Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsBNI Tokyo boosts Indonesian diaspora loans

PT Bank Negara Indonesia (Persero) Tbk or BNI (stock code: BBNI) through its BNI Tokyo branch returns with a Diaspora Loan program for the Indonesian diaspora community living in Japan.

Change text size

Gift Premium Articles

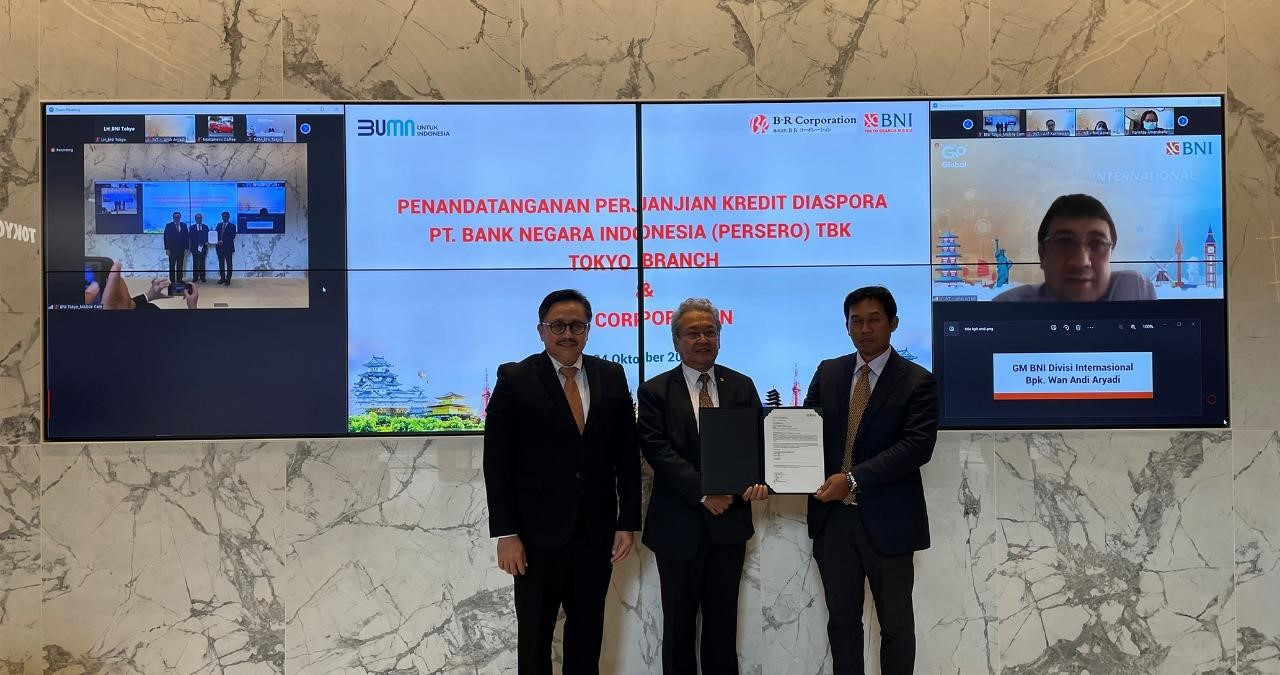

to Anyone

BNI Tokyo general manager Yudhi Zufrial (left), Indonesian Ambassador to Japan Heri Akhmadi (center), B-R Corporation president director Budi Raharjo (right) and acting leader for the BNI International Division Wan Andi Aryadi (onscreen) pose for photographs during the signing of the Diaspora Credit Collaboration in Tokyo on Monday (10/24).

BNI Tokyo general manager Yudhi Zufrial (left), Indonesian Ambassador to Japan Heri Akhmadi (center), B-R Corporation president director Budi Raharjo (right) and acting leader for the BNI International Division Wan Andi Aryadi (onscreen) pose for photographs during the signing of the Diaspora Credit Collaboration in Tokyo on Monday (10/24).

B

NI continues to encourage the Diaspora loan program with the aim of providing financial support for Indonesia-related businesses run by the Indonesian diaspora community.

PT Bank Negara Indonesia (Persero) Tbk or BNI (stock code: BBNI) through its BNI Tokyo branch returns with a Diaspora Loan program for the Indonesian diaspora community living in Japan.

The signing was carried out by BNI Tokyo general manager Yudhi Zufrial and B-R Corporation president director Budi Raharjo and was witnessed by the Indonesian Ambassador to Japan Heri Akhmadi at the BNI Tokyo branch on Monday (10/24).

Ambassador Heri, in his remarks, applauded BNI Tokyo’s active role in supporting the diaspora community by helping them open bank accounts in Indonesia or through Diaspora Loans. This is in accordance with the Indonesian embassy’s mission to reach out to Indonesians outside the country.

“[The embassy], Bank Indonesia Tokyo, BNI Tokyo and several state-owned companies [SOEs] in Tokyo included in the Small, Medium Enterprises [SMEs] Center are actively facilitating import and export activities for the SME industry in Japan and Indonesia,” he added.

Budi, meanwhile, shared how B-R Corporation was founded in 2009 in Sapporo, Hokkaido, Japan. B-R Corporation has customers from other countries, especially Southeast Asian countries such as Vietnam, Cambodia and Indonesia.

Throughout the years, Budi, through B-R Corporation, has provided the best service at a competitive price and with quick, on-time delivery. The company is active in auctions for used heavy equipment where transactions are made directly with manufacturers and is committed to finding high-quality used machinery.

“We thank BNI for propelling us forward to become a catalyst for the development of diaspora-owned businesses, a bridge to the world for Indonesian businesses that allows us to contribute in a real way to the development of the national economy,” Budi said.

BNI’s contribution to diaspora

In a separate statement, BNI enterprise and corporate banking director Muhammad Iqbal said the role of BNI’s overseas branches was very important as a bridge between Indonesian businesses and the world. As one of the largest banks in Indonesia, BNI has a wide network of overseas branches in Singapore, Hong Kong, Tokyo, London, New York, Seoul and Amsterdam.

Through the BNI Xpora program, BNI initiated the Diaspora Loan program in 2021 with the aim of providing financial assistance for Indonesia-related businesses run by the diaspora. The Diaspora Loan is a step in BNI’s journey to explore business potentials from abroad to Indonesia and vice versa.

"We appreciate B-R Corporation for opening up opportunities for BNI to contribute to its business. We certainly hope that more Indonesian diaspora companies will join us and collaborate to strengthen BNI's role as a global bank from Indonesia," Iqbal said.

By September, BNI had collaborated with 29 diaspora customers in various sectors

including 14 restaurants, 11 trading and service providers, three minimarkets and one transportation service.

BNI Tokyo strives to facilitate Indonesia-related businesses in Japan, especially from the diaspora SME segment, by facilitating working capital loans to develop their businesses.

“The Diaspora Loan is a credit granting program for the Indonesian diaspora and was comprehensively and prudently designed to accommodate the needs of Indonesian diaspora in expanding their businesses abroad,” Iqbal concluded.