Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsFirst of its kind: Indonesians now able to open bank account through Gojek app

Change text size

Gift Premium Articles

to Anyone

M

any Indonesians will likely know the experience of opening a bank account for the first time; waiting in line at the bank, signing the required paperwork and undergoing verification, depositing the cash, and trying out the crisp new card at the ATM.

Yet as the pandemic limited face-to-face interaction and inadvertently caused lines everywhere, banking as an activity has become a rather cumbersome activity. Shorter opening hours and limited entry quotas have discouraged many from going to the bank, as does the general wariness of traveling and entering crowded areas.

Until now.

Digital wallet and payment solutions platform GoPay and tech-based Bank Jago have introduced a new service integration that will enable Indonesians to open a Jago bank account directly from the Gojek application on their phones.

The first of its kind in Indonesia, the integration between an on-demand platform and a digital bank will provide convenient access to digital banking for the millions of unbanked and underbanked consumers in the country.

According to the 2020 Financial Inclusion Survey by the Finance Ministry, only 61.7 percent of Indonesians own a bank account, and a recent study by the Demographic Institute of the University of Indonesia (LDUI) showed that one in five GoPay users currently do not have or use a bank account actively.

The same study also noted that consumers are increasingly ready to use financial services, with one in four GoPay users interested in opening a bank account through GoPay.

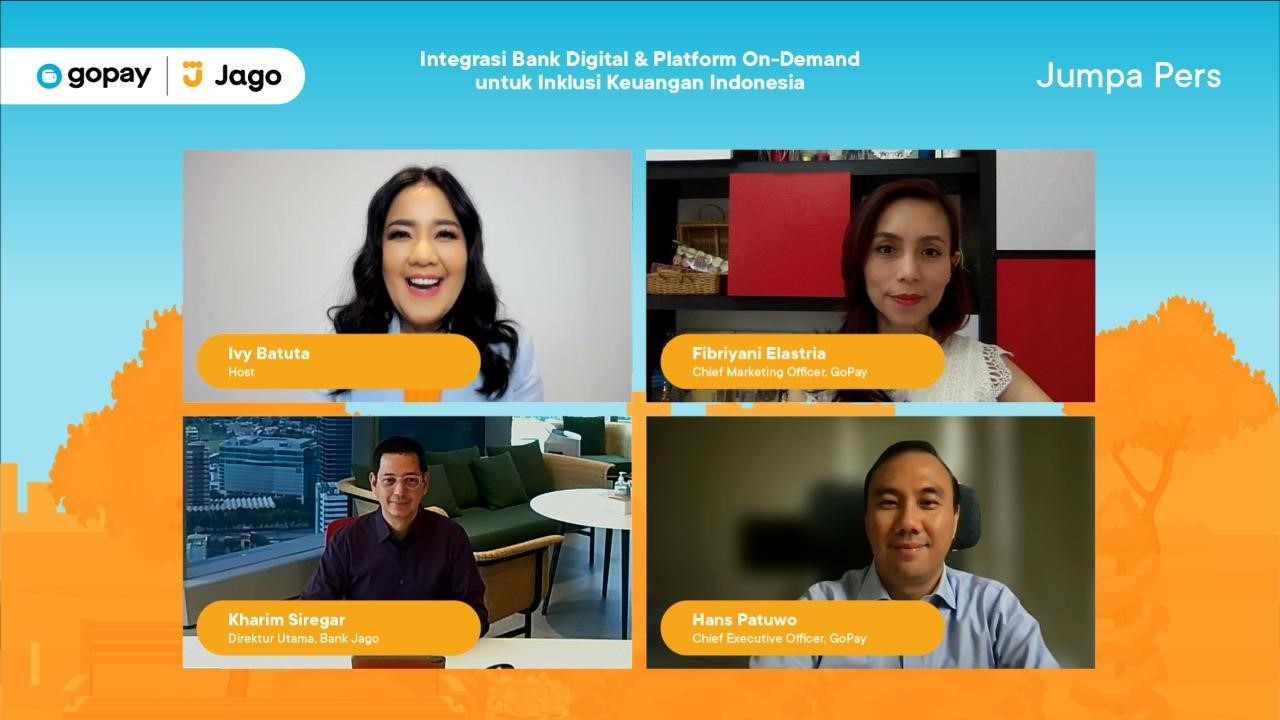

GoPay CEO Hans Patuwo said that accelerating financial inclusion in Indonesia has been GoPay’s mission from day one, and integration with Jago is a true game changer for the platform.

“[This] marks a new phase in our efforts to bring digital financial services to more people, as we provide convenient access to banking for millions across the country and help them kickstart their financial planning journeys. We will continue to work with Jago and other financial institutions, leveraging our respective strengths to deliver a truly unique, frictionless financial management experience for consumers from all levels of society,” he said.

The integrated service is available to all consumers in Indonesia with a verified GoPay account and the Gojek application, with no fees or minimum balance required to open a Jago bank account. Once the account has been opened, GoPay Jago users will not have to pay any top-up fees when moving funds between GoPay and Jago, providing greater benefits and convenience in managing their finances.

Kharim Siregar, President Director of Bank Jago, said that the bank aims to enhance the growth of millions through life-centric digital financial services, and our collaboration with GoPay is tangible proof of this commitment.

“By linking our app - which makes money management simple, innovative, and collaborative - with GoPay’s wide reach, we can provide new benefits and an improved experience for consumers, enabling them to transact quickly, easily and safely in the Gojek ecosystem. With this integration between GoPay and Jago, consumers can now open a Jago account via the Gojek application as well as use their Jago pockets as a source of funds to pay for various daily necessities.”

GoPay and Bank Jago’s integration complements a feature launched earlier this year, which allows Jago users to connect their Jago Pockets to the Gojek app and make cashless payments for Gojek services such as transport, food, and bill payments. Together, this means that GoPay Jago users can now enjoy a fully seamless experience in payments and financial management.