Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsOJK’s planned rate rules could ‘kill’ P2P lenders: Observer

Change text size

Gift Premium Articles

to Anyone

T

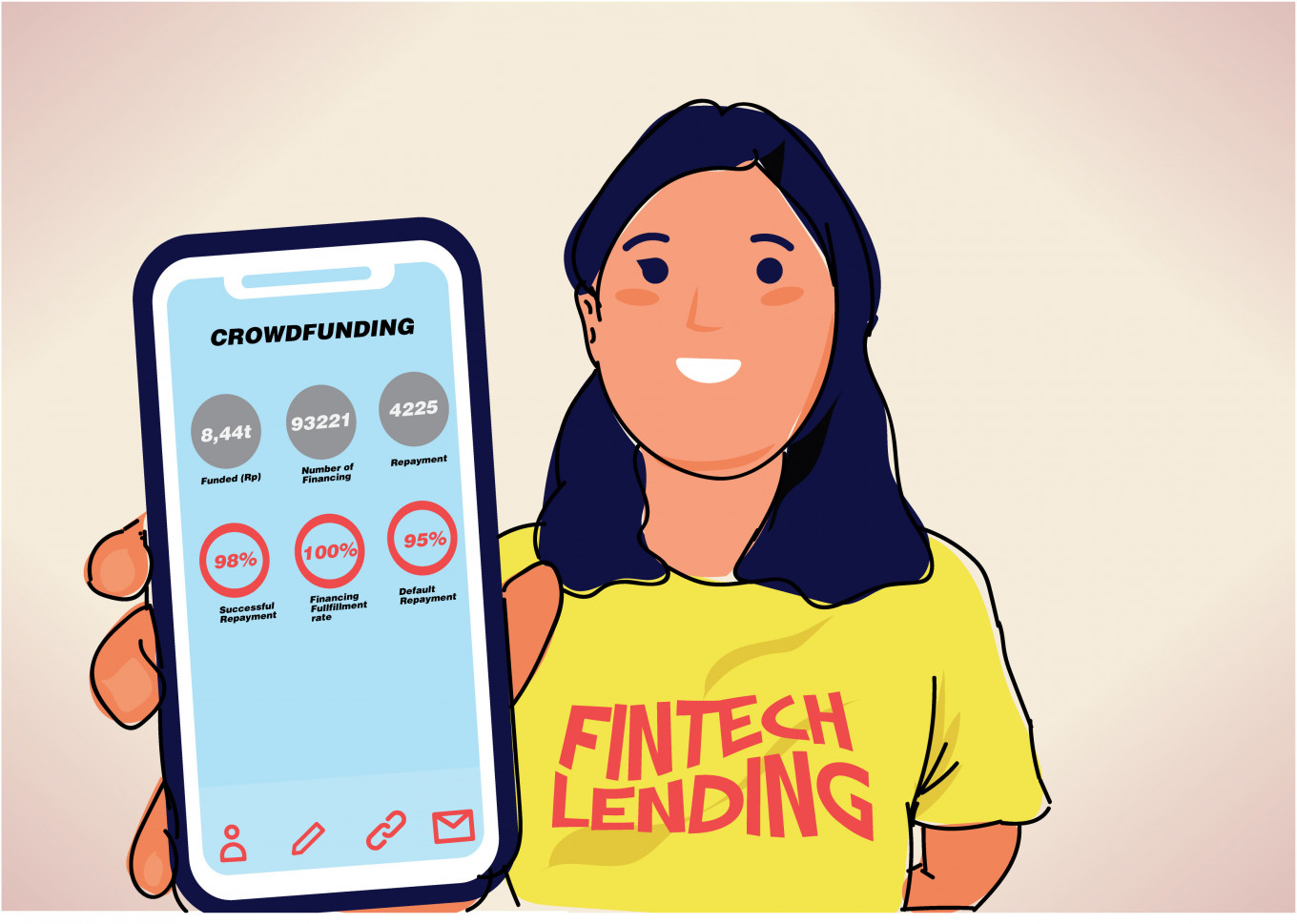

he Financial Services Authority (OJK) will decide what interest rates peer-to-peer lenders may impose on borrowers in a move that some claim could kill a vital segment of the fintech industry.

The OJK has yet to determine the chargeable rates but expects them – based on internal research and historical data – to be between 0.3 and 0.46 percent a day.

The upper figure of that range, according to the OJK, is the prevailing amount currently charged by the industry, and it is down to almost half of the 0.8 percent per day typically demanded in the early days of fintech lending.

M. Ihsanuddin, the OJK’s undersecretary for nonbank industry supervision, said the considered range struck a balance between the risks faced by lenders for providing loans without face-to-face interaction and the repayment capability of most borrowers.

However, he added, the OJK would still want to look into the matter thoroughly before announcing the final rules.

“We don’t want to be careless. We will discuss the appropriate amount,” Ihsanuddin told reporters during a press briefing on Thursday.

Read also: OJK tightens rules on unit-linked insurance