Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsMarkets Right Now: Asian shares tumble as Trump gains

The latest on developments in financial markets (All times local):10:30 a.m.

Change text size

Gift Premium Articles

to Anyone

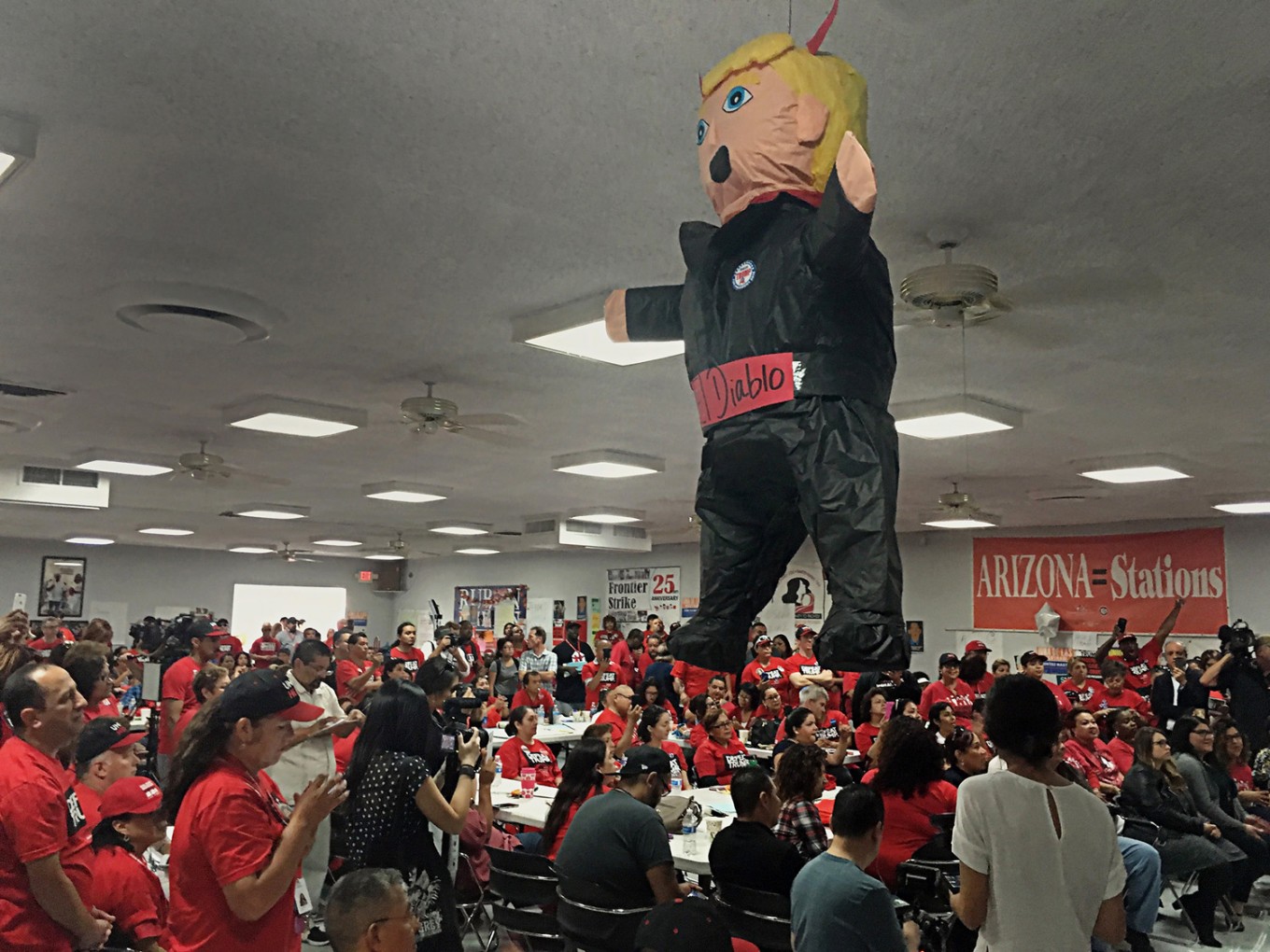

Upbeat -- Members of the Culinary Workers Union Local 226, cheer during a rally under a Donald Trump pinata in Las Vegas on Monday, Nov. 7. Voters in swing state Nevada will play an outsized role on Tuesday when they decide whether Hillary Clinton or Donald Trump should get their six coveted electoral votes. The state also has seen a high number of Latinos vote early where Democrat Catherine Cortez Masto is trying to become the nation's first Latina senator. (AP/Russell Contreras)

Upbeat -- Members of the Culinary Workers Union Local 226, cheer during a rally under a Donald Trump pinata in Las Vegas on Monday, Nov. 7. Voters in swing state Nevada will play an outsized role on Tuesday when they decide whether Hillary Clinton or Donald Trump should get their six coveted electoral votes. The state also has seen a high number of Latinos vote early where Democrat Catherine Cortez Masto is trying to become the nation's first Latina senator. (AP/Russell Contreras)

The latest on developments in financial markets (All times local):

10:30 a.m.

Share benchmarks are tumbling across Asia after Donald Trump gained the lead in electoral votes, with 123 to Hillary Clinton's 97 as of 9 p.m. EST (0200 GMT). Markets had opened solidly higher but quickly shed those gains, reflecting investor concern over what a Trump presidency might mean for the economy and trade.

Japan's Nikkei 225 index dropped 2.4 percent to 16,777.85 as the US dollar sank against the Japanese yen, a trend that would be unfavorable to exporters. Hong Kong's Hang Seng plunged 1.7 percent to 22,514.70.

South Korea's Kospi index fell 1.4 percent to 1,976.49 and Australia's S&P ASX/200 lost 1.2 percent to 5,196.70.

Earlier, investors had appeared convinced that Hillary Clinton would win the presidency. Clinton is viewed as a more stable option who might maintain current policies.

In currency trading, the US dollar was trading at 102.60 yen down from a high earlier in the session of 105.46. The euro was at $1.1142, up from its previous close of $1.1020.

___

8 p.m. EST (9:00 a.m. Hong Kong time)

Shares are mostly higher in Tokyo and other Asian markets as US polls begin to close in the culmination of a highly charged presidential race.

Japan's Nikkei 225 index added 1.3 percent to 17,401.90 as the US dollar surged against the Japanese yen, a trend that would help exporters.

South Korea's Kospi index added 0.4 percent to 2,012.41 and Australia's S&P ASX/200 jumped 0.8 percent to 5,298.80.

Analysts said most investors appeared convinced that Hillary Clinton will beat Donald Trump. Clinton is viewed as a more stable option who might maintain current policies.

In currency trading, the US dollar was trading at 105.29 yen up from 104.96, and the euro was at $1.1000, just below its previous close of $1.1020.

___

4:00 p.m.

Stocks are ending broadly higher on Wall Street, building on big gains a day earlier, as investors keep a close eye on the US presidential election.

Safe-play sectors like utilities and phone companies rose more than the rest of the market Tuesday.

PG&E rose 1.5 percent and Frontier Communications rose 1 percent.

Hertz plunged 22.5 percent after its earnings came up far short of what analysts were looking for.

The Dow Jones industrial average rose 72 points, or 0.4 percent, to 18,332.

The Standard & Poor's 500 index climbed 8 points, or 0.4 percent, to 2,139. The Nasdaq composite increased 27 points, or 0.5 percent, to 5,193.

___

11:45 a.m.

Stocks are turning higher in midday trading on Wall Street after shaking off an early stumble.

Investors are keeping a close eye on the U.S. presidential election Tuesday, a day after the market had its biggest gain since March.

The gains are being led by safe-play sectors like utilities and phone companies. Duke Energy climbed 1 percent and AT&T and Verizon each rose 0.4 percent.

Hertz plunged 40 percent after its earnings came up far short of what analysts were looking for.

The Dow Jones industrial average rose 74 points, or 0.4 percent, to 18,332.

The Standard & Poor's 500 index climbed 7 points, or 0.3 percent, to 2,138. The Nasdaq composite increased 18 points, or 0.4 percent, to 5,185.

___

9:35 a.m.

Stocks are moving modestly lower in early trading on Wall Street, a day after the market's biggest surge since March.

Several companies were sinking Tuesday after reporting disappointing results. Car rental company Hertz plunged 42 percent after its earnings came up far short of what analysts were looking for.

Homebuilder D.R. Horton's earnings also were shy of estimates, and drugstore chain CVS had lower revenue than analysts expected.

The market had soared a day earlier as Hillary Clinton's chances for winning the US presidential election appeared to improve. Investors have been anxious over signs that the U.S. presidential race was tightening.

The Dow Jones industrial average slipped 37 points, or 0.2 percent, to 18,221.

The Standard & Poor's 500 index fell 6 points, or 0.3 percent, to 2,124. The Nasdaq composite declined 16 points, or 0.3 percent, to 5,150. (**)