Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

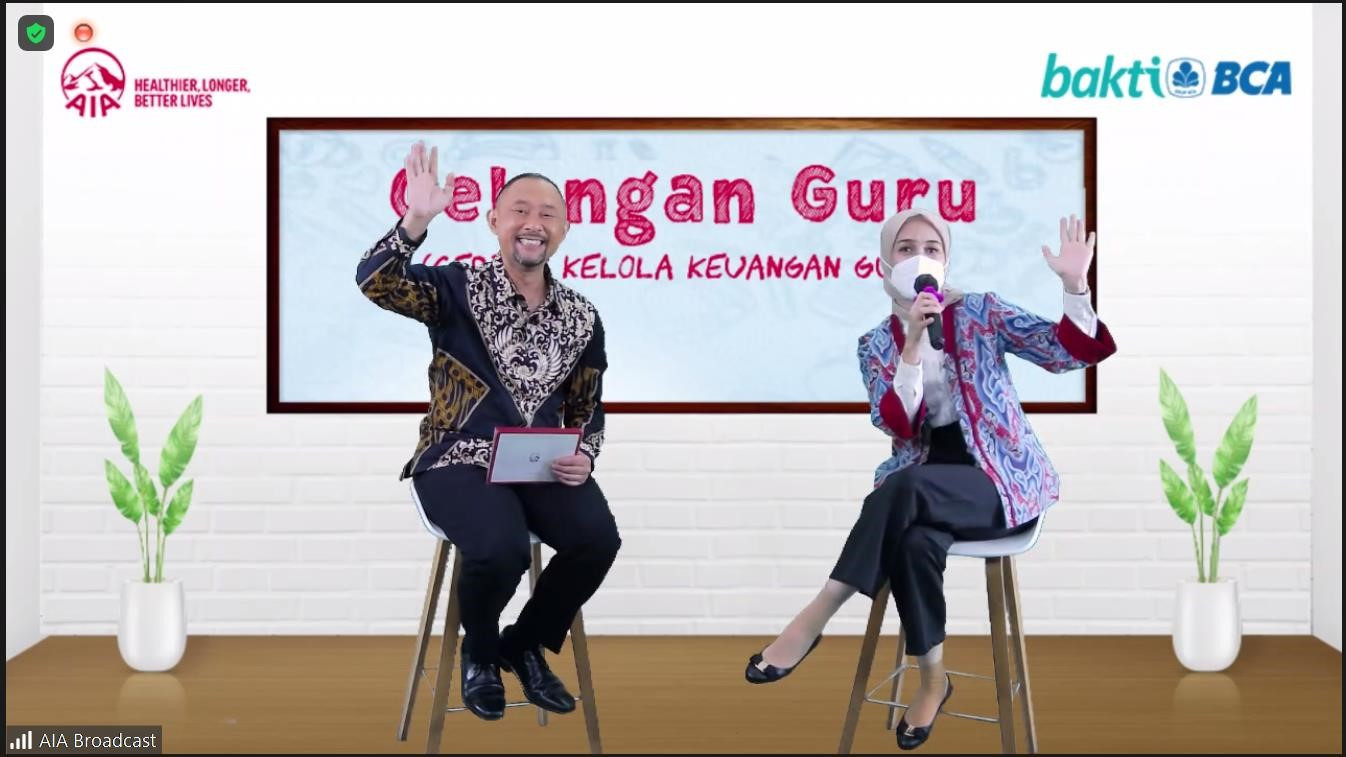

View all search resultsBCA and AIA celebrate the nation's teachers with financial literacy webinar

Change text size

Gift Premium Articles

to Anyone

PT Bank Central Asia and AIA has collaborated with the Putera Sampoerna Foundation to educate teachers on financial literacy.

On Nov. 21, National Teacher’s Day, they launched a webinar with the title Cerdas Mengelola Keuangan Guru, Cerdas Mengelola Keuangan Guru (Celengan Guru). Participating in the webinar were the executive vice president of BCA’s Wealth Management Division Yovvy Chandra, executive vice president of corporate social responsibility (CSR) Inge Setiawati, chief of AIA Partnership Distribution Phung Magdalena and influencer and principal consultant of Zapfinance Prita Ghozie.

The Putera Sampoerna Foundation invited 25,000 teachers from all over Indonesia to attend the webinar.

Attendees found the topics of interest raised by Prita Ghozi to be crucial and engaging. They ranged from healthy finances, management of household budgets and savings to investment and protection.

AIA was honored to host the event with BCA. “Here in AIA, we commit to improving financial literacy, especially regarding life insurances. We see the importance of the teachers’ role in promoting the public’s awareness on protection during the current pandemic recovery situation,” Phung explained.

BCA has other initiatives related to improving financial literacy. It has empowered over 500,000 beneficiaries through education programs for students, families of Indonesian migrant workers, the Saba Desa program, financial literacy education through Mobile Information Systems for Financial Literacy (SiMOLEK) launched by the Financial Services Authority (OJK), and advocating LAKU BCA products in public.

Most of BCA’s educational activities focus on regions with low financial literacy rates.

BCA’s programs are a form of support for the government in improving literacy rates across the nation. Recent surveys have shown that many communities across Indonesia have inadequate financial literacy rates. The National Financial Literacy and Inclusivity Survey (SNLIK) that the OJK conducted in 2019 revealed that Indonesia has a low literacy rate of 38.03 percent.

Together with other banking institutions, BCA is striving to close this gap with various CSR programs.

“We hope that beneficial programs such as these will positively impact teaching staff in schools. We’d also like to see teachers passing on today’s lessons to their students at school. That, of course, is part of our effort to increase financial literacy rates in Indonesia.” Yovvy said. “I can’t wait to see other programs like this reach an even wider audience.”

Indonesia’s unsung heroes are now moving toward a more digitalized future. They will require further knowledge in various subjects, including but not limited to finances.

“As an actor in national banking, BCA is committed to providing the best in financial-literacy education. We, of course, are aware that teachers stand in the front line between students and education at school,” Inge said. “That’s why we’ve taken the initiative to educate teachers on financial literacy. It’s not just about finances in general, but also how to manage finances in the household.”