Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsDigital payments in Indonesia: A Cultural shift

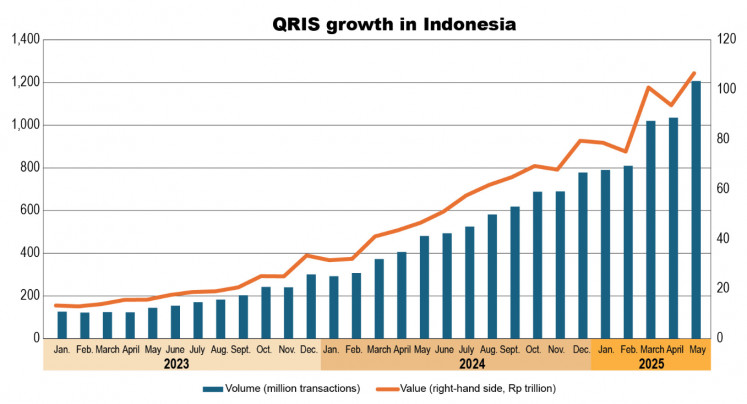

QRIS transaction volume had risen by 163 percent year-on-year (yoy) in July, while BI-FAST handled 414.6 million transactions, up 38 percent yoy, with a total value of Rp 1 quadrillion.

Change text size

Gift Premium Articles

to Anyone

T

he use of digital payment channels in Indonesia has evolved beyond mere technology adoption, it has become part of a broader cultural transformation.

Whether it is paying for coffee with QRIS or sending money between banks via BI-FAST in seconds, digital payments have become embedded in daily life. This shift marks not just a change in method, but a new mindset toward how people interact with money.

But why are digital channels so widely embraced? Behavioral Economics, particularly the Theory of Heuristics and Biases by Daniel Kahneman and Amos Tversky, offers one explanation.

People tend to make decisions based on habit, convenience or incentives, rather than purely rational cost-benefit analysis. In Indonesia’s case, instant rewards like e-wallet cashback or the speed of BI-FAST make digital options feel easier and smarter, even if users do not always consider long-term trade-offs.

According to Bank Indonesia (BI), as of July, QRIS transaction volume had risen by 163 percent year-on-year (yoy), while BI-FAST handled 414.6 million transactions, up 38 percent yoy, with a total value of Rp 1 quadrillion. To put it in perspective, this amount is nearly half of Indonesia’s annual card transactions.

Meanwhile, total digital transactions, including internet and mobile banking, reached 4.44 billion transactions, marking a 45 percent annual increase. These figures indicate that digital channels are no longer optional, they are becoming the default.

This transformation is not limited to urban digital natives. Thanks to programs like QRIS Tuntas (QRIS Tarik Tunai, Transfer and Setor Tunai) and expanded infrastructure from banks and fintech companies, rural and remote areas are also embracing digital finance.

According to BI, as of May, the total number of QRIS merchants nationwide exceeded 38 million, with strong growth recorded outside Java, which booked 19 percent growth. Kalimantan recorded 24 percent growth, while Sulawesi-Maluku-Papua, Sumatra and Bali-Nusa Tenggara posted 24 percent, 19 percent and 16 percent, respectively.

This trend reflects a more geographically inclusive expansion of digital payment adoption across the archipelago.

In terms of payment methods, users today no longer rely on a single option. Instead, they choose channels based on context.

E-wallets are preferred for small, everyday purchases and online shopping, QRIS is commonly used for face-to-face payments with small vendors, while BI-FAST or virtual accounts are favored for large transfers or business transactions. This multi-channel behavior reflects growing financial sophistication, as consumers increasingly tailor payment tools to their specific needs and situations.

As digital adoption grows, so do the challenges, ranging from cybersecurity threats, data breaches and social engineering scams, to digital literacy gaps among the elderly and underserved populations, as well as misleading promotions that may conceal hidden fees or restrictive terms.

According to the Financial Services Authority (OJK), there were 18,339 consumer complaints submitted via the Consumer Protection Portal (APPK) as of May 2025. Of these, 38 percent were linked to financial technology (fintech) platforms, 37 percent related to banking services and 20 percent involved financing companies.

To ensure the long-term success of digital payment systems, the system must be transparent, secure and inclusive. In this context, policymakers and regulators can take several steps. Some of these include enforcing stronger data protection and cybersecurity laws, expanding digital literacy programs, especially for vulnerable groups, requiring clear disclosure of fees and terms and promoting platform accountability and transparency.

Initiatives such as ASEAN QRIS Cross-Border Payments and the Indonesia Payment System Blueprint 2025 underscore Indonesia’s long-term commitment to building a secure and integrated digital financial ecosystem. This aligns with the nation’s evolving payment culture, from cash to cashless, from card to contactless, and from banks to apps.

Looking ahead, voice payments, biometric authentication and embedded finance may soon become mainstream. Yet, it is essential to ensure that innovation remains inclusive and leaves no one behind.

Everyone, regardless of location, age or device ownership, must be able to participate. This may require subsidized smartphone access, affordable internet in rural regions, community workshops for digital skills, and strong collaboration across sectors to bridge the urban-rural divide.

Digital payment in Indonesia is no longer just about adopting new technology. They reflect a broader shift in how people live, transact and trust the financial system. The momentum is clear, but the future must be fair and inclusive. The challenge ahead is not whether people will adopt digital payments, but how we ensure no one is left behind.

*****

The writer is an analyst at Mandiri Institute