Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

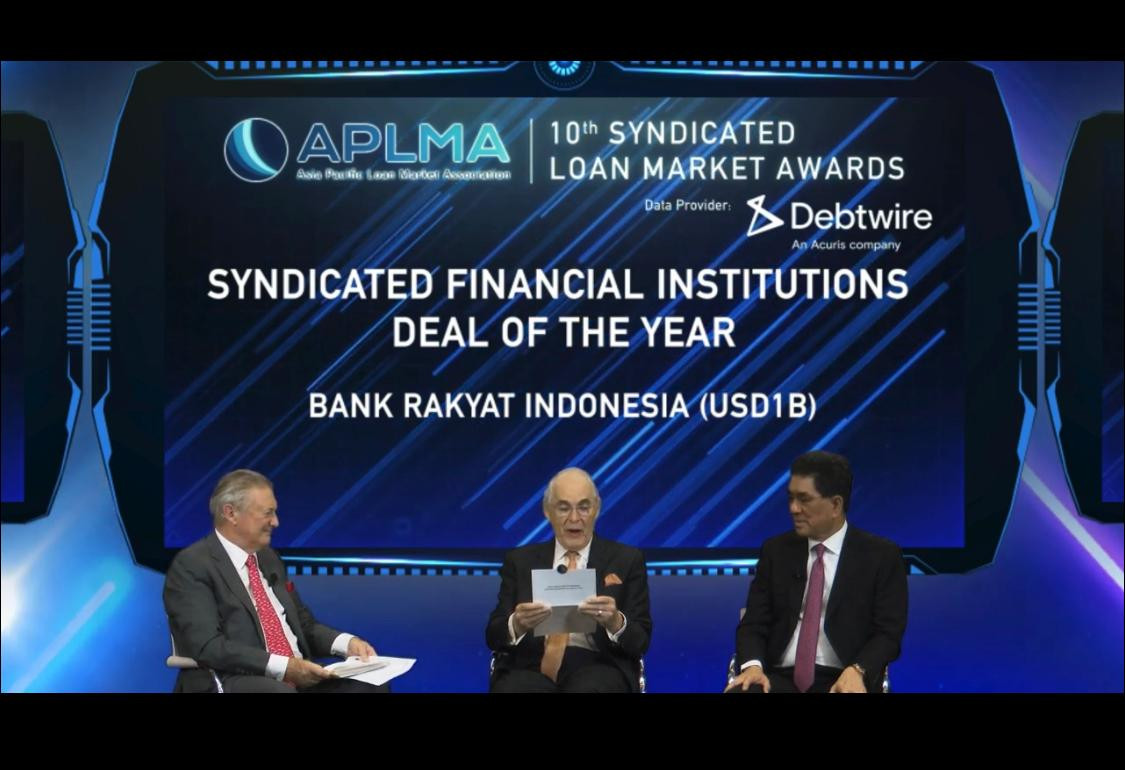

View all search resultsBRI named Syndicated Financial Institution Deal of the Year by APLMA.

BRI again recorded an achievement on the international level, where this time the award was given by the Asia Pacific Loan Market Association (APLMA).

Change text size

Gift Premium Articles

to Anyone

B

RI again recorded an achievement on the international level, where this time the award was given by the Asia Pacific Loan Market Association (APLMA). The APLMA is a professional institution with members from financial and nonfinancial institutions in Asia Pacific that actively participate in the loan market. At the 10th APLMA Asia Pacific Syndicated Loan Market Awards 2020, which were held virtually on March 10, BRI received an award in the Syndicated Financial Institution Deal of the Year category.

This award was given for BRI's success in raising US$1 billion in funds with a relatively competitive average all in rate of LIBOR + 136 bps. A total of 10 investors participated from Asia, Europe and the United States.

BRI's success in raising funds shows that BRI is able to seize opportunities well amid the uncertainty of global economic conditions throughout 2020. This collection of funds from abroad aims to strengthen the liability structure through diversifying sources of funding and supporting the company's business expansion.

BRI senior executive vice president of treasury and global services Listiarini Dewajanti said that the award from the APLMA was an acknowledgement by the international financial market of BRI's role as a global bank. "We hope this can be used as a benchmark in Indonesia that to gain investor confidence a company needs to have a sustainable and profitable business model," explained Listiarini.

Throughout 2020, BRI's treasury business focused on increasing revenue and market share through activities in the securities market and foreign exchange transactions. In 2020, treasury business managed to increase revenue by 138.71 percent year-on-year.

BRI's treasury business is also active in raising funding in addition to deposits with efficient interest rates to support BRI's business expansion. In the securities market, BRI has been named “Best Primary Dealer” for three consecutive years since 2017 in the annual Main Dealer activity by the Finance Ministry.

BRI also received the Best Sustainability Bond award from The Asset Hong Kong related to foreign fund raising activities through the issuance of sustainability bonds in 2019. These bonds were the first sustainability bonds issued by a state-owned company and were received very well by the market, being oversubscribed by eight times the nominal issuance.

BRI, through the treasury business, is actively involved in assisting the management of the National Economic Recovery fund to rescue MSME players affected by the COVID-19 pandemic. "The main focus of BRI's business growth remains on the MSME segment, which we will continue to push up to 85 percent, but for other businesses we will continue to push for positive growth," concluded Listiarini.