Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsTreasury app provides new approach to investing in gold

The app enables people to save and sell their gold online.

Change text size

Gift Premium Articles

to Anyone

Gold is often seen as profitable form of investment, but most people still think that transactions can only be done offline.

The newly launched app Treasury aims to provide a new approach to investing in gold. It allows users to buy, transfer, sell and save their gold online. People can buy and save gold for as little as Rp 20,000 ($1) and print gold bullion with a minimum weight of 0.5 gram.

“Our grandparents and parents believe the safest way to keep gold is in its physical form, but nowadays many people do it without knowing the exact amount of gold they have,” said Dian Supolo, CEO of Treasury, in an official statement.

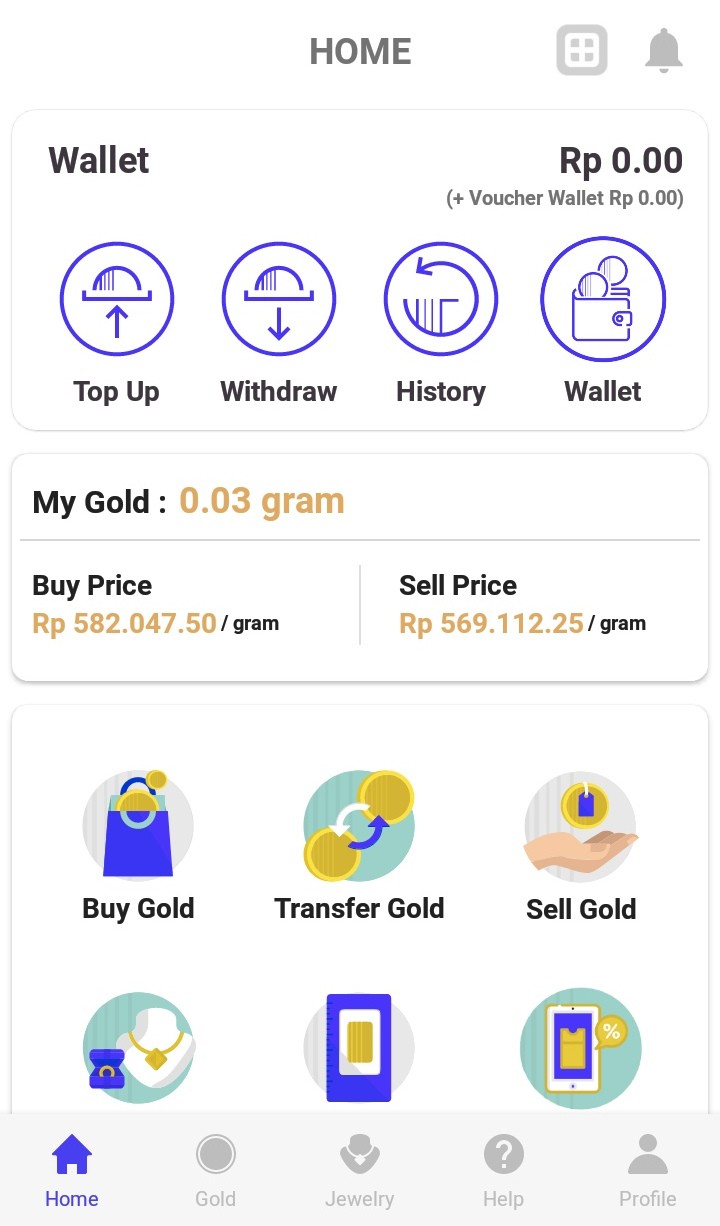

Homepage of Treasury app. (Treasury/Ni Nyoman Wira)

After signing up with an e-mail and password, users can view, buy and sell in real time. It also features an e-wallet with a minimum balance of Rp 10,000 that can be topped up at ATMs.

Read also: Indonesian company launches gold-cryptocurrency hybrid investment

Treasury has teamed up with Indonesia Clearing House (ICH) to process transactions, with PT. Untung Bersama Sejahtera (UBS) acting as the gold provider. Those who decide to have their investment printed will receive it alongside a certificate and insurance by UBS.

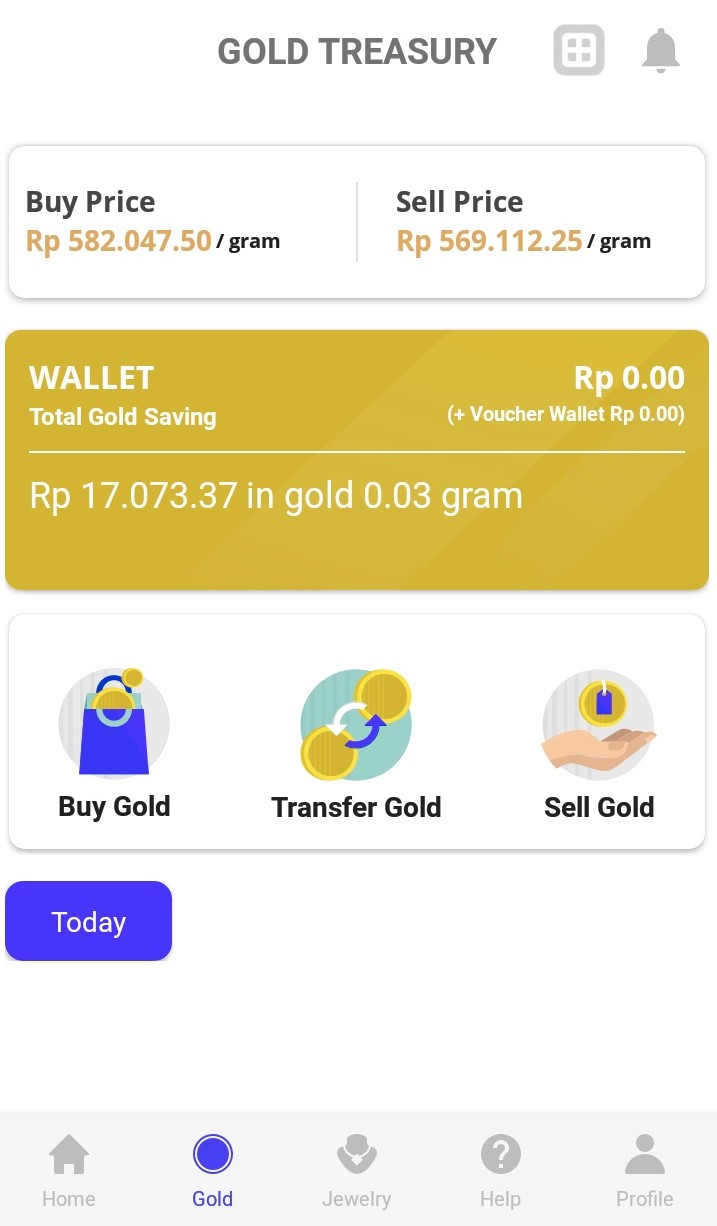

After signing up with an e-mail and password, users can view, buy and sell in real time. (Treasury/Ni Nyoman Wira)Most features will become active after people complete their profile by attaching their identity card, tax identification numbers (NPWP) and bank account details. Users can list the heir of their gold investment as well.

“We’d like to help people buy and save gold, hence they can find out about the amount of their gold investment and achieve their financial goals,” Dian said. “It’s also safer compared to keeping it at home or in a safe deposit box.”

The app can be downloaded for free for Android. (wir/mut)