, especially in non-urban areas, posing as a big challenge for industry players to expand services. In a 2019 survey by the Financial Services Authority (OJK), the country scored only 38.03 percent on the financial literacy index and 76.19 percent on the financial inclusion index. The government has been pushing for financial inclusion in the country, aiming to score 90 percent on the financial inclusion index by 2024.

With all those opportunities and challenges, fintech can do so much more to serve Indonesians for a more inclusive society, boost financial inclusion and create a more effective and efficient market environment across the archipelago. The banking industry plays a big role in fintech development going forward as an established system that can provide a platform for local fintech players to develop their solutions while ensuring data security and compliance.

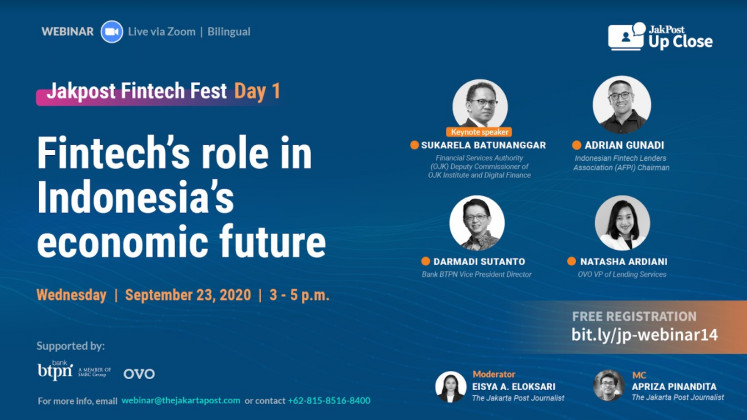

JakPost webinar on Fintech Fest

The JakPost Fintech Fest will discuss issues related to fintech to raise awareness about the capabilities of fintech in reaching out to the broader public from the perspectives of regulators, industry players and academics. The Fintech Fest will carry the theme “The role of fintech in the future of Indonesia’s economy” on Day 1, “Fintech for financial inclusion across Indonesia” on Day 2 and “Showcasing fintech capabilities (Peer-to-peer, payment, investment, crowdfunding and many more)” on Day 3.

The virtual discussion will feature authoritative speakers from relevant stakeholders to bring about diverse points of view regarding the matter in order to have constructive public discourse.

The series will highlight issues, such as:

- What the future looks like for fintech industry

- How the pandemic has transformed fintech industry

- The room for fintech to contribute more in public service

- Reaching the unbanked: Success stories in fintech boosting financial inclusion in Indonesia

- Beyond Java: Challenges in expanding fintech services across Indonesia

- Fintech capabilities: What are the types of fintech out there and what sets them apart

- The regulatory perspective of innovation in fintech: Opportunities and challenges

The Zoom webinar will be held bilingually, primarily English (simultaneous interpretation available), from 3 p.m. – 5 p.m., from Friday, September 23 – 25, 2020 and will feature:

Day 1

Keynote Speech:

- Sukarela Batunanggar, Financial Services Authority (OJK) Deputy Commissioners of OJK Institute and Digital Finance

Speakers:

- Miguel Soriano, International Finance Corporation (IFC) Senior Digital Finance Specialist*

- Adrian Gunadi, Indonesian Fintech Peer-to-Peer Lending Association (AFPI) Chairman

- Darmadi Sutanto, Bank BTPN Deputy President Director

- Natasha Ardiani, OVO VP of Lending Services

*to be confirmed

Day 2

Keynote Speech:

- Sugeng, Bank Indonesia (BI) Deputy Governor

Speakers:

- Chrisma Albandjar, Indonesian Fintech Lenders Association (Aftech) Board Member and Head of G2P Working Group

- Chaikal Nuryakin, University of Indonesia’s Social and Economic Research Institute (LPEM-UI) Head of Research Group for Digital Economy and Behavioral Economics

- Mohan Jayaraman, Experian Asia-Pacific Managing Director for Southeast Asia and Regional Innovation

Day 3

Speakers:

- Erwin Haryono, Bank Indonesia (BI) Executive Director of Payment System Department

- Triyono Gani, Financial Services Authority (OJK) Head of Digital Financial Innovation Group

- Budi Gandasoebrata, Gopay Managing Director

- Tommy Yuwono, Pintek Co-Founder and President Director

Day 1

Wimboh Santoso, who will deliver a keynote address, will share his views on several issues: OJK’s vision in Indonesia’s fintech industry: Opportunities and challenges in the future for Indonesia’s fintech, regulations in place and in the pipeline to support fintech while protecting consumers safety, review of regulatory oversight by OJK in creating supportive environment for fintech to grow in Indonesia and partnership with the private sector and NGOs in advancing fintech, and educating consumers about personal data protection, user safety in using fintech especially against the backdrop of the emergence of illegal fintech.

Azam Khan will speak on the latest research and findings about fintech in Indonesia and how Indonesia fares against the rest of the world in terms of regulatory framework, private sector initiatives and research in advancing fintech . He will also advise regulators and the private sector in unlocking Indonesia’s fintech potential.

As a chairman of the Indonesia Fintech Association, Niki Luhur will share his views on how the pandemic had transformed the fintech industry, vision for Indonesia’s fintech: What could be unlocked, or developed further by Indonesia’s fintech players, opportunities and challenges in advancing fintech industry in Indonesia, from regulations to collaborative works and financial literacy and more. He will also highlights diversity of products and services offered by Aftech members.

Day 2

Destry Damayanti, who will give a keynote speech, will talk about regulatory framework to support financial inclusion through fintech: What is in place and what is in the pipeline, financial literacy as crucial factor in boosting fintech’s role in financial inclusion and women as the force behind fintech development.

Adrian Gunadi will discuss several issues, including reaching the unbanked: Success stories in fintech boosting financial inclusion in Indonesia; Beyond Java: Challenges in expanding fintech services across Indonesia and diversification of fintech products and services to reach out to broader consumers.

Chaika Nuryakin will talk about the latest research and findings on fintech’s role in Indonesia’s financial inclusion progress; review of public policies to support financial inclusion through fintech.

We can also learn lessons from other countries around the world in reaching out to the unbanked using fintech platforms. An OVO representative will share the company’s experience in expanding beyond Java, its challenges and opportunities. The representative will also share views on how financially literate Indonesian consumers is in the eyes of OVO and what some key takeaways are in educating consumers in Indonesia so far.

Mohan Jayaraman will share his role in supporting financial inclusion in Indonesia’s fintech industry. He will talk, for example, about how data can be used to learn about consumer behavior and reach out to a broader population and about collaboration projects in Indonesia in support of fintech and financial inclusion.

Day 3

Filianingsih Hendarta will discuss various issues, including regulatory support for fintech innovation: What is in place and what is in the pipeline?; licensing process for fintech innovation in Indonesia: What has been done to improve ease of doing business and on-the-ground stories about and public-private partnership

Triyono Gani will give his review and outlook for fintech and discuss how to create supportive regulatory framework for innovation while maintaining prudential principles: Head of Digital Financial Innovation Group OJK’s stories on efforts to balance out dynamics in fintech innovation and prudential principles in policy-making and monitoring.

GoInvestasi representative will speak about various issues, including the importance of innovation during the pandemic to meet changes in consumer behavior: The case of rising online investment, the rise of retail investors: Recent trend in investment using fintech platforms, regulatory overview whether Indonesia’s regulations enough to support the dynamics of innovation in fintech and what on the regulatory front could be done to support fintech innovations.

A Pluang representative will share stories about the shift in consumer behavior toward online investment as gold prices rise. The representative will also discuss educating consumers about safety and protection standards and share view on types of investment can be made online and how to ensure consumers make decisions based on as much information as possible.

The JakPost webinar will be useful to the public at large, university students, public and private sector leaders and staff, start-up companies’ leaders and staff, fintech companies’ leaders and staff, researchers and the international community, as well as well as those interested in seeking information on the latest developments in Indonesia’s fintech and the country’s fintech prospects.