Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsIndonesia sustainable taxonomy: Pathway to attain sustainable development

Setting up a taxonomy is not an end game; it is an ongoing document that needs to be updated accordingly. It also needs to be aligned with international standards as well as its country’s domestic net-zero emissions agenda.

Change text size

Gift Premium Articles

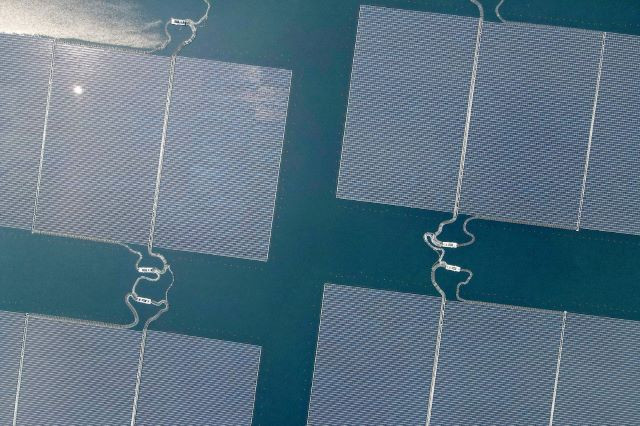

to Anyone

According to the Indonesian Biennial Update Report (BUR), the sum required to achieve Indonesia's climate change target for the period 2018-2030 is Rp 4 quadrillion (US$253.4 billion), while Indonesia’s fiscal budget (APBN) capability is anticipated to be just 20-27 percent of overall funding. (Shutterstock/Mee Ko Dong)

According to the Indonesian Biennial Update Report (BUR), the sum required to achieve Indonesia's climate change target for the period 2018-2030 is Rp 4 quadrillion (US$253.4 billion), while Indonesia’s fiscal budget (APBN) capability is anticipated to be just 20-27 percent of overall funding. (Shutterstock/Mee Ko Dong)

S

ince 2022, Indonesia has been developing a sustainable taxonomy system developed by the Financial Services Authority (OJK). It is essential to develop a national taxonomy, which would also serve as a guideline for achieving Indonesia’s sustainable development agenda, especially in financing sustainable business activities. However, setting up a taxonomy is not an end game; it is an ongoing document that needs to be updated accordingly. It also needs to be aligned with international standards as well as its country’s domestic net-zero emissions agenda.

Indonesia has indicated its commitment to meeting its emission reduction targets in accordance with this agreement via the Nationally Determined Contribution (NDC) document, which also become a commitment of many countries. Most recently, Indonesia promised to decrease greenhouse gas emissions by 31.89 percent with its own capabilities and 43.20 percent with international cooperation.

To reach this goal, substantial funding is required. According to the Indonesian Biennial Update Report (BUR), the sum required to achieve Indonesia's climate change target for the period 2018-2030 is Rp 4 quadrillion (US$253.4 billion), while Indonesia’s fiscal budget (APBN) capability is anticipated to be just 20-27 percent of overall funding. Outside of the APBN, alternative finance can be gained by expanding the involvement of the financial sector in sustainable financing.

The financial sector's product/service innovation will further help to provide the private sector with several opportunities for financing sustainable projects. Hence, it is critical that the criteria for supported investments are consistent with measures to decrease the likelihood of harmful environmental consequences. A taxonomy then, plays an important function in this context. The taxonomy can serve as guidance for the financial industry in financing sustainable operations.

To support their sustainability goals, countries or companies are starting to use green/sustainability taxonomies or frameworks. In general, a sustainability taxonomy can be defined as a classification system that aids in the identification of economic activities that can help a country meet its environmental goals in accordance with predetermined targets. On a smaller scale, companies can build sustainability frameworks to support their net-zero journey. At the same time, a sustainable taxonomy helps companies understand how “green” their economic activities are, and companies use this information as the basis for measuring the improvement in the environmental benefits of their activities. The existence of this definition and classification aids investors in understanding a country's green activities, encourages corporations to engage in green activities, assists regulators in meeting environmental targets, facilitates intermediary transactions for financial institutions and reduces the risk of greenwashing.