Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsDecoupling of the consumer classes

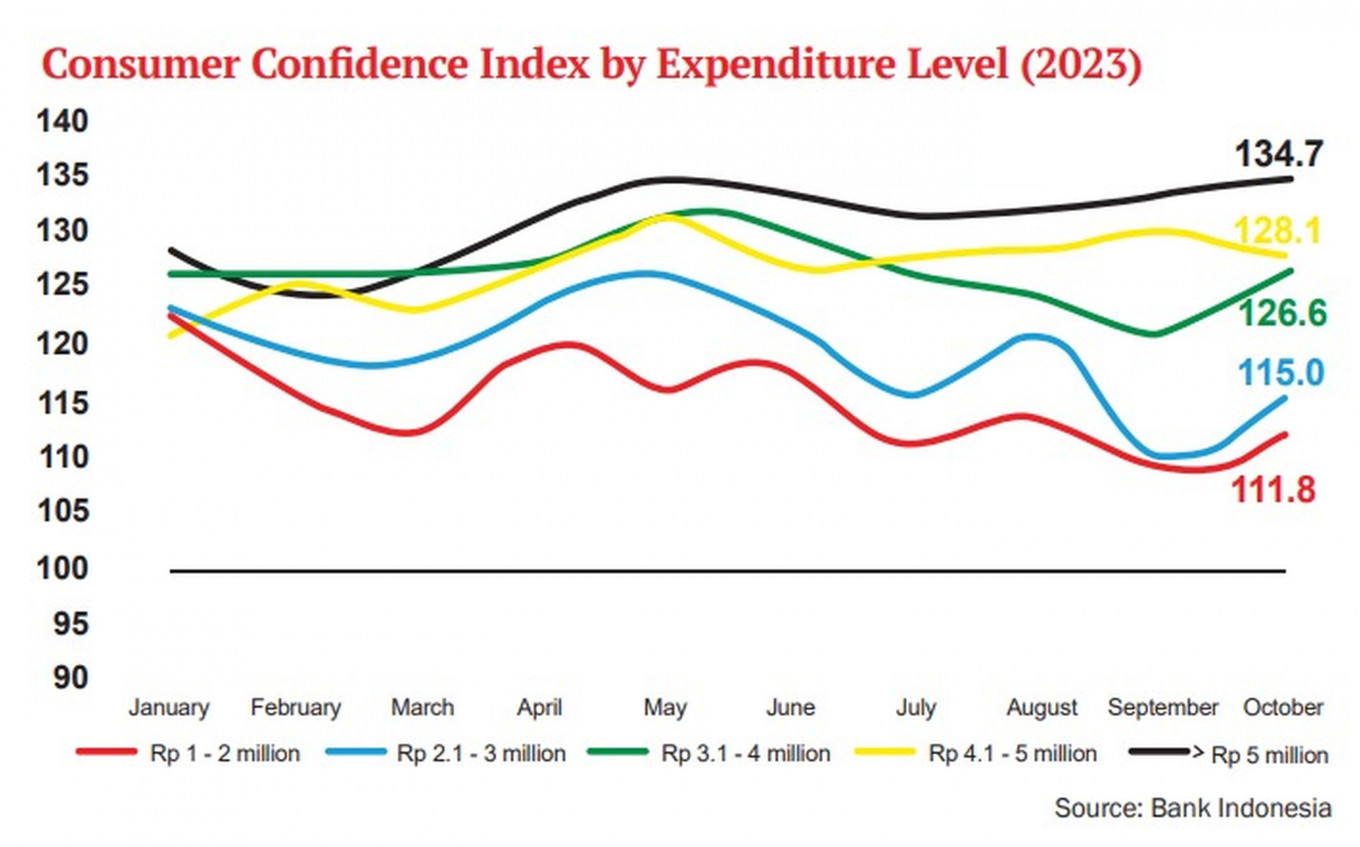

Indicators have shown that the consumer classes are decoupling from each other. While middle-to-upper class consumption grows stronger, consumption of the middle-to-lower class is deteriorating.

Change text size

Gift Premium Articles

to Anyone

I

ndonesia gross domestic product (GDP) missed the 5 percent year-on-year (yoy) growth mark by 0.06 percentage point in the third quarter this year, but household consumption remained steady, growing 5.06 percent yoy in the same period.

Household consumption has been the backbone of GDP growth. With household consumption of Rp 2.8 quadrillion (US$181 billion), its contribution to total GDP of Rp 5.3 quadrillion is 52.62 percent. Of the 4.94 percent yoy GDP growth in the third quarter of 2023, 2.63 percent comes from household consumption alone.

Does that mean all Indonesians are consuming more? Despite the strong aggregate household consumption, the answer is no. Indicators have shown that the consumer classes are decoupling from each other. While middle-to-upper class consumption grows stronger, consumption of the middle-to-lower class is deteriorating.

Household consumption is broken down to seven consumption categories: (1) food and beverages (F&B), (2) apparel, footwear and maintenance services, (3) equipment, (4) health and education, (5) transportation and communication, (6) restaurants and hotels and (7) others.

For F&B, since it mostly comprises staple needs, its consumption growth tends to be resilient and stable. F&B grew 4.07 percent yoy in the third quarter of 2023, higher than the 2.65 percent yoy growth in the third quarter of 2022.

The stable consumption growth for F&B is also reflected by the revenue growth of F&B companies. Indofood (INDF) revenue from its consumer branded products segment has grown annually for 25 quarters consecutively despite the COVID-19 pandemic, with 1.7 percent yoy growth in the third quarter.

Furthermore, Mayora (MYOR) and the food and refreshment segment of Unilever (UNVR) bounced back by growing 2.8 and 2 percent yoy respectively in the third quarter this year, after a contraction in the quarter before.