Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsSpeculation of Japan forex intervention after yen rally

Change text size

Gift Premium Articles

to Anyone

A

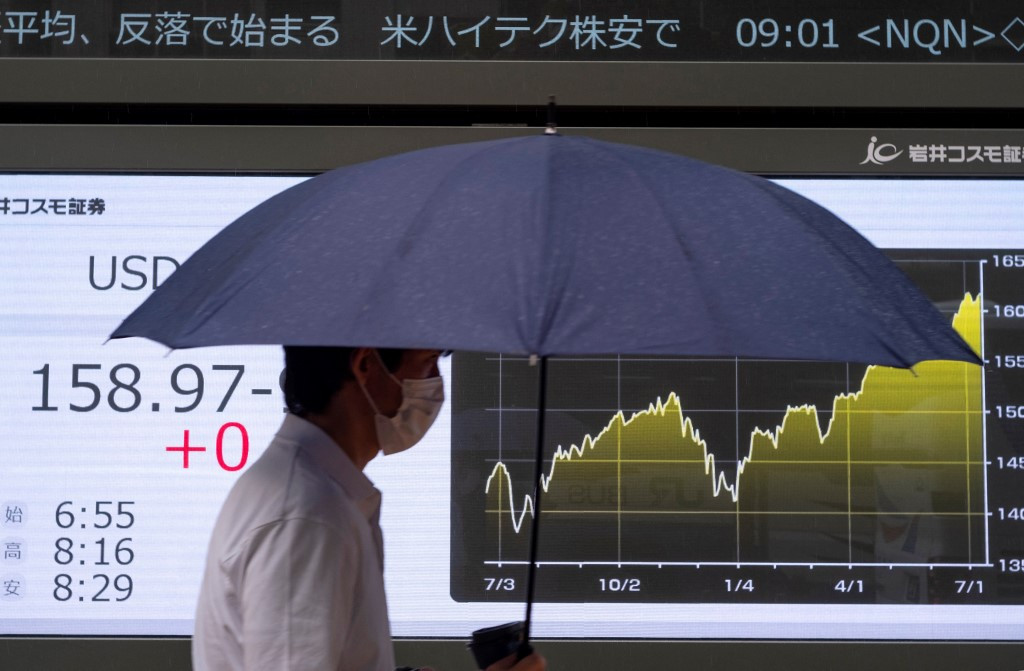

surge in the yen triggered speculation among analysts on Friday that Japanese authorities may have again intervened in forex markets to prop up the ailing currency.

In New York, the dollar shed more than two percent against the Japanese unit, which has been on a downwards slide for months and in late June hit its weakest value since 1986.

The sharp move came after data showed the US consumer price index (CPI) -- a key gauge of inflation -- came in lower than anticipated in June.

"I haven't had any confirmation, and we don't in these things, but we strongly suspect the hand of the Bank of Japan there," Ray Attrill at National Australia Bank said.

The "outsized move" makes it "fairly inconceivable that it hasn't had a helping hand", he added on Friday's "NAB Morning Call" podcast.

Between late April and late May, Japan's finance ministry spent 9.79 trillion yen (US$61 billion) to prop up the yen -- the first time it had done so since October 2022.

The ministry releases data on forex interventions at the end of each month.

Japan's top currency diplomat Masato Kanda told reporters late Thursday that authorities "are not in a position to comment on whether they intervened in the market", according to public broadcaster NHK.

"Objectively speaking, there have been quite rapid fluctuations, which has affected people's lives," Kanda said.

The Japanese currency has cratered from around 115 per dollar before Russia's invasion of Ukraine in February 2022.

The plunge is due in part to the Bank of Japan's policy of maintaining ultra-low interest rates to support the economy, while other central banks have hiked theirs.

Charu Chanana, head of FX strategy at Saxo Markets, told AFP that "the pronounced move in the yen appears to be coming on the back of combined impact from US inflation and intervention by Japanese authorities".

"There seems to be a new playbook for Japanese interventions, coming in along with supportive fundamentals, making the strength in yen somewhat more durable," Chanana said.