Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

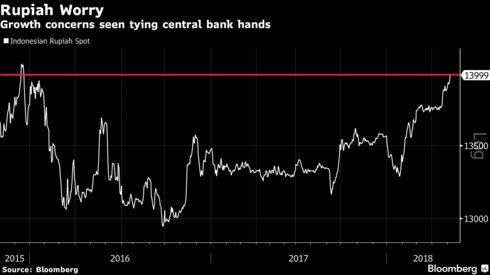

View all search resultsRupiah breaches 14,000 as GDP growth misses estimate

Change text size

Gift Premium Articles

to Anyone

I

ndonesia’s rupiah traded above 14,000 to a U.S. dollar for the first time since December 2015 on concern disappointing economic growth may limit the central bank’s options to defend the currency.

The rupiah fell as much as 0.5 percent to 14,003 to a dollar, before trading at 13,999 by 4:55 p.m. in Jakarta. The slide extended the currency’s loss to 3.2 percent in the past three months, making it the worst performer in Asia after India’s rupee, data compiled by Bloomberg show.

Indonesia’s economy expanded at a slower pace last quarter than economists had forecast, making it difficult for Bank Indonesia to increase interest rate to shield the currency. The central bank has stepped up buying of sovereign bonds from the secondary market to stem a selloff and intervened in the forex market to stabilize the rupiah without much success.

The pressure on the currency may continue as foreign investors will convert rupiah-denominated dividend and interest payments from stocks and bonds into dollars, according to Mingze Wu, an FX trader at INTL FCStone Inc. in Singapore.

“This is just regular seasonality adding pressure,” Wu said. “Nonetheless 14,000 is a psychological barrier so the central bank may yet play a part to defend this especially if price breaks just above this region which may trigger stops.”

Bank Indonesia Governor Agus Martowardojo has said the bank will ensure ample liquidity of local currency and foreign exchange in the market to ease volatility and cited its second line of defense including bilateral currency swaps as a cushion to stem further losses.

Foreign investors net sold $1.1 billion of sovereign bonds last month on top of net sale of $2.6 billion of stocks this year, data compiled by Bloomberg show. Indonesian debt is seen as a bellwether with its high yields, strong economic growth and a reformist government, with foreign investors holding 38.5 percent of local-currency bonds.

“There’s a misconception that Indonesia’s economy is heading toward deterioration as indicated by rupiah depreciation,” said Enrico Tanuwidjaja, Jakarta-based head of economic & research for PT UOB Indonesia. “But we see this as broad-based dollar strengthening, and the efforts taken by Bank Indonesia to intervene from time-to-time to correct the misconception is justified.”